HomeWork Solutions has received many calls about the CARES Act stimulus bill and the Payroll Protection Program offering forgivable loans to employers who retain their employees. Unfortunately, the US Small Business Association (SBA) has just issued final terms of the program which specifically exclude household employers from eligibility. The document notes that, “The Administrator, in consultation with the Secretary of the Treasury (the Secretary), determined that household employers are ineligible because they are not businesses.”

Read More

Topics:

nanny,

agency,

senior,

CPA

Congress passed, and the president signed into law, the Families First Coronavirus Response Act on March 18. The law allows employees paid time to care for themselves or loved ones and includes provisions for new tax credits to offset employers’ costs. But the immediate need to pay employees on leave may still be difficult for families struggling with monetary losses.

Read More

Topics:

nanny,

agency,

senior,

CPA,

coronavirus,

COVID-19

We believe the majority of families want to ensure that the nanny or senior caregiver who took care of their family is taken care of in this crisis. Now that families understand what their legal obligations are under the Families First Coronavirus Response Act (FFCRA), let’s take a few moments to understand how the money works out.

Read More

Topics:

nanny,

agency,

senior,

CPA

HomeWork Solutions is fielding many questions about the Families First Coronavirus Response Act (FFCRA) from families and caregivers alike. We are committed to helping nannies and other household workers understand and have access to the benefits they deserve, and equally to helping families to understand their new (temporary) responsibilities. Lastly, HomeWork Solutions is waiving some fees for families who have not been paying their nannies on the books. Catching up on "NannyTaxes" will protect families from liability for unemployment claims and/or unpaid wage claims while ensuring the nannies who care for our families are cared for in this crisis.

Read More

Topics:

nanny,

agency,

senior,

CPA

19 MAR 2020: UPDATED INFORMATION ABOUT EMPLOYER RESPONSIBILITIES IS FOUND HERE

The spread of the coronavirus worldwide has caused employers and employees alike to adapt, sometimes rapidly, to changes to normal daily routines. Primary care physicians are using video chat to assess some patients presenting with flu-like symptoms rather than have them visit the office. Healthcare janitorial services have changed protocols. And many employers have banned corporate travel and liberalized remote-work policies. Airlines are cancelling flights and holiday and entertainment plans are being postponed or cancelled.

Read More

Topics:

nanny,

agency,

senior,

CPA

Many nanny employers are sole proprietors, operating their own small businesses, law practices, medical or accounting firms. These nanny employers turn to nanny care because they need the flexibility in their childcare to allow them to focus work time on growing their businesses. They honestly could not do it without in-home childcare, so it seems logical to pay your nanny through your business, right? Wait a minute, the tax code does not agree with you!

Read More

Topics:

nanny,

agency,

CPA

Household employee payroll is a legal imperative, as well as the right way to treat your valued household employee. Although it is necessary, it is often a headache and a hassle. You can combat the hassles of household payroll by outsourcing to specialists. There are a number of benefits to outsourcing household your payroll needs, including the five listed below.

Read More

Topics:

nanny,

agency,

senior,

CPA

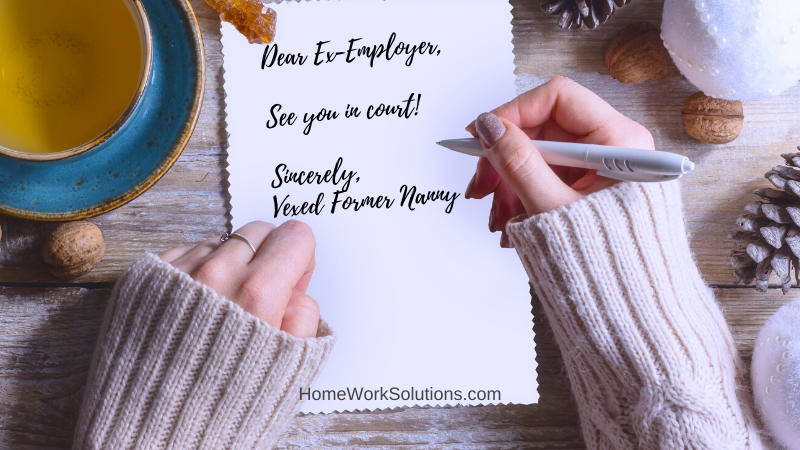

When you hire a nanny, senior caregiver, or other household staff, you immediately become an employer subject to all tax and labor laws in force. Unfortunately, the intimacy of the relationship can often induce the parties to cross legal boundaries, and these actions can eventually get the family into hot water.

Read More

Topics:

nanny,

agency,

senior,

CPA

As a nanny, you are required to wear several different hats: authoritarian, event planner, cook, playmate, and more. During your employment, you may also be asked to step in to be an overnight nanny occasionally. If you are okay with adding occasional overnight stays to your job duties, be sure to talk about this at the time you are first hired.

Read More

Topics:

nanny,

agency,

CPA

%2c%20determined%20that%20household%20employers%20are%20ineligible%20because%20they%20are%20not%20businesses.%2013%20CFR%20120.100.png)