If you recently hired a household employee, you know that you have employment tax obligations. One of those is to pay Federal and State Unemployment Insurance tax. This benefit program is confusing to most, so here we will break down some essential things to know about it.

Read More

Topics:

nanny w-2 form,

household employee taxes,

nanny undocumented,

nanny unemployment insurance,

nanny payroll,

nanny benefits,

W-4,

pandemic

Are you considering hiring a nanny? Maybe a senior caregiver for one of your aging parents? Finding and hiring an experienced household employee helps provide the extra hand you need. But don’t forget, you’ll need to factor in the cost of hiring someone to work in your home. Paying them ‘under the table’ is illegal. Here are some essential things to remember when paying your employee fair and legally.

Read More

Topics:

nanny unemployment insurance,

hiring a nanny,

nanny overtime,

nanny paid time off,

nanny mileage reimbursement,

nanny tax compliance,

caregiver,

nanny vacation,

agency

The worldwide COVID-19 pandemic has caused unprecedented job loss and disruption to the economy. Household workers are some of the most economically vulnerable workers, as they live paycheck to paycheck in many instances. While some highly qualified nannies are landing on their feet as their college education provides a good baseline to help with home schooling, other wonderful caregivers with less educational experience find themselves out of work with no immediate prospects.

Read More

Topics:

senior caregiver unemployment insurance,

nanny unemployment insurance,

nanny,

agency,

senior,

CPA,

COVID-19

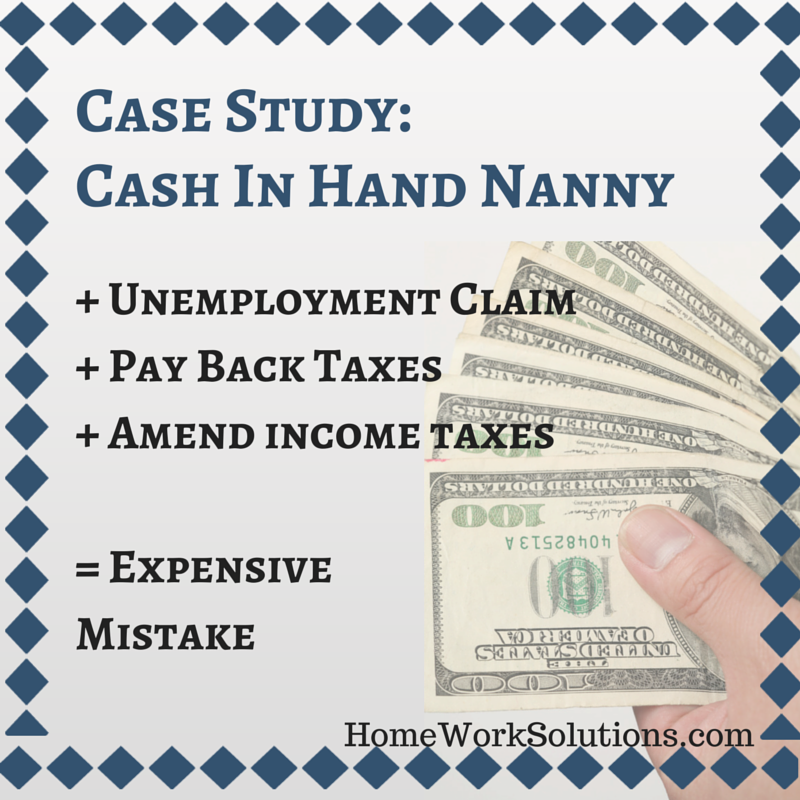

HWS' Client Care Manager, Mary Crowe, shares the story of a client who paid the nanny cash under the table, and later found himself on the wrong side of his state's unemployment agency.

Mike and Joyce R. hired a nanny when their twins were infants. They agreed with the nanny at the time that they were going to pay her $500 a week off the books. The nanny worked out wonderfully and she stayed with Mike and Joyce for almost three years, and was let go when the twins started a full-time pre-school/daycare situation. The family’s needs had changed, and they found another very part-time nanny to cover the afterschool hours.

Read More

Topics:

nanny off the books,

nanny unemployment insurance,

nanny taxes,

nanny tax case study

.png)