Good communication that establishes a mutual understanding is necessary when hiring a nanny, senior caregiver, or other household employee to work in your home. When it comes to defining benefits such as paid holidays, the details matter to ensure there is no misunderstanding about how these holidays will be compensated. If the employee often works more than 40 hours per week, defining this benefit and clarifying expectations becomes even more critical. Let’s examine how labor laws determine when overtime is due and how guaranteed pay alters the picture.

Read More

Topics:

overtime rules,

household employee,

household employer,

hiring a nanny,

time tracking,

nanny hourly wage,

domestic employer legal responsibilities,

nanny overtime,

Hiring Elder care,

Senior Caregiver Payroll

When you hire a new household employee, it's important to handle the process carefully and thoroughly. Whether you're welcoming a nanny, a senior caregiver, or a household chef, understanding the key steps can help ensure a smooth integration into your home and family life. Here are several essential considerations to remember as you begin this important journey.

Read More

Topics:

household employee taxes,

caregiver payroll,

household staffing agency,

household employee,

hiring a nanny,

nanny employment practices,

nanny payroll,

nanny payroll tax,

nannies,

nanny tax,

nanny employee,

domestic employer legal responsibilities,

household payroll,

Hiring Elder care,

hiring care for seniors,

domestic worker,

caregiver management

Need a housekeeper, nanny, personal assistant, or estate manager to lend a helping hand in your home on a regular basis? Once you find the right person, you want to make sure that they stay employed with you for as long as possible. That means ensuring that everything is kept on the up and up – from communication, to a set payroll schedule, to tax withholdings. Hiring an in-home employee makes you a household employer. And you’ll need to be aware of what your legal responsibilities are.

Read More

Topics:

elder care,

household employer,

calculate nanny payroll tax,

1099 v w-2,

domestic employer legal responsibilities,

nanny tax compliance,

household payroll,

caregiver

Considering hiring a caregiver, nanny, or other in-home employee? You may think it’s more convenient to pay them under the table, but in fact, this could be a very costly decision if you end up getting caught. There are some important legal must-knows before hiring a household employee and here, we will go over what those are.

Read More

Topics:

domestic employer legal responsibilities

Having a child is a big commitment – it takes time, patience, and money, but the rewards of being a parent are unlike anything else in life. For many parents, the change in lifestyle that comes with parenting means that you need some extra hands.

Read More

Topics:

nanny tax,

domestic employer legal responsibilities

The California Domestic Workers' Bill of Rights (CA DWBR), which went into effect in 2014, along two other pieces of recent legislation obligate California household employers to special responsibilities. Recently the January 1, 2017 sunset provision of the 2014 CA DWBR legislation was repealed - a significant victory for domestic worker rights advocates.

California household employers must first make a determination, based on the nature of the work performed, whether their employee is a domestic service worker or a personal attendant. Duties determine the applicablity of Wage Orders and employee protections in California. It's a bit complicated!

Read More

Topics:

domestic employer legal responsibilities,

nanny independent contractor,

nanny work agreement,

california household employment

Are you an employer that employees one or more household employees? New laws require that employers providing wages to their employees now have the burden of proof, showing that they have paid the workers fairly and that they employees were not short changed out of the pay that they were due.

This shift of the burden of proof from the employee to the employer has huge implications in household employment. Household employment is in the midst of the perfect storm

Read More

Topics:

domestic employer legal responsibilities,

wage theft prevention

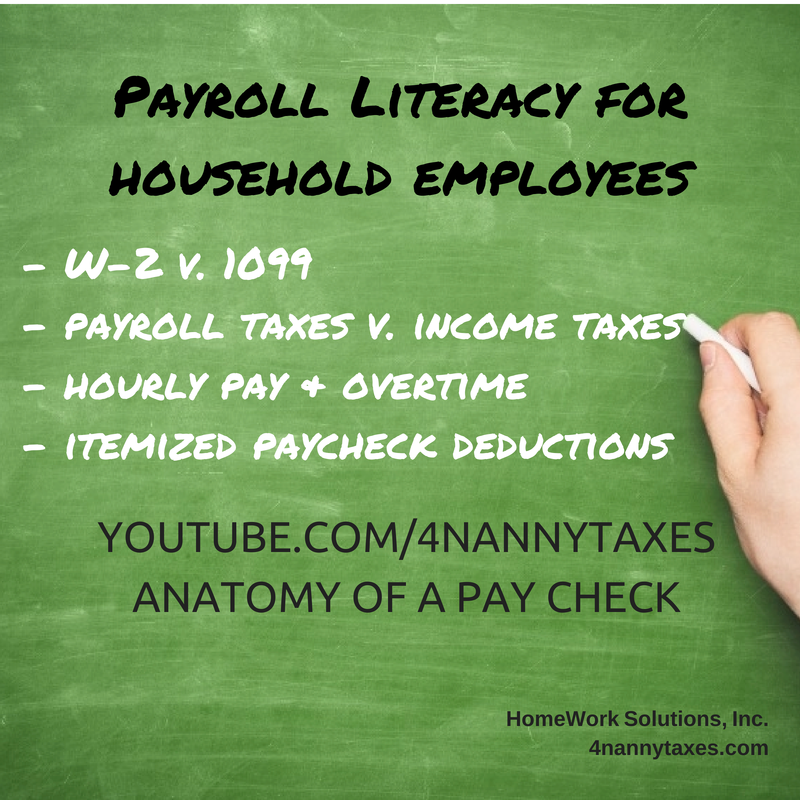

Nannies and senior caregivers who work in a private home, receive instructions and directions from the family employer and are paid by the family (either directly or via a household payroll company) are employees in the eyes of the IRS and US Department of Labor. As employees, many aspects of compensation and payroll are governed by payroll and labor law, no different than employees in a department store, factory or othr workplaces. Tax and labor law that covers household employees are often unique, and all too often neither the family nor the caregiver know the important details. Household payroll literacy on the part of a nanny or senior caregiver is important as they negotiate pay and benefits with their employers, many of whom don't understand these key points themselves.

Read More

Topics:

household employee taxes,

household payroll literacy,

nanny employment practices,

domestic employer legal responsibilities

Massachusetts’ Domestic Workers’ Bill of Rights (DWBR), S.2132, passed the MA Senate on May 8, the MA State House on June 18, and signed into law by Gov. Duval Patrick on July 2, 2014. The bill goes into effect April 2015.

Read More

Topics:

domestic workers bill of rights,

domestic employer legal responsibilities

A bill to increase the Massachusetts minimum wage and grant extended legal protections to Massachusetts' nannies, housekeepers and senior caregivers passed the Massachusetts House 125-24 April 4, 2014. The bill will move to the Massachusetts' Senate where stand alone minimum wage legislation (no linkage with domestic workers' rights) has previously passed. The two chambers will have to reach an agreement on the differences between their respective bills.

Read More

Topics:

domestic workers bill of rights,

domestic employer legal responsibilities