We took a difficult call recently from an adult daughter of an elderly couple who employed two senior caregivers. The Smiths live in New York

We took a difficult call recently from an adult daughter of an elderly couple who employed two senior caregivers. The Smiths live in New York

Topics: eldercare, aging parents, senior care, payroll tax enforcement, nanny background screening

El Congreso de los Estados Unidos está debatiendo la reforma migratoria que podría liderar un camino a la ciudadanía para los cerca de once millones de trabajadores indocumentados que viven y trabajan hoy en las sombras, evadiendo la legislación fiscal. Una buena parte de éstos trabajadores, están empleados como niñeras, empleadas domésticas y personas al cuidado de adultos mayores.

Topics: nanny payroll, nanny tax, payroll tax enforcement, nanny tax compliance

The IRS reports that audits of tax returns with income over $200,000 increased by 13% in 2012 over the prior year. The Wall Street Journal's Market Watch recently published advice on 5 steps to take to avoid an IRS audit on your Federal income tax return.

Topics: babysitter nanny tax, nanny payroll tax, nanny taxes, payroll tax enforcement

President Obama and congressional leaders in both parties have re-energized the debate on proposed immigration reform in the last several weeks. A "pathway to citizenship" for undocumented aliens currently residing in the US is a key element of the debate.

Topics: nanny undocumented, household payroll tax, payroll tax enforcement

Reprinted from April 2007

Topics: nanny tax statute of limitations, payroll tax enforcement

Reprinted from March 2007

Topics: elder care, household payroll tax, payroll tax enforcement

California is striving to shine a light on its underground economy. At the end of 2011, the LA Times reported that employers who pay their workers under the table - to avoid payroll taxes, workers’ compensation insurance and other government mandates - cost the state about $7 billion annually in lost tax revenues. Last week, California’s Labor Enforcement Task Force set up a public hotline for workers and employers to call in complaints and provide enforcement tips. Employers who are playing by the rules want to create a level playing field by "ratting out" their competitors who cheat. One state official notes, “The hotline will be a valuable tool to gather information and bring into compliance those employers who treat workplace safety and wage and hour laws as a nuisance”.

Topics: nanny tax audit, domestic employer legal responsibilities, payroll tax enforcement, california household employment

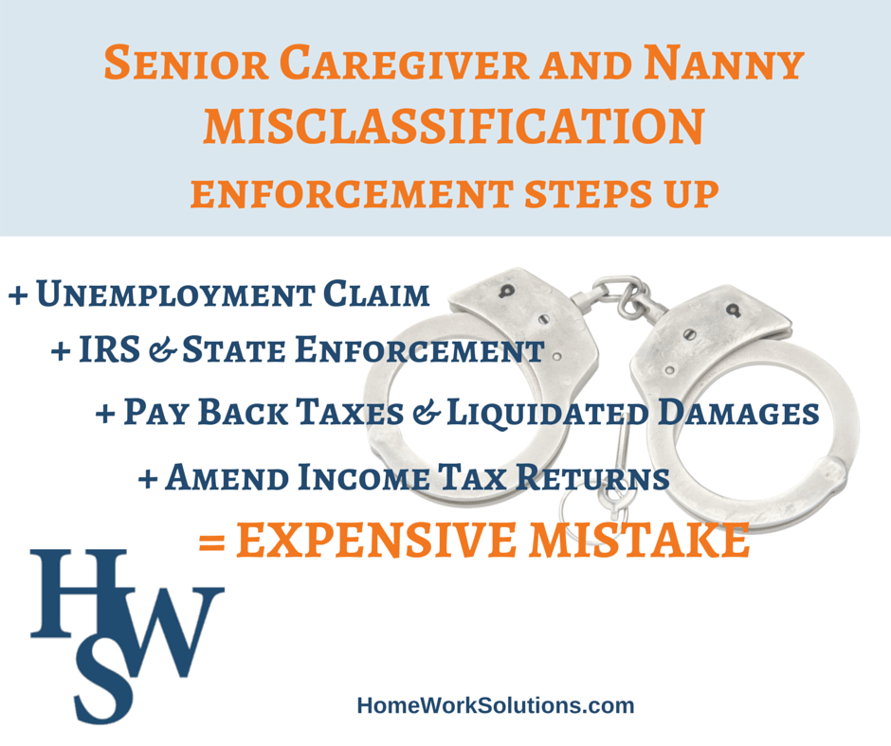

Worker misclassification - the practice by an employer of treating an employee as an independent contractor for purposes of avoiding employment taxes - is a constant issue in the field of household employment. Many household employers - and employees - simply feel this is easier, that the tax forms are too complicated, or the tax expense too high.

Worker misclassification - the practice by an employer of treating an employee as an independent contractor for purposes of avoiding employment taxes - is a constant issue in the field of household employment. Many household employers - and employees - simply feel this is easier, that the tax forms are too complicated, or the tax expense too high.

Topics: worker misclassification independent contractor, domestic employer legal responsibilities, payroll tax enforcement

The Internal Revenue Service (IRS) and 11 states, as we reported in October 2011, have entered into information sharing agreements for purposes of employment tax enforcement. Virginia, apparently, is making a concerted effort to collect state unemployment taxes from employers known to the IRS, but not to the state.

Topics: nanny tax audit, nanny tax statute of limitations, worker misclassification independent contractor, payroll tax enforcement, nanny tax compliance

The IRS's 2010 budget request includes an increase of approximately $300 million above its 2009 appropriations for enforcement. Conventional wisdom says that IRS compliance activities recoup $5 for every $1 spent. Historically, IRS enforcement efforts step up in times of budgetary crisis. The efforts target closing the "tax gap" - the difference between taxes owed and taxes paid. The "nanny tax gap" is estimated to be more than $5 billion per year and possibly as much as $20B.

Topics: payroll tax enforcement