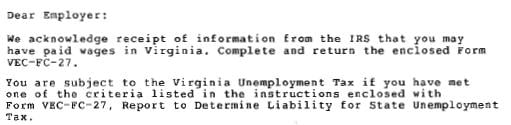

The Internal Revenue Service (IRS) and 11 states, as we reported in October 2011, have entered into information sharing agreements for purposes of employment tax enforcement. Virginia, apparently, is making a concerted effort to collect state unemployment taxes from employers known to the IRS, but not to the state.

We received dozens of these letters in our office in the last week. For these employers, it is a simple matter of helping the state match of the Federal Employer Identification number with the state's unemployment tax account. For those employers who are not properly reporting wages and taxes to the govenrment, it is a much more complicated affair.

We received dozens of these letters in our office in the last week. For these employers, it is a simple matter of helping the state match of the Federal Employer Identification number with the state's unemployment tax account. For those employers who are not properly reporting wages and taxes to the govenrment, it is a much more complicated affair.

Historically, employment tax enforcement efforts step up when tax revenues do not meet current obligations. Two thirds of the states have been forced to take loans from the Federal government to meet unemployment benefit obligations. Twenty states are in arrears in their loan repayment and next year that number is expected to rise. The 2011 information sharing agreement between the IRS and the states' departments of labor and revenue is unprecedented.

If you want to learn more about household employment taxes and your family's obligations, visit our Frequently Asked Questions or download the free e-book below. HomeWork Solutions works with thousands of families nationwide - we Simplify the Nanny Tax.

~~~~~~~~~~~~~~~

2015 Update:

The total of states who are formally sharing information for employment tax enforcement is now at 22. While the focus of the US DOL and the states has centered on misclassification - the practice of treating an employee as an independent contractor and thus avoiding employment taxes - the National Law Review notes that "Plaintiffs' lawyers, too, are focused on these claims, with an increasing number of class and collective action lawsuits following in their wake. Recent, high-profile court cases against FedEx, Uber and Lyft highlight the perils of misclassification."