If you employ one or more domestic workers (nanny, senior care aid, housekeeper, etc.), you have special responsibilities mandated by the New York Department of Labor.

Compensation

- Minimum Wage: You must pay your worker at least the minimum wage. If you provide meals or housing to your employee, you may be eligible for a credit toward the minimum wage paid to the worker (for more information, visit the NY Dept. of Labor website).

- Overtime: An employee is entitled to overtime at 1.5 times the employee’s basic hourly rate after 40 hours of work in a calendar week. If the Employee lives in your home, overtime is engaged after 44 hours in a workweek.

- Paid Time Off: After one year of employment, employees are entitled to three paid days off.

Time Off

- Weekly: One day of rest must be provided per week. Employers are encouraged to set this day to coincide with the employers day of worship, if they observe one.

- Yearly: After one year of employment, employees are entitled to three paid days off per year.

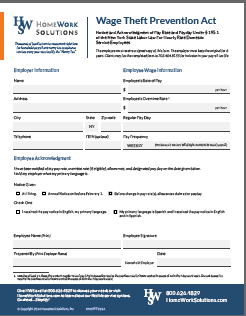

Written Work Agreement

- Contract: To be enforceable, a work contract must offer notice on policies regarding sick leave, vacation, personal leave, holidays, and hourly reporting.

- Sample Contract and Free Guide to Writing Your Own Nanny Contract

Insurance

- Unemployment Insurance: Unemployment insurance is required for any employee you pay over $500 per calendar quarter.

- Worker’s Compensation Insurance: This insurance is required for any employee that works at least forty hours per week, and covers them (and you) if they are injured on the job.

- Statutory Disability Insurance: This insurance covers an employee who cannot work because they are injured or sick (this includes pregnancy) as a result of something that does not occur in the course of their work. This policy pays benefits for up to twenty-six weeks. The employer can charge the employee up to $0.60 per week to cover the cost of the policy.

- Health Insurance: You are not required to provide health insurance to your employee.

Payroll Taxes

- State and Federal Payroll Taxes: The employer is responsible for unemployment tax and the employer’s portion of the FICA taxes. The employer is entitled to withhold the employee's portion of the FICA taxes from the nanny's wages; however, if the employer does not withhold the EMPLOYER remains responsible to pay this tax to the IRS.

- State and Federal Income Taxes: Income taxes are the nanny's responsibility. The nanny may ask and the employer may agree to withhold federal, state, and local income taxes from the worker’s paycheck. The domestic employer is not required to withhold income taxes, it is an accommodation to the worker.

- Reporting: The worker and the employer must file certain forms to comply with tax requirements. To learn more about your tax responsibilities, call HomeWork Solutions at 1-800-626-4829 for a free consultation or visit us here for to learn about our payroll and tax compliance services.

For more information on the NY State Domestic Bill of Rights, visit their website.

Related Resource:

411: Household Payroll in New York

Webinar Recording: HWS and Park Slope Parents Employing a Nanny in New York