May was an extremely busy month for labor rules across the U.S. Read on for our latest roundup of the Department of Labor's final rule, its ramifications across industries, and expert opinions on how all these topics impact your practice and your clients.

DOL Finalizes Fiduciary Investment Advice Regulation | Practical Law The Journal | Reuters

Reuters

The Department of Labor (DOL) has finalized a regulation on the definition of fiduciary investment advice under the Employee Retirement Income ...

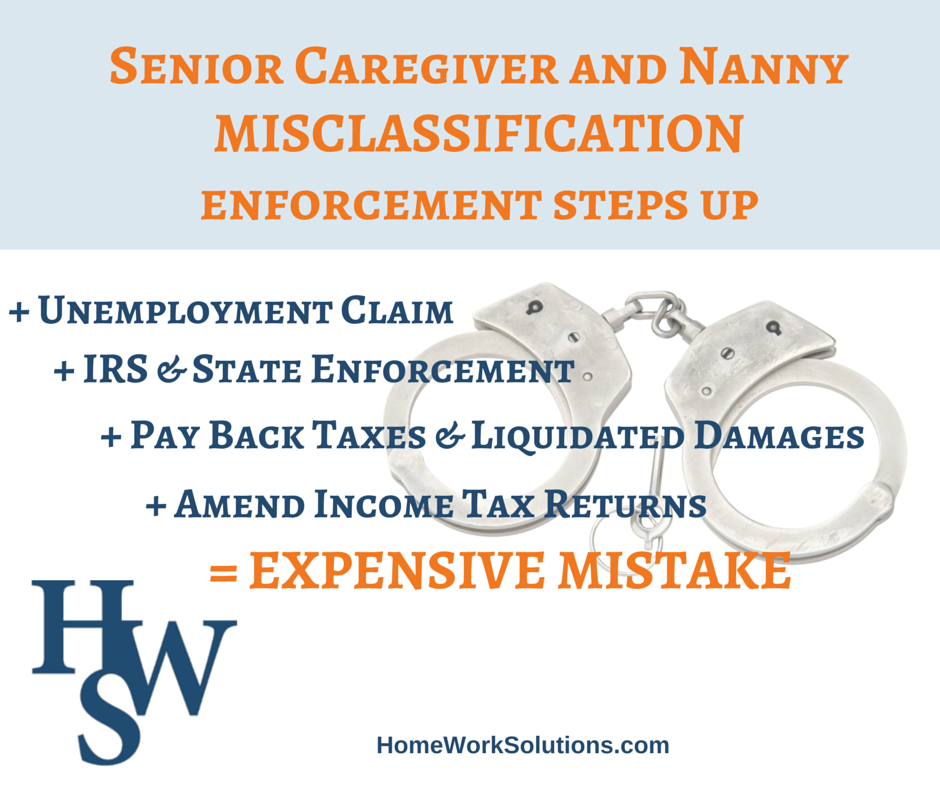

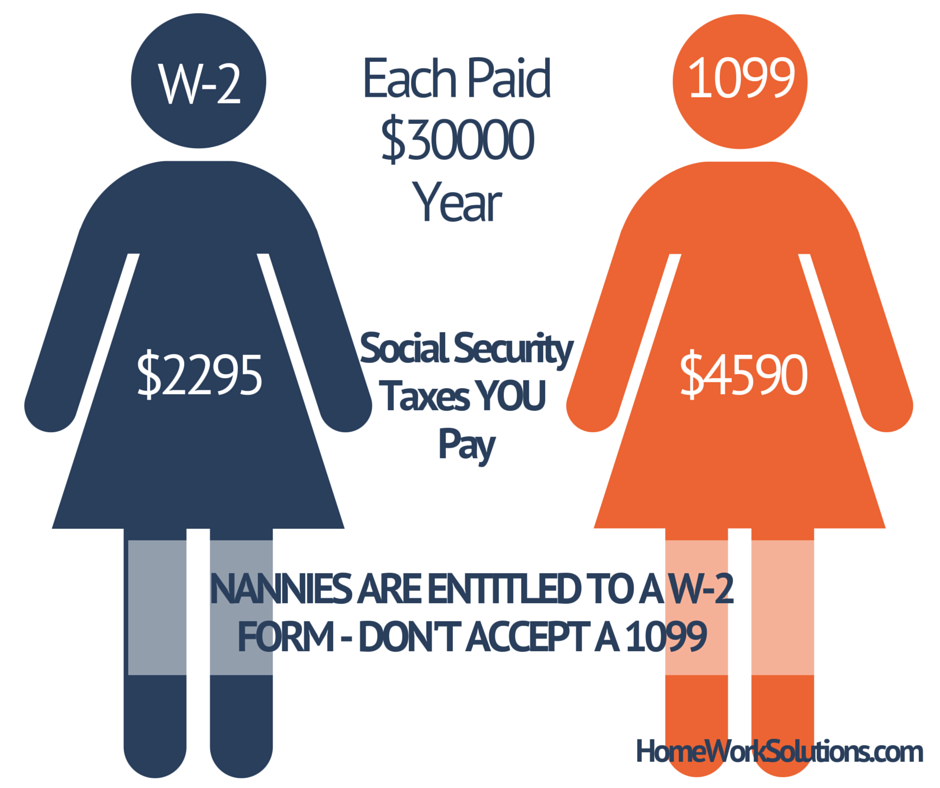

.png?width=290&name=W-2_(1).png) Tax season is in full swing, and Americans are preparing to file their annual income tax returns. If you are a household employer - you employ a nanny, housekeeper or senior caregiver - you will find conflicting advice on how to handle the "nanny taxes."

Tax season is in full swing, and Americans are preparing to file their annual income tax returns. If you are a household employer - you employ a nanny, housekeeper or senior caregiver - you will find conflicting advice on how to handle the "nanny taxes."