Need a housekeeper, nanny, personal assistant, or estate manager to lend a helping hand in your home on a regular basis? Once you find the right person, you want to make sure that they stay employed with you for as long as possible. That means ensuring that everything is kept on the up and up – from communication, to a set payroll schedule, to tax withholdings. Hiring an in-home employee makes you a household employer. And you’ll need to be aware of what your legal responsibilities are.

Read More

Topics:

elder care,

household employer,

calculate nanny payroll tax,

1099 v w-2,

domestic employer legal responsibilities,

nanny tax compliance,

household payroll,

caregiver

Did you know that if you pay a senior caregiver or nanny directly that it’s likely that the law considers your caregiver an employee?

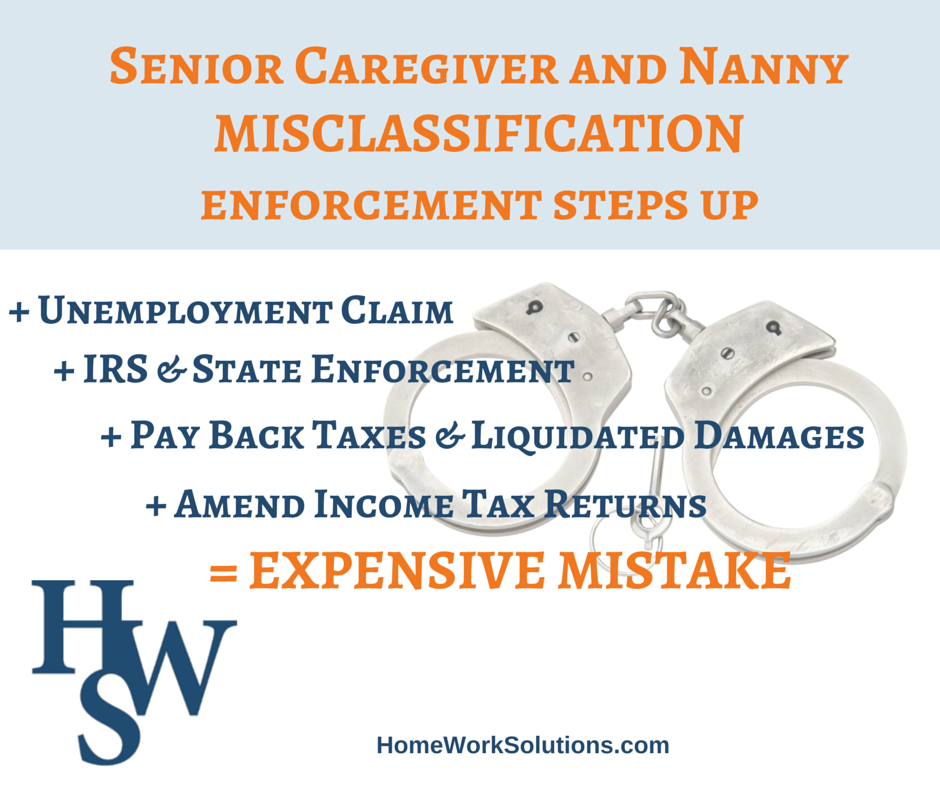

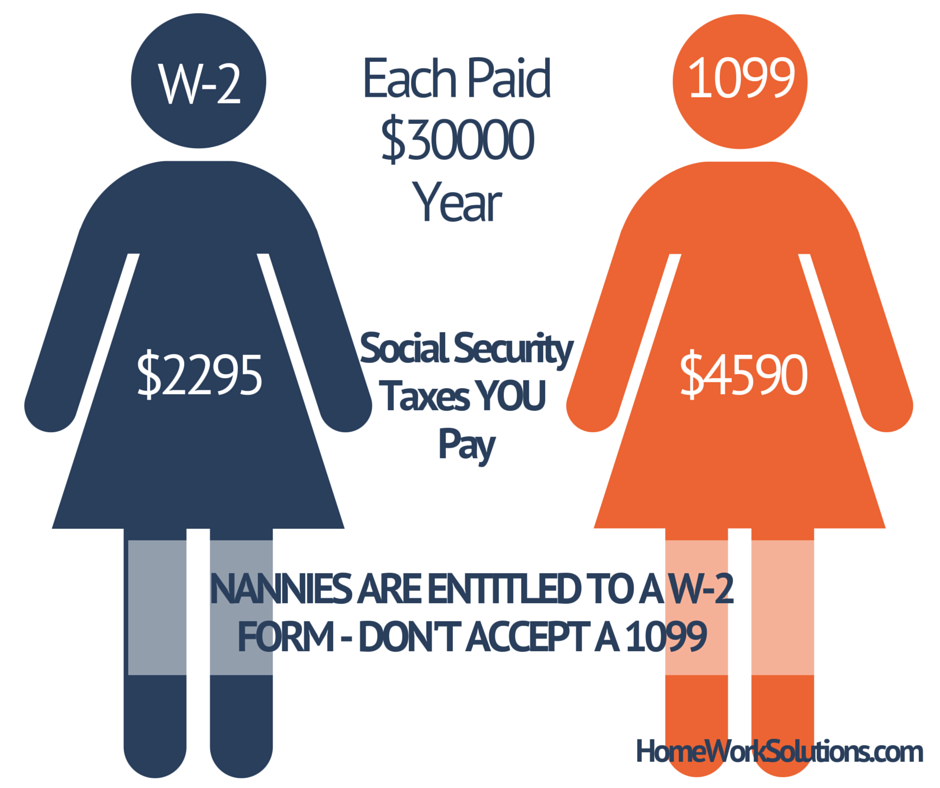

As an employer, you have the responsibility to understand and follow pertinent labor regulations and laws. This includes tracking hours worked each week, paying FICA and overtime, and getting insurance for workers compensation, which will help protect you and the caregiver in case an injury occurs on the job. If you don’t adhere to these laws and instead classify your employee as an independent contractor, you could be liable for misclassification. It could be an incredibly costly mistake that leads to back tax payments and other expensive penalties.

Read More

Topics:

independent contractor,

1099 v w-2

A recent Forbes article sums this reoccurring argument up nicely – the government’s massive enforcement surrounding worker classification, or misclassification, is all about money, lots and lots of money.

Read More

Topics:

1099 v w-2,

nanny independent contractor,

senior caregiver independent contractor

Every American dreads this date. APRIL 15th! We see images of adding machine tape, lines at the post office, and piles of tax receipts. January is the month household employers deliver W-2 forms to their nanny, housekeeper and other household employees. After a month of frantic phone calls from employers and caregivers alike pleading for tax help, I can offer the following reflections:

Read More

Topics:

nanny taxes,

1099 v w-2,

nanny tax compliance,

Senior Caregiver Payroll

HWS' Client Care Manager, Mary Crowe, shares the story of a client who issued her nanny a 1099 form, and later found herself on the wrong side of the IRS.

Our client, Linda M. came to us when her relationship with her nanny was in crisis over taxes. Linda lives in New Jersey and she hired her nanny in the fall and was paying her in cash every week. She has an accountant to handle her income taxes, and when she hired the nanny her accountant told her that everyone treats their nanny as an independent contractor.

Read More

Topics:

nanny w-2 form,

worker misclassification,

1099 v w-2

Usually around this time of year we start getting worried phone calls from families confused by the household employee taxes or the "nanny taxes." We pulled together some more of the frequently asked questions our tax experts are getting in time for April 15th.

Q. My domestic (elder caregiver, housekeeper, nanny) wants to be treated as a "contractor." Can I do that?

Read More

Topics:

elder care,

eldercare,

household employee taxes,

senior care,

1099 v w-2,

senior home-care workers

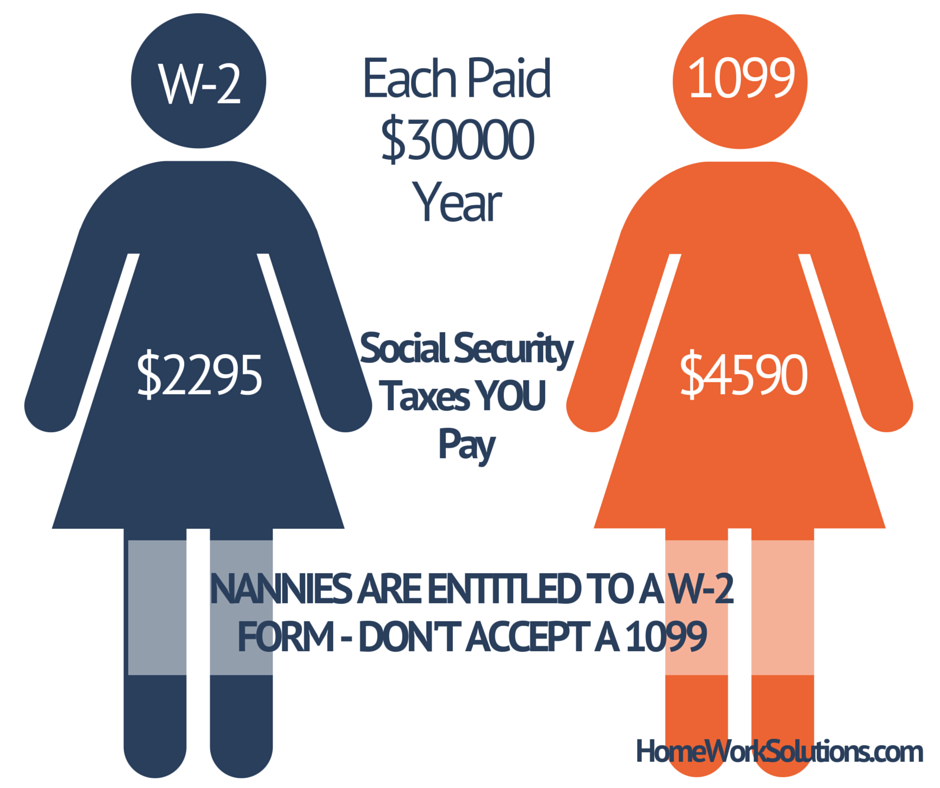

Regardless of whether your household employee is full time or part time, employers are required to pay employment taxes if the employee is paid $1900 or more per year (in 2014).

Read More

Topics:

household employee,

household employer,

nanny taxes,

1099 v w-2,

household payroll tax,

household payroll

Household employee placements- including butlers, chefs, housekeepers and nannies- are on the rise, said Sarah Tilton of the Wall Street Journal in a recent online article. Accustomed to the high level of service they receive on luxury vacations and five star hotels, wealthy homeowners are increasingly staffing their residences with specially trained personnel to make their lives more comfortable.

Read More

Topics:

household employee taxes,

1099 v w-2,

domestic employer legal responsibilities,

nanny tax compliance

.png?width=290&name=W-2_(1).png) Tax season is in full swing, and Americans are preparing to file their annual income tax returns. If you are a household employer - you employ a nanny, housekeeper or senior caregiver - you will find conflicting advice on how to handle the "nanny taxes."

Tax season is in full swing, and Americans are preparing to file their annual income tax returns. If you are a household employer - you employ a nanny, housekeeper or senior caregiver - you will find conflicting advice on how to handle the "nanny taxes."

Read More

Topics:

household employee,

worker misclassification,

independent contractor,

nanny tax,

nanny taxes,

1099 v w-2

Hiring a nanny or a housekeeper to help you out at home, a personal assistant to keep you organized, a senior caregiver to help you out with your aging parents, a gardener, cook or any other household worker to whom you pay directly (more than $1800 in calendar year 2013, $1900 in calendar year 2014) and you control the way the work is done and how, makes you a household employer!

According to the IRS's Publication 926 household employers who pay a worker more than $1800 cash wages in a calendar year, are required to file payroll taxes.

Read More

Topics:

worker misclassification independent contractor,

1099 v w-2

.png)

.png?width=290&name=W-2_(1).png) Tax season is in full swing, and Americans are preparing to file their annual income tax returns. If you are a household employer - you employ a nanny, housekeeper or senior caregiver - you will find conflicting advice on how to handle the "nanny taxes."

Tax season is in full swing, and Americans are preparing to file their annual income tax returns. If you are a household employer - you employ a nanny, housekeeper or senior caregiver - you will find conflicting advice on how to handle the "nanny taxes."