If you're hiring a nanny, senior caregiver, or other household employee, you're not just providing a paycheck; you’re also responsible for certain tax withholdings. In 2026, if you pay a household employee more than $3,000, you're required to withhold Social Security and Medicare taxes (FICA) from their wages.

Read More

Topics:

caregiver payroll,

nanny,

nanny payroll,

nanny tax,

senior,

CPA,

homework solutions,

household employer taxes,

2026 W-4 form,

household employee withholding,

IRS tax forms,

how to fill out a w-4 form,

2026 tax updates,

W-4 form

Read More

Topics:

caregiver payroll,

nanny agency,

senior care,

nanny,

nanny tax,

Senior Caregiver Payroll,

legal nanny pay,

household employment taxes,

household employer responsibilities,

nanny tax laws,

under the table payment risks,

paying nanny cash,

nanny payroll service

Hiring someone to work in your home—whether it’s a nanny, a senior caregiver, or a personal assistant—is an act of trust. It’s also the start of a legal relationship that comes with tax and payroll responsibilities many families don’t expect.

Read More

Topics:

caregiver payroll,

nanny agency,

nanny,

nanny taxes,

agency,

household employment,

Pay nanny legally,

household employment taxes,

nanny tax guide

Feeling like there’s never enough time in the day? You’re not alone. Between work, family, and everything else on your plate, managing your household’s payroll and taxes can feel overwhelming. But here’s the good news: you don’t have to do it all yourself.

Read More

Topics:

household employee taxes,

caregiver payroll,

nanny,

nanny payroll,

nanny background screening,

agency,

senior,

outsource household payroll,

stress-free payroll solutions

At HomeWork Solutions, we know that managing taxes can be confusing, especially when you're working as a nanny or caregiver. You might be tempted to try to simplify things by claiming "exempt" on your W-4 tax withholding form, thinking that it will allow you to keep more of your paycheck. However, this decision can lead to serious financial and legal consequences down the road.

Read More

Topics:

caregiver payroll,

household employee,

nanny payroll,

nanny taxes,

household payroll,

homework solutions

When you hire a new household employee, it's important to handle the process carefully and thoroughly. Whether you're welcoming a nanny, a senior caregiver, or a household chef, understanding the key steps can help ensure a smooth integration into your home and family life. Here are several essential considerations to remember as you begin this important journey.

Read More

Topics:

household employee taxes,

caregiver payroll,

household staffing agency,

household employee,

hiring a nanny,

nanny employment practices,

nanny payroll,

nanny payroll tax,

nannies,

nanny tax,

nanny employee,

domestic employer legal responsibilities,

household payroll,

Hiring Elder care,

hiring care for seniors,

domestic worker,

caregiver management

When your nanny decides to leave, whether the parting is mutual or unexpected, it can be an emotional and complicated time for everyone involved. Here are some important steps to consider to ensure a smooth transition and to maintain a positive relationship through the change:

Read More

Topics:

caregiver payroll,

household employee,

household employer,

hiring a nanny,

nanny employment practices,

nanny taxes,

nanny employee,

nanny return of family property,

household payroll,

nanny employment termination,

nanny separation,

caregiver,

domestic worker,

childcare,

child care

The short answer is yes. Domestic employees, such as nannies, household assistants, and elder care providers are hourly employees under the law, and therefore must be paid overtime. The Fair Labor Standards Act (FLSA) provides the framework to determine weekly overtime requirements for household workers. Some states also have laws requiring daily overtime. It is important to understand all applicable rules to determine when overtime pay is due.

Read More

Topics:

eldercare,

caregiver payroll,

nanny agency,

senior care,

nanny employment practices,

nanny,

nanny tax,

nanny overtime,

household payroll,

Senior Caregiver Payroll,

agency,

senior,

CPA

After hiring a nanny or senior caregiver, families often turn to Certified Public Accountants or other tax preparers with questions about what to do next. “How do I handle payroll,” and “Do I have to pay taxes,” are common questions.

Read More

Topics:

caregiver payroll,

accountants,

nanny payroll

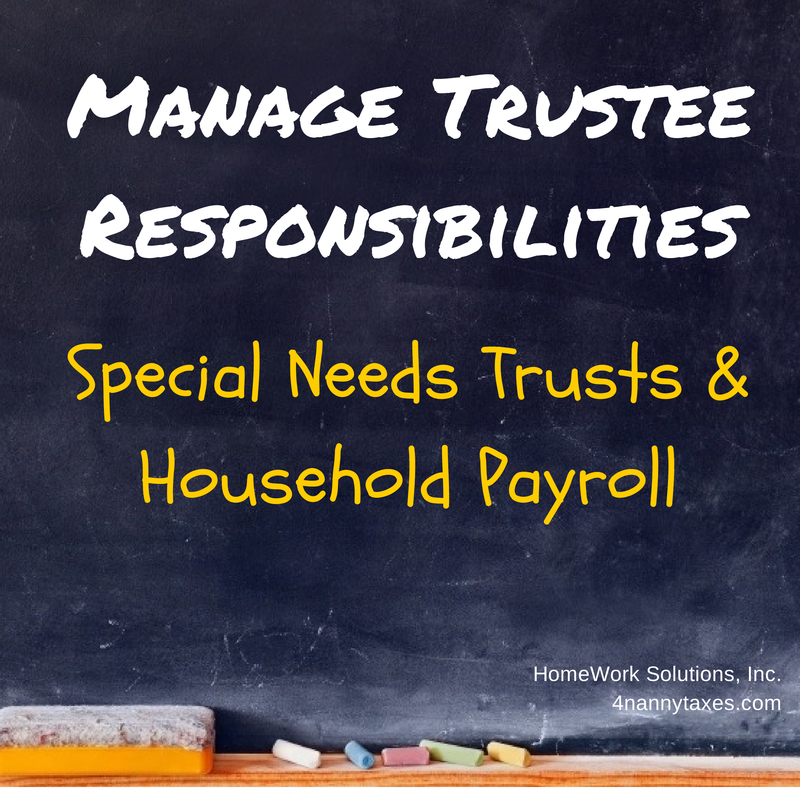

Do you hire, manage and issue payroll to a beneficiary’s caregiver(s) in your capacity as a trustee? If so it is important to understand the legal and tax obligations this type of employment creates for both the trust and you personally.

Read More

Topics:

Special Needs Trust,

caregiver payroll,

worker misclassification,

household payroll,

workers compensation household employees

.png)