A Guide for Nannies Picking Up Side Jobs

Babysitting is an essential service for parents who want to go on a date, attend a child-free event, or simply have some time to recharge. However, when tax season arrives, many caregivers wonder whether they need to pay taxes on those earnings. The answer depends on how much money changed hands and whether the temporary work meets the guidelines for self-employment.

Read More

Topics:

household employee taxes,

nanny,

agency,

nanny side jobs,

babysitting taxes,

babysitter self-employment tax

Feeling like there’s never enough time in the day? You’re not alone. Between work, family, and everything else on your plate, managing your household’s payroll and taxes can feel overwhelming. But here’s the good news: you don’t have to do it all yourself.

Read More

Topics:

household employee taxes,

caregiver payroll,

nanny,

nanny payroll,

nanny background screening,

agency,

senior,

outsource household payroll,

stress-free payroll solutions

When you hire a new household employee, it's important to handle the process carefully and thoroughly. Whether you're welcoming a nanny, a senior caregiver, or a household chef, understanding the key steps can help ensure a smooth integration into your home and family life. Here are several essential considerations to remember as you begin this important journey.

Read More

Topics:

household employee taxes,

caregiver payroll,

household staffing agency,

household employee,

hiring a nanny,

nanny employment practices,

nanny payroll,

nanny payroll tax,

nannies,

nanny tax,

nanny employee,

domestic employer legal responsibilities,

household payroll,

Hiring Elder care,

hiring care for seniors,

domestic worker,

caregiver management

If you recently hired a household employee, you know that you have employment tax obligations. One of those is to pay Federal and State Unemployment Insurance tax. This benefit program is confusing to most, so here we will break down some essential things to know about it.

Read More

Topics:

nanny w-2 form,

household employee taxes,

nanny undocumented,

nanny unemployment insurance,

nanny payroll,

nanny benefits,

W-4,

pandemic

Are you thinking ahead to summer? Before you know it, your kids will be out of school for an extended time. Between summer camps, vacations, and outside playdates, there will be many different activities to fill up the free time. Hiring a summer nanny provides a helping hand, minimizing the stress associated with disrupting your daily school routines. Here are some reasons why you should consider hiring a nanny this summer.

Read More

Topics:

household employee background check,

household employee taxes,

household staffing agency,

nanny summer schedule,

summer nanny,

nanny tax compliance,

agency

Whether you're a mom, dad, grandparent , or guardian, the children in your life are some of your greatest treasures. Finding the right person to love and care for them is significant and hiring a qualified nanny to work in your home requires some research. Here are some of the most important things you should know before hiring a long-term nanny.

#1: Know what you need.

Every family is unique, which means your childcare needs will be unique too. Understand your family's needs and make a list of expected duties and responsibilities you want a nanny to have. Then, think about the qualities you're looking for in a nanny. Do you want someone young and energetic that may be just starting their nanny career? Maybe you would be more comfortable with someone experience, who has worked with multiple families during their career. Know what you're looking for, and let that help guide your search.

Read More

Topics:

household employee taxes,

nanny agency,

summer nanny,

nanny payroll tax,

nannies,

nanny tax compliance,

outsource nanny payroll,

domestic worker

Hiring a senior caregiver, a nanny, or a housekeeper who regularly works in your home is a personal decision. It takes time to find the right person to fit your family's unique needs, so once you've found that person, it's essential to get things started on the right foot. Here are three of the most important things to do immediately upon hiring your new domestic employee.

Read More

Topics:

household employee taxes,

household employee,

nanny payroll tax,

nanny work agreement,

nanny tax compliance,

caregiver,

nanny management

Whether you hired a nanny, a housekeeper, a personal assistant, or a private educator this year, there are some important things to know when it comes to filing taxes. When you hire someone to work in your home, you become an employer. Tax and labor laws generally apply, even if there are some small exemptions unique to household employers. Many families don’t know this and make the mistake of paying the employee “off the books.” This could be a very costly error. Here are some specific ways to avoid domestic employee tax problems.

Read More

Topics:

housekeeper,

household employee taxes,

nanny payroll tax,

nanny hourly wage,

nanny independent contractor,

nanny tax compliance,

household payroll,

caregiver

If you are a CPA at this time of year, you are hoping and praying that your clients with nannies have their documents in order. Your fingers are crossed that your clients have tracked their nanny’s hours worked, paychecks paid, and all with their Social Security and Medicare taxes withheld. You really hope they have already done their quarterly unemployment tax filings and issued their nanny's W-2. Unfortunately, the odds are not in your favor. Most nanny employers either are not fully aware of the responsibilities of household employment or lack the time to handle these obligations, which leads to hours and hours of extra work on the part of you, their CPA.

Read More

Topics:

household employee taxes

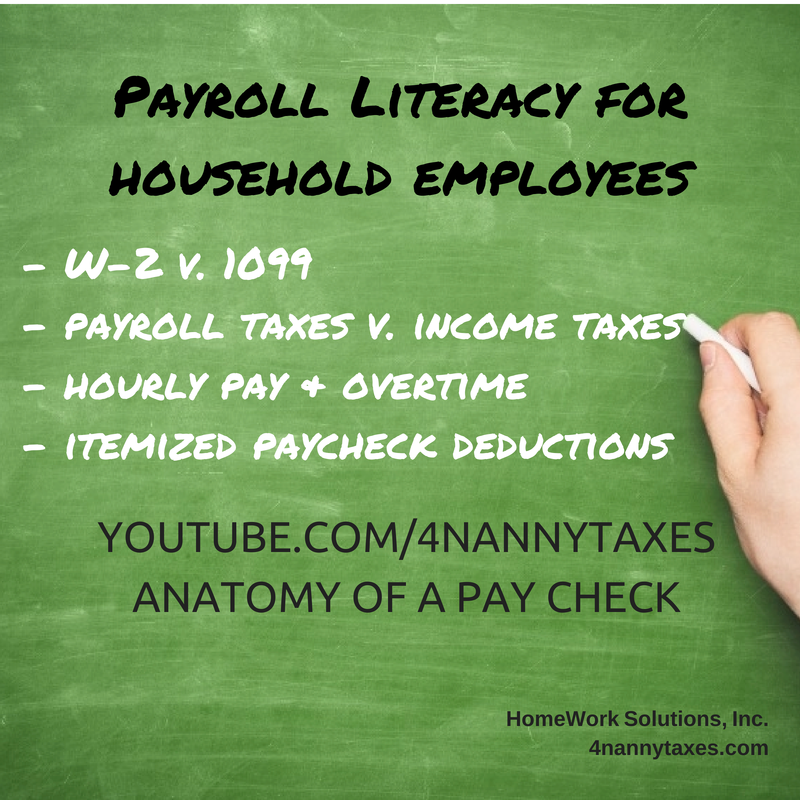

Nannies and senior caregivers who work in a private home, receive instructions and directions from the family employer and are paid by the family (either directly or via a household payroll company) are employees in the eyes of the IRS and US Department of Labor. As employees, many aspects of compensation and payroll are governed by payroll and labor law, no different than employees in a department store, factory or othr workplaces. Tax and labor law that covers household employees are often unique, and all too often neither the family nor the caregiver know the important details. Household payroll literacy on the part of a nanny or senior caregiver is important as they negotiate pay and benefits with their employers, many of whom don't understand these key points themselves.

Read More

Topics:

household employee taxes,

household payroll literacy,

nanny employment practices,

domestic employer legal responsibilities

.png)