The CPA or accounting professional is often the first resource a family consults when hiring a nanny or senior caregiver. Families have questions about their tax responsibilities and the myriad rules and responsibilities that surround their new role as a household employer. You of course are knowledgeable about household employment taxes (the so-called “nanny taxes”) and have probably assisted many families to report and pay these taxes as part of your personal income tax practice. While you and the family can of course refer to IRS Publication 926 for specifics about Federal household employment tax reporting, your experience tells you this is not the end of the story.

Read More

Topics:

household employee taxes

Last Friday, HWS' Client Care Manager Mary Crowe took a phone call that went along these lines:

Read More

Topics:

household employee taxes,

nanny payroll tax

Usually around this time of year we start getting worried phone calls from families confused by the household employee taxes or the "nanny taxes." We pulled together some more of the frequently asked questions our tax experts are getting in time for April 15th.

Q. My domestic (elder caregiver, housekeeper, nanny) wants to be treated as a "contractor." Can I do that?

Read More

Topics:

elder care,

eldercare,

household employee taxes,

senior care,

1099 v w-2,

senior home-care workers

Hiring a nanny to care for children, or a caregiver for an elderly family member can be very expensive. These employees often work long hours and your need for their services is generally perpetual. The high cost of employing household workers often makes it tempting for families not to report paid wages, since reporting carries additional financial requirements related to unemployment insurance and other benefits. However, the risks to families who do not pay their domestic employees "on the books" are considerable.

Read More

Topics:

household employee taxes,

household employee,

household employer,

household payroll tax,

workers compensation household employees

In an inspiring and forward-thinking section of the New York Times on innovations in retirement, an article on innovative solutions to senior living offered news on several fronts. While most readers will be familiar with the existing alternatives such as in-home senior care, assisted living and independent senior living options, the article features new ideas that will certainly gain more traction as the baby boomer population ages. Often referred to as "aging in place," here are some examples highlighted in the article:

Read More

Topics:

elder care,

aging in place,

eldercare,

household employee taxes,

nanny background screening

With compliance rates hovering around 10-20%, many household employers are only now beginning to seriously consider the costs and risks related to paying nannies and other household workers "on the books." While filing and paying taxes on household employees brings with it additional costs and paperwork, more families are recognizing the merits of filing as employers, and helping household workers with income tax withholding.

Read More

Topics:

household employee taxes,

nanny payroll,

nanny tax,

nanny taxes

Household employee placements- including butlers, chefs, housekeepers and nannies- are on the rise, said Sarah Tilton of the Wall Street Journal in a recent online article. Accustomed to the high level of service they receive on luxury vacations and five star hotels, wealthy homeowners are increasingly staffing their residences with specially trained personnel to make their lives more comfortable.

Read More

Topics:

household employee taxes,

1099 v w-2,

domestic employer legal responsibilities,

nanny tax compliance

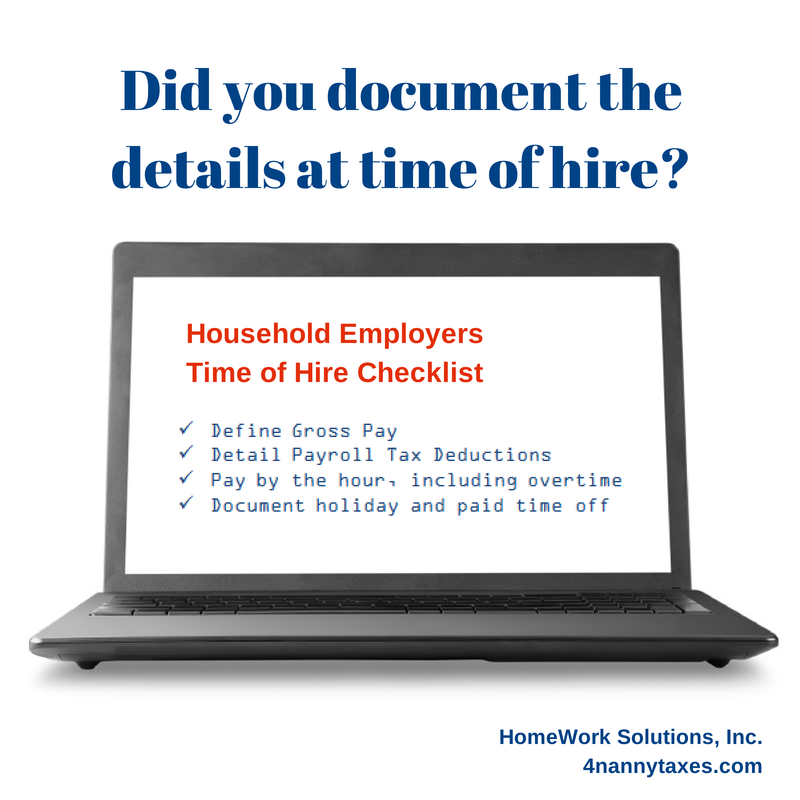

If you employ a household employee (defined by the IRS as any domestic worker earning more than $1900 in calendar year 2014), you are responsible for the so-called "nanny taxes". By keeping track of paperwork, you'll be in a much better position come tax time next year. Nanny agency owners can also benefit from staying organized during the year whether they are filing their agency's taxes on their own or with a tax preparer.

Read More

Topics:

household employee taxes,

household employee,

payroll recordkeeping,

nanny tax compliance

Don’t be stuck in fear ! We are here to help you!

I have told many of our clients that they are not the first person that we have helped when they were behind on their nanny taxes. I tell them that because it’s true!

Read More

Topics:

household employee taxes,

W-2,

nanny payroll tax,

nanny tax,

nanny taxes