When you hire a new household employee, it's important to handle the process carefully and thoroughly. Whether you're welcoming a nanny, a senior caregiver, or a household chef, understanding the key steps can help ensure a smooth integration into your home and family life. Here are several essential considerations to remember as you begin this important journey.

Read More

Topics:

household employee taxes,

caregiver payroll,

household staffing agency,

household employee,

hiring a nanny,

nanny employment practices,

nanny payroll,

nanny payroll tax,

nannies,

nanny tax,

nanny employee,

domestic employer legal responsibilities,

household payroll,

Hiring Elder care,

hiring care for seniors,

domestic worker,

caregiver management

When your nanny decides to leave, whether the parting is mutual or unexpected, it can be an emotional and complicated time for everyone involved. Here are some important steps to consider to ensure a smooth transition and to maintain a positive relationship through the change:

Read More

Topics:

caregiver payroll,

household employee,

household employer,

hiring a nanny,

nanny employment practices,

nanny taxes,

nanny employee,

nanny return of family property,

household payroll,

nanny employment termination,

nanny separation,

caregiver,

domestic worker,

childcare,

child care

The short answer is yes. Domestic employees, such as nannies, household assistants, and elder care providers are hourly employees under the law, and therefore must be paid overtime. The Fair Labor Standards Act (FLSA) provides the framework to determine weekly overtime requirements for household workers. Some states also have laws requiring daily overtime. It is important to understand all applicable rules to determine when overtime pay is due.

Read More

Topics:

eldercare,

caregiver payroll,

nanny agency,

senior care,

nanny employment practices,

nanny,

nanny tax,

nanny overtime,

household payroll,

Senior Caregiver Payroll,

agency,

senior,

CPA

Summer fun is coming to an end soon, and kids will be heading back to school before you know it. Transitioning from a summer schedule to an organized school environment can take some adjustment. Sometimes it can be difficult for children and parents, so here are some things to keep in mind to make things run as smoothly as possible.

Read More

Topics:

nanny agency,

nanny employment practices,

nanny payroll tax,

nanny job interview,

childcare,

nanny interview,

nanny management,

nanny job search

Starting July 15 and continuing through the end of 2021, many parents will be receiving a child tax credit as part of the American Rescue Plan. The tax credit is $3,600 for children younger than age six and $3,000 for those between six and seventeen. The payments are an ‘advance’ on 2021 taxes and will arrive in monthly installments on the 15th of every month. The total credit is available for married couples with children earning a combined $150,000 or less that file jointly or $75,000 for individuals. For people making more, the money will be reduced accordingly. Most people will get the funds through direct deposit into their bank account or how you filed your 2020 taxes.

Read More

Topics:

household employee,

nanny employment practices,

nanny payroll tax,

nannies,

nanny tax,

nanny interview,

nanny job search,

CPA,

IRS,

kids

Are you considering hiring a nanny? As a household employer, paying your nanny a fair wage is essential. While you may not be required to offer paid vacation, health insurance, paid sick time, or retirement savings plans, offering some benefits is important. Benefits can help you attract and retain the best nannies in the industry. In addition, it helps your nanny avoid exhaustion or burnout. So, while you are considering your nanny's employment details, make sure you think seriously about what it takes to provide a good benefits package.

Read More

Topics:

nanny employment practices,

nanny,

nanny payroll tax,

nanny health insurance,

nanny benefits,

household payroll

Tie their shoes. Make their beds. Prepare breakfast or lunch for themselves. Load the dishwasher. Laundry. These are all essential to-dos for children to learn. Are you teaching them these kinds of responsibilities or just doing it for them? Or, is your nanny doing most of the work rather than teaching the kids essential life-skills while she’s on duty?

Read More

Topics:

nanny employment practices

When it comes to performance reviews, employers are looking for efficient and effective strategies that allow for two-way conversation, feedback, and the ability to set goals while raising morale. Traditional performance reviews have a history of being unhelpful which in turn can lower employee morale, forcing employers to readjust how they review their employee’s performance. If you’re looking for ways to formally evaluate your senior caregiver or your nanny, here are some new strategies that can improve communication and bolster your employee’s confidence and productivity at the same time.

Read More

Topics:

nanny employment practices,

senior caregiver employment practices

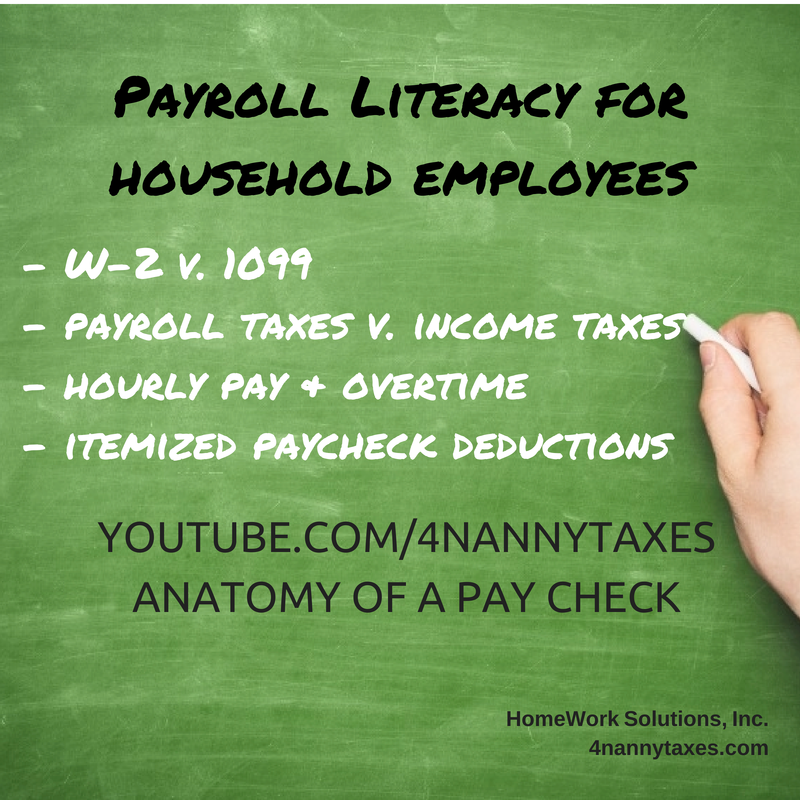

Nannies and senior caregivers who work in a private home, receive instructions and directions from the family employer and are paid by the family (either directly or via a household payroll company) are employees in the eyes of the IRS and US Department of Labor. As employees, many aspects of compensation and payroll are governed by payroll and labor law, no different than employees in a department store, factory or othr workplaces. Tax and labor law that covers household employees are often unique, and all too often neither the family nor the caregiver know the important details. Household payroll literacy on the part of a nanny or senior caregiver is important as they negotiate pay and benefits with their employers, many of whom don't understand these key points themselves.

Read More

Topics:

household employee taxes,

household payroll literacy,

nanny employment practices,

domestic employer legal responsibilities