It's been called the Silver Tsunami - America's 65+ demographic, which currently accounts for 13 percent of the overall population, is expected account for more than 20 percent by 2050 according to the U.S. Census Bureau. Three quarters of that population strong prefers and expects to age in place, remaining in their homes and communities as long as possible. Many families turn to senior home caregivers to help their loved ones remain independent in a safe environment, especially when non-medical support is called for.

Once the caregiver is hired, questions remain about how to handle the senior caregiver's payroll. Families turn to senior home care referral agencies, accountants and geriatric care managers for guidance. HWS has heard some remarkably bad advice on senior caregiver payroll, advice that when followed often comes back to haunt the senior or their family members.

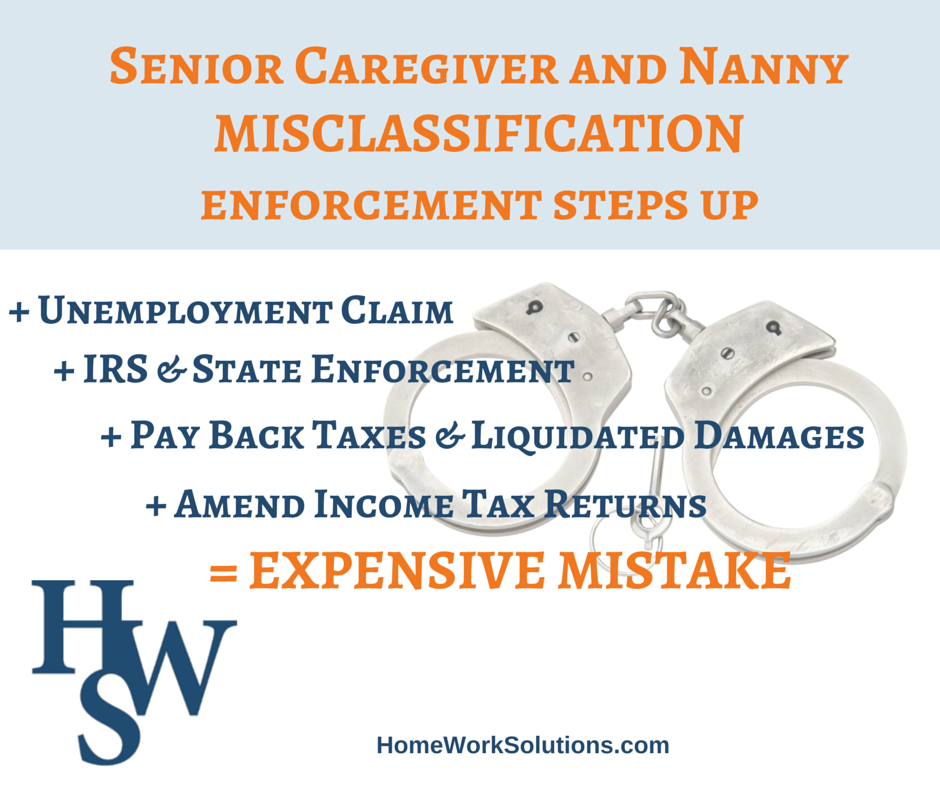

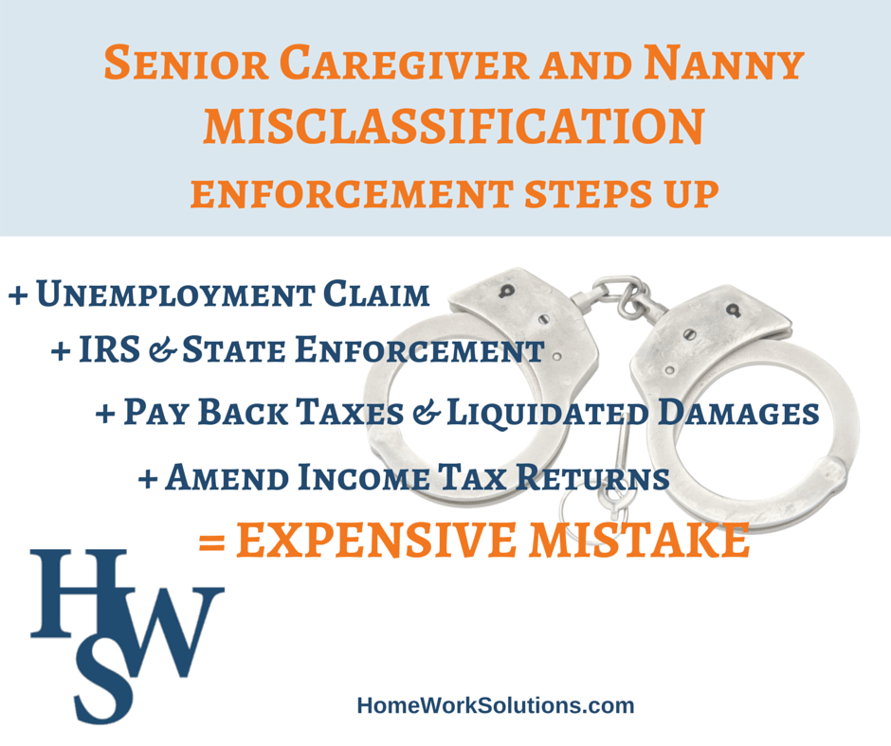

Worker misclassification - the practice by an employer of treating an employee as an independent contractor for purposes of avoiding employment taxes - is a constant issue in the field of household employment. Many household employers - and employees - simply feel this is easier, that the tax forms are too complicated, or the tax expense too high.

Worker misclassification - the practice by an employer of treating an employee as an independent contractor for purposes of avoiding employment taxes - is a constant issue in the field of household employment. Many household employers - and employees - simply feel this is easier, that the tax forms are too complicated, or the tax expense too high.