Kelley R. is a licensed social worker and a new mom. She and her husband hired a nanny so she could go back to work. After reviewing their budget, Kelley and her husband found a great nanny through a friend’s recommendation. Kelley saw no problem with agreeing to her request for a weekly wage of $800 take home after taxes, about $41,600 per year. Kelley found that getting all the reporting and tax calculations right – particularly when working from a net take home pay – proved to be a headache.

Read More

Topics:

senior care,

nanny,

nanny hourly wage,

nanny wage,

agency,

senior,

CPA

Summer is right around the corner, and kids are dreaming of their extended vacations. Unfortunately, many parents don't get the same amount of time off from their work responsibilities. Will you need an extra hand with the kids this summer?

Read More

Topics:

household employee,

nanny summer schedule,

nanny agency,

nanny payroll,

nanny payroll tax,

nanny tax,

nanny wage,

household payroll,

temporary nanny,

nanny job search

As employers, we’re required to provide fair compensation to our nanny and that means either providing a solid hourly, weekly, or monthly rate. Many families feel that paying a flat rate is the simplest and most efficient way to do things; however by law a nanny is an hourly employee and entitled to pay for all hours worked at the hourly rate, and may be entitled to overtime. Because the Fair Labor Standards Act specifies that household workers are to be paid hourly, improperly wording your compensation offer to the nanny can put you at risk to unpaid wage and unpaid overtime claims.

Read More

Topics:

nanny salary,

nanny wage

Nanny Wage Reviews

Your nanny is a childcare professional - and should be treated as one. That means as a nanny employer, you need to consider things like:

Read More

Topics:

nanny salary,

nanny wage

Having kids can get incredibly expensive, and paying for quality childcare is one of those expenses. However, as you might expect, the cost of living varies greatly from state to state and in some cities in the United State, childcare is significantly more costly. Data that was released recently by the Economic Policy Institute looked at more than 600 metropolitan areas in the country and included in a variety of factors in the findings including transportation, food costs, childcare, and housing. The results showed that childcare is usually the most expensive line item for parents raising little ones. Here are the 10 most expensive metro areas for childcare in the United States.

Read More

Topics:

nanny wage

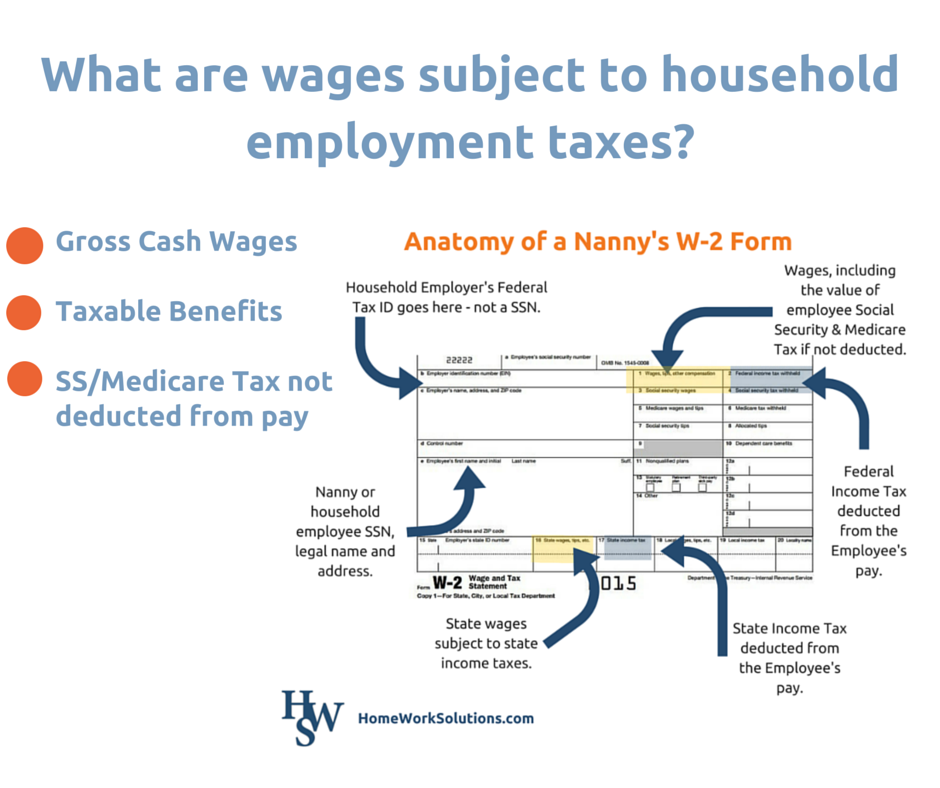

Have you searched long and hard for the perfect nanny or other household employee? When you find the right person that fits right in with your family, it’s time to determine salary and what will constitute household payroll wages.

Read More

Topics:

housekeeper,

nanny wage,

household payroll

Can you believe another year has flown by already? And 2014 is right around the corner …

HomeWork Solutions wants to help you stay ahead of the game by summarizing important deadlines and considerations before you get caught up in the holiday festivities.

Read More

Topics:

nanny w-2 form,

nanny tax,

nanny wage

In the household staffing arena, it is very common for families to express their appreciation for valued service with an end of year monetary bonus. Household employers often have the following questions:

Read More

Topics:

nanny payroll,

nanny bonus,

nanny wage

The beautiful baby has arrived and mom is preparing to return to work. The new parents begin interviewing nannies, a stressful endeavor for all concerned! Will she keep my baby safe? Will she love my child? Can I depend on her to be on time and not call out at the last minute? Does she have the experience I am looking for? Can I afford her? The absolutely last thing on the new parent's mind in these interviews is tax and labor law, and this is where nanny and family can find themselves out of sync.

Read More

Topics:

nanny hourly wage,

nanny work agreement,

nanny wage

.png)

.jpg)