Driving children is a significant responsibility, and when it’s part of a nanny’s role, it deserves careful planning and clear communication. Whether a nanny is using their own vehicle or the family’s, it’s important to establish safety standards, insurance coverage, and reimbursement policies that reflect mutual respect and professionalism. This guide walks you through how to do just that.

Read More

Topics:

nanny,

nanny mileage reimbursement,

agency,

nanny car insurance,

nanny driving children,

hiring a nanny who drives

When you welcome a nanny into your home, you're inviting someone to play an important role in your family's life. Offering benefits is a wonderful way to show your nanny just how much you value their care, dedication, and professionalism.

Read More

Topics:

nanny,

nanny health insurance,

nanny benefits,

nanny mileage reimbursement,

agency,

household employee benefits,

nanny compensation package,

HomeWork Solutions nanny payroll,

tax-free fringe benefits for nannies,

offering benefits to a nanny

If your nanny provides transportation for your children—whether it’s school drop-offs, sports practices, or playdates—it’s important to fairly reimburse them for the costs of using their vehicle. Proper reimbursement not only builds trust and goodwill but also keeps you compliant with tax and labor regulations. Here’s a straightforward guide to help you navigate mileage reimbursement for your nanny.

Read More

Topics:

nanny,

nanny mileage reimbursement,

Nanny driving expenses,

Gas reimbursement for nanny,

How to reimburse nanny for gas,

caregiver reimbursement

Are you considering hiring a nanny? Maybe a senior caregiver for one of your aging parents? Finding and hiring an experienced household employee helps provide the extra hand you need. But don’t forget, you’ll need to factor in the cost of hiring someone to work in your home. Paying them ‘under the table’ is illegal. Here are some essential things to remember when paying your employee fair and legally.

Read More

Topics:

nanny unemployment insurance,

hiring a nanny,

nanny overtime,

nanny paid time off,

nanny mileage reimbursement,

nanny tax compliance,

caregiver,

nanny vacation,

agency

It's almost time to say goodbye to another year! Our experienced team of professionals at HomeWork Solutions is here to help you stay on top of the deadlines and other details that you need to have when it comes to household payroll. This year, there were a variety of important action items that took place both on a state and federal level. Here’s a quick description of important must-knows:

Read More

Topics:

nanny pay rate notice,

caregiver pay rate notice,

domestic workers bill of rights,

nanny mileage reimbursement,

household payroll

Payroll changes often happen at the beginning of the calendar year, and nanny tax related changes are no different. The HomeWork Solutions household payroll experts have assembled a short overview of changes a nanny employer, employer of a senior caregiver, or any household employer needs to know.

Read More

Topics:

nanny health insurance,

nanny mileage reimbursement,

New York household payroll,

Affordable Care Act,

california household employment,

DC household payroll

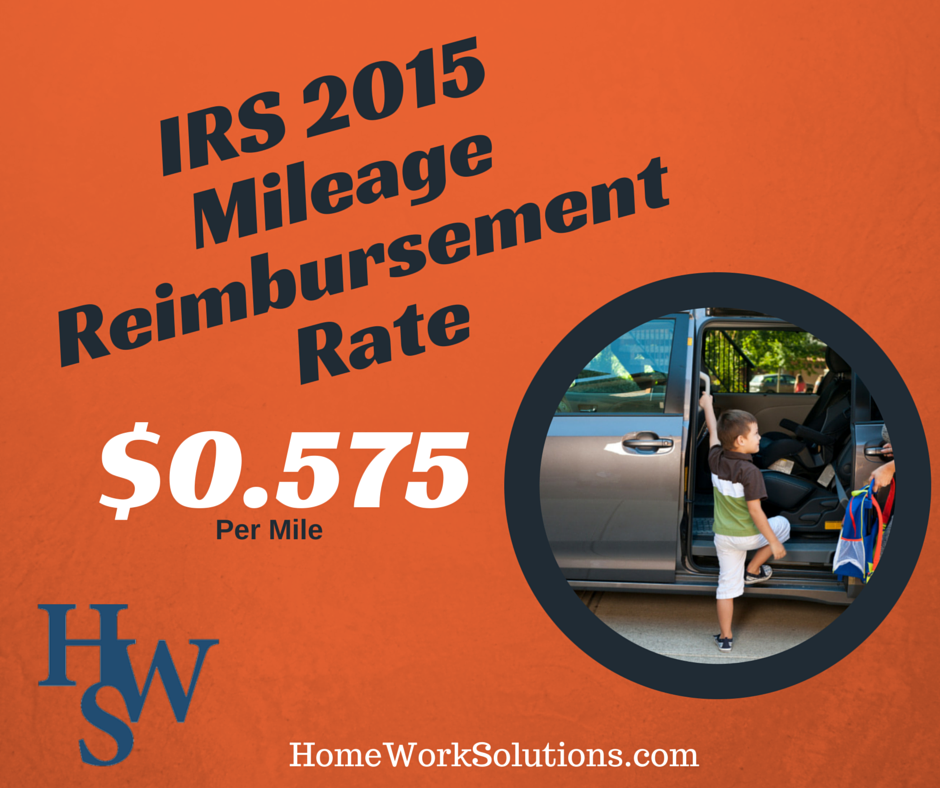

While mileage reimbursement and commuter transit benefits are scheduled to decrease January 1, 2014, other nanny tax numbers will increase.

Read More

Topics:

nanny tax,

domestic workers bill of rights,

nanny mileage reimbursement

The IRS an increase to the standard mileage reimbursement rate to take effect January 1st, 2013. The new rate increased from 55.5¢ (2012) to 56.5¢. For compliant household employers preparing to give their nannies a W-2 this tax season, this is imperative information.

Read More

Topics:

nanny expense reimbursement,

household employee expense reimbursement,

nanny payroll,

nanny mileage reimbursement

Many families who expect a nanny or house manager to purchase items for the family provide a family credit card for the expenses – making tracking of the purchases easy and avoiding the need for expense reimbursement.

Read More

Topics:

nanny expense reimbursement,

nanny mileage reimbursement

Many nannies are on the go with their charges on a regular basis. Library story hour, sports, music lessons, and even the grocery store are common destinations. The nanny and the parents both need a way to communicate - from the mundane coordination of activities to the unlikely emergency. In this era of instant communication, virtually all household staff need a cell phone to meet the expectations of their employer and perform their job duties.

Read More

Topics:

nanny expense reimbursement,

household employee expense reimbursement,

nanny mileage reimbursement

.jpg)