The end of 2022 is right around the corner. This is a popular time for household employers to recognize their employees with a holiday bonus. A bonus is a great way to show your appreciation for a job well done and shows your employees that you are grateful for their dedication.

Read More

Topics:

senior care,

nanny,

agency,

senior,

CPA

Kelley R. is a licensed social worker and a new mom. She and her husband hired a nanny so she could go back to work. After reviewing their budget, Kelley and her husband found a great nanny through a friend’s recommendation. Kelley saw no problem with agreeing to her request for a weekly wage of $800 take home after taxes, about $41,600 per year. Kelley found that getting all the reporting and tax calculations right – particularly when working from a net take home pay – proved to be a headache.

Read More

Topics:

senior care,

nanny,

nanny hourly wage,

nanny wage,

agency,

senior,

CPA

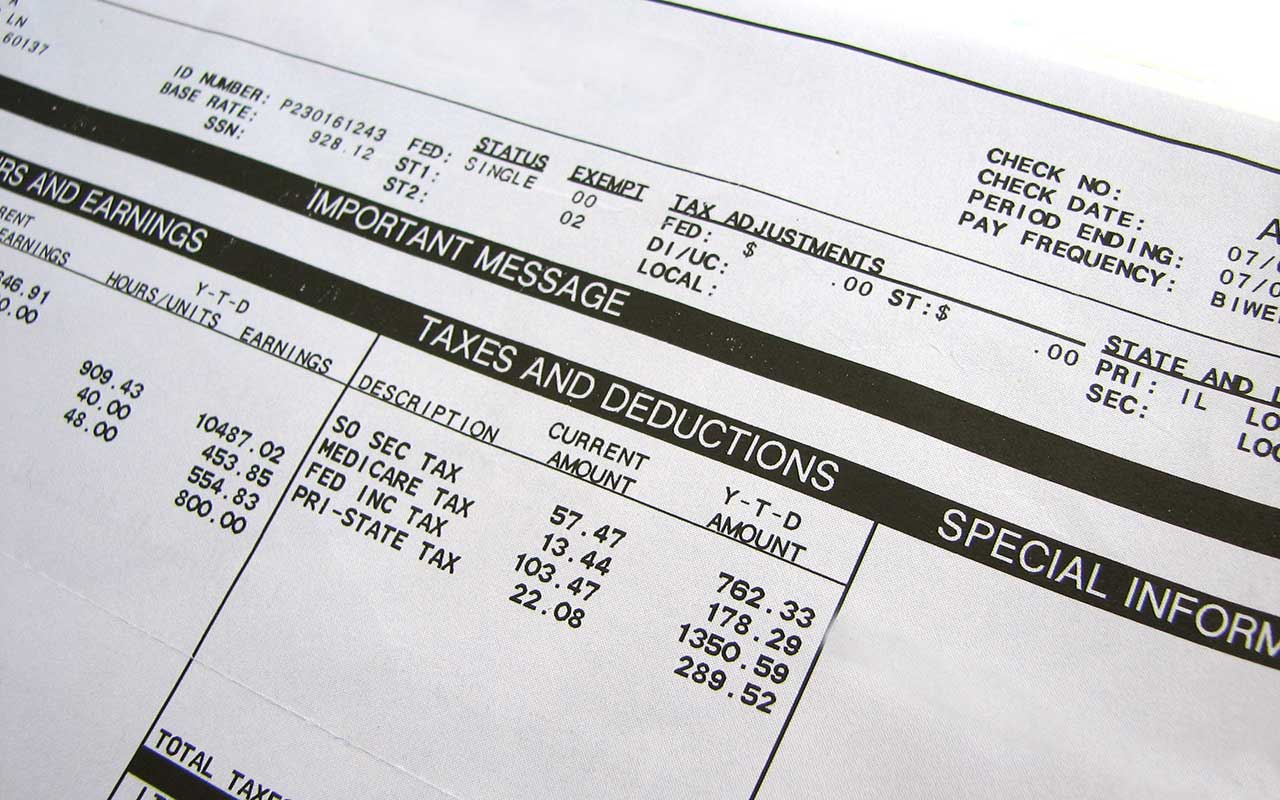

When you hire someone to work in your home, it is important to make sure you classify their employment correctly, and pay them legally. Most household workers are classified as employees, and with that employment relationship comes payroll and tax reporting requirements. Providing a paystub is one of these requirement in most states. The only states without paystub laws are Alabama, Florida, Arkansas, Georgia, Louisiana, Mississippi, Ohio, South Dakota, and Tennessee.

Read More

Topics:

worker misclassification,

payroll,

senior care,

nanny,

wage theft prevention,

agency,

senior,

CPA

When hiring an employee to work in your home, conducting background checks and calling references are key parts of the hiring process. Understanding the information that you will get from each can be the difference between a good hire and a bad one.

Read More

Topics:

household employee background check,

senior care,

nanny,

nanny tax,

caregiver background screening,

nanny background screening,

senior

When you find an amazing nanny, who is not only reliable, but aces the job every day, it is easy to lose sight of their life outside of work. Through casual conversation, your nanny may, or may not, have indicated their plans to grow their own family one day. When that day comes, and your ace lets you know they want to take parental leave, you need to understand parental leave laws, so you can be a great employer to your amazing nanny.

Read More

Topics:

nanny savings,

nanny tax,

agency,

senior,

CPA

If your household employee’s immediate family member – such as a parent or a spouse – passes away, they will need some time to grieve. They will also have personal arrangements and other legal details to take care of. That’s why it is important to have an established bereavement policy in place in your employment agreement, so discussions can be kept brief in difficult times.

Read More

Topics:

nanny,

nanny tax,

senior,

CPA

Governments are recognizing the need to ensure household employees are paid a living wage and slowly phasing in wage increases over a series of years. Effective July 1, 2022, minimum wage will be increasing in many states and cities across the country. As longtime advocates for fair and legal pay, we believe this is long overdue!

Read More

Topics:

senior care,

nanny,

agency,

senior,

CPA