Generally, in life, it pays to do things right the first time. Your nanny payroll taxes are no exception to the rule: while it may be tempting to evade these pesky taxes, in the long run, you will be thankful that you managed your household employment taxes well. It will cost much more of your money, time, and patience to deal with the consequences of tax fraud than to file your payroll taxes correctly the first time around!

Read More

Topics:

nanny tax audit,

nanny tax statute of limitations,

nanny tax,

nanny taxes,

caregiver,

nanny tax case study

Every American dreads this date. APRIL 15th! We see images of adding machine tape, lines at the post office, and piles of tax receipts. January is the month household employers deliver W-2 forms to their nanny, housekeeper and other household employees. After a month of frantic phone calls from employers and caregivers alike pleading for tax help, I can offer the following reflections:

Read More

Topics:

nanny taxes,

1099 v w-2,

nanny tax compliance,

Senior Caregiver Payroll

Part Time Nannies, Summer Nannies

MYTH “My nanny only works during the summer months when our kids are out of school. I don’t need to worry about nanny taxes since she is only a temporary employee.”

Read More

Topics:

nanny tax,

nanny taxes

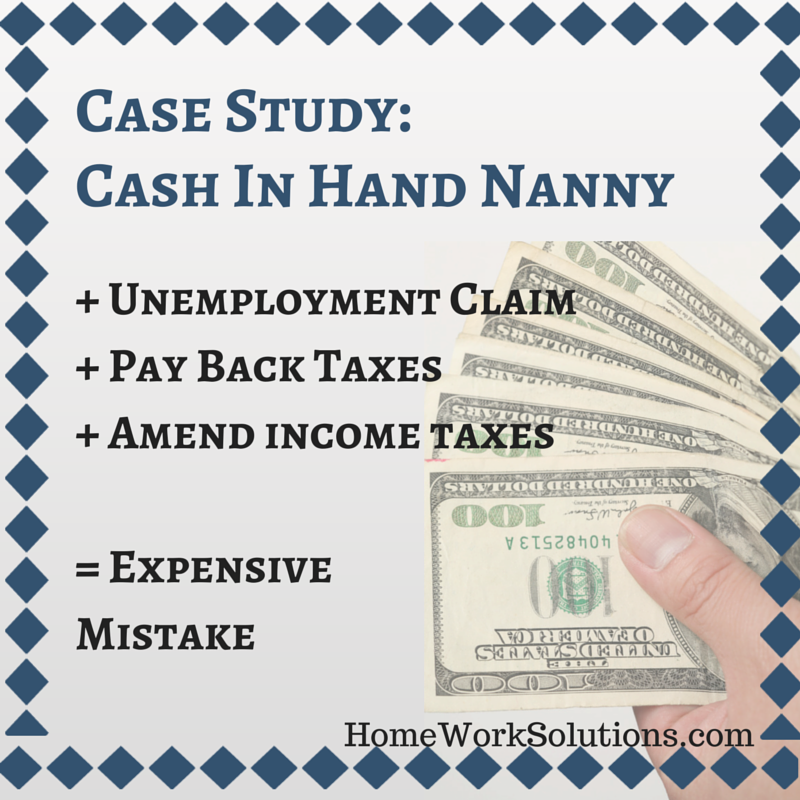

When a nanny who has earned her wages under the table is fired and files an unemployment claim, nanny taxes can become a big deal for the former employers (your family!). Read on about how—and why—paying your household employees on the books is the best choice for you and your family.

Read More

Topics:

nanny off the books,

nanny taxes,

nanny tax compliance

HWS' Client Care Manager, Mary Crowe, shares the story of a client who paid the nanny cash under the table, and later found himself on the wrong side of his state's unemployment agency.

Mike and Joyce R. hired a nanny when their twins were infants. They agreed with the nanny at the time that they were going to pay her $500 a week off the books. The nanny worked out wonderfully and she stayed with Mike and Joyce for almost three years, and was let go when the twins started a full-time pre-school/daycare situation. The family’s needs had changed, and they found another very part-time nanny to cover the afterschool hours.

Read More

Topics:

nanny off the books,

nanny unemployment insurance,

nanny taxes,

nanny tax case study

I recently attended Nannypalooza in Philadelphia where I was asked by a nanny in attendance if I could coach her on how to speak to her employer about being paid on the books. Immediately several other nannies joined the conversation, sharing that this is one of the most difficult conversations to initiate with their employers.

Read More

Topics:

nanny off the books,

nanny job satisfaction,

nanny taxes

School is out, and families nationwide are turning to summer nannies to provide safe, individualized caregiving for their young children over the summer holidays.

Read More

Topics:

nanny payroll,

summer nanny,

nanny taxes

Regardless of whether your household employee is full time or part time, employers are required to pay employment taxes if the employee is paid $1900 or more per year (in 2014).

Read More

Topics:

household employee,

household employer,

nanny taxes,

1099 v w-2,

household payroll tax,

household payroll

With compliance rates hovering around 10-20%, many household employers are only now beginning to seriously consider the costs and risks related to paying nannies and other household workers "on the books." While filing and paying taxes on household employees brings with it additional costs and paperwork, more families are recognizing the merits of filing as employers, and helping household workers with income tax withholding.

Read More

Topics:

household employee taxes,

nanny payroll,

nanny tax,

nanny taxes

The early bird really does get the worm, according to a recent article featured on The Motley Fool, a multimedia financial-services company that reaches millions of people each month through its website, books, newspaper column, television appearances, and subscription newsletter services. Author Jim Staats of Manilla.com reports that it’s never too early to prepare the necessary paperwork before the April 15th deadline; in fact, there are several ways that he suggests you can try to lower your tax bill each year:

Read More

Topics:

filing taxes,

tax return,

nanny taxes

.png)