The Internal Revenue Service issued new 2014 income tax withholding schedules and they are fully integrated with our online tax calculator now. We are fielding a lot of inquiries about new paycheck amounts and will try to address the common questions here:

Read More

Topics:

nanny,

nanny tax,

nanny taxes,

household payroll tax

Don’t be stuck in fear ! We are here to help you!

I have told many of our clients that they are not the first person that we have helped when they were behind on their nanny taxes. I tell them that because it’s true!

Read More

Topics:

household employee taxes,

W-2,

nanny payroll tax,

nanny tax,

nanny taxes

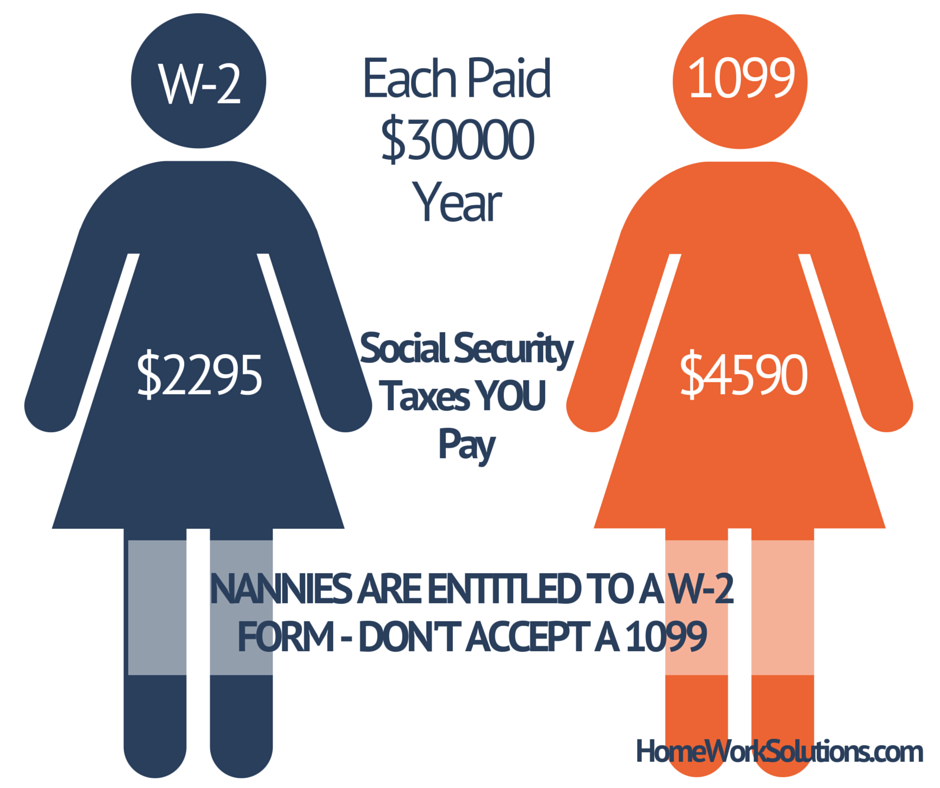

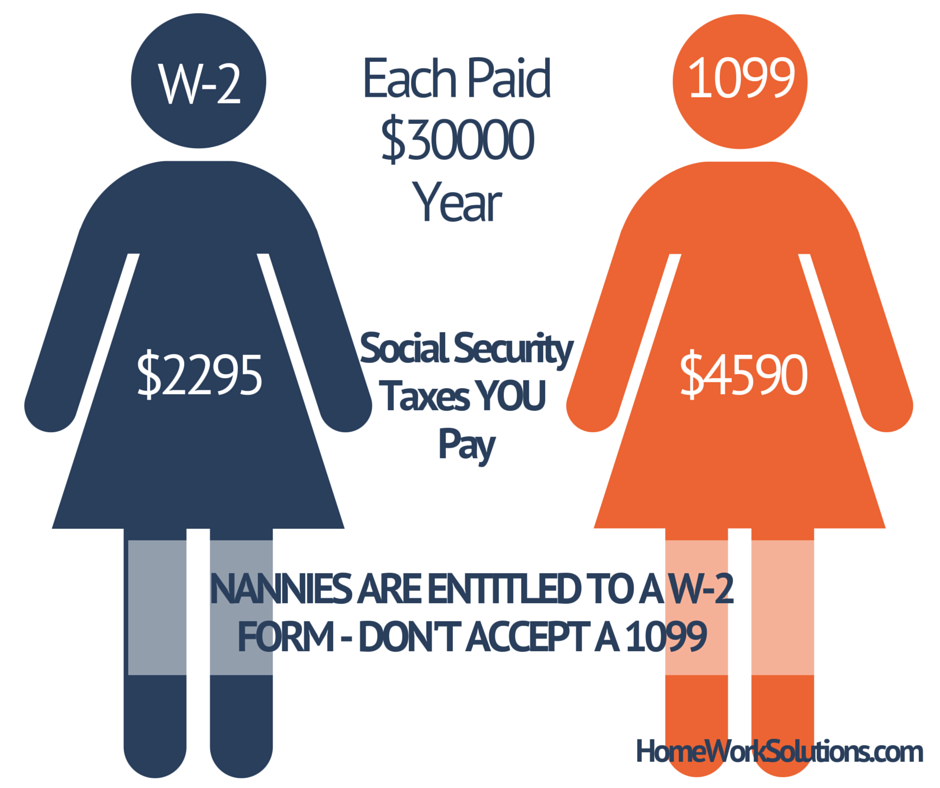

.png?width=290&name=W-2_(1).png) Tax season is in full swing, and Americans are preparing to file their annual income tax returns. If you are a household employer - you employ a nanny, housekeeper or senior caregiver - you will find conflicting advice on how to handle the "nanny taxes."

Tax season is in full swing, and Americans are preparing to file their annual income tax returns. If you are a household employer - you employ a nanny, housekeeper or senior caregiver - you will find conflicting advice on how to handle the "nanny taxes."

Read More

Topics:

household employee,

worker misclassification,

independent contractor,

nanny tax,

nanny taxes,

1099 v w-2

This past year, shocking headlines of arrest, strip-search of Indian diplomat overshadow alleged mistreatment of her nanny.

Foreign diplomats and foreign staff members of the United Nations and other "Non-Governmental Organizations" associated with the UN are permitted under US law, as a courtesy, to bring their foreign domestic service workers to work in the United States. These foreign domestic service workers are employed as nannies, maids, housekeepers and senior caregivers. The US State Department imposes strict rules that the foreign diplomat must agree to, contractually, with the domestic worker that governs their employment in the United States as part of the visa application and issuance.

Read More

Topics:

foreign domestic workers,

G5 domestic,

GV domestic,

nanny taxes

HomeWork Solutions is the Nation’s Leading Preparer of Household Employment Tax Returns, the so called “Nanny Taxes”

HomeWork Solutions provides professional payroll and tax services to household employers, nationwide. Our company has more than 20 years of experience helping families comply with their household employment payroll and taxes. Our office is staffed with 18 payroll professionals and 2 interns 100% dedicated to simplifying this complicated process for YOU!

Read More

Topics:

nanny payroll,

nanny tax,

nanny taxes,

calculate nanny payroll tax,

household payroll

There is good news for household employers who pay their nanny or senior caregiver "on the books." These employers are often eligible for tax savings on their personal income tax returns. And these tax savings often go a long way towards offsetting the household employer taxes they paid!

Read More

Topics:

nanny payroll tax,

nanny tax,

nanny taxes,

nanny health insurance

The IRS reports that audits of tax returns with income over $200,000 increased by 13% in 2012 over the prior year. The Wall Street Journal's Market Watch recently published advice on 5 steps to take to avoid an IRS audit on your Federal income tax return.

Read More

Topics:

babysitter nanny tax,

nanny payroll tax,

nanny taxes,

payroll tax enforcement

Rhode Island kicks off tax amnesty program. If you are a Rhode Island tax payer and are delinquent on any states taxes, you will soon have an opportunity to come current on your taxes without having to pay any penalties. The Rhode Island Department of Taxation announced the amnesty program in its most recent newsletter, joining a handful of states offering amnesty to individuals and/ or businesses.

Read More

Topics:

nanny payroll tax,

nanny taxes,

household payroll tax,

nanny tax compliance

We are receiving an unusual number of phone calls this year related to nanny e-Filing issues. Here are the most common issues. In all cases filing a paper tax return this year is the corrective action needed.

Read More

Topics:

nanny taxes

The Form 1040 Schedule H is the vehicle that household employers use to report wages paid and employment taxes due for household workers. This form is a bit more complex for 2011 due to 2 significant events.

Read More

Topics:

nanny payroll tax,

nanny taxes,

household payroll tax

.png?width=290&name=W-2_(1).png) Tax season is in full swing, and Americans are preparing to file their annual income tax returns. If you are a household employer - you employ a nanny, housekeeper or senior caregiver - you will find conflicting advice on how to handle the "nanny taxes."

Tax season is in full swing, and Americans are preparing to file their annual income tax returns. If you are a household employer - you employ a nanny, housekeeper or senior caregiver - you will find conflicting advice on how to handle the "nanny taxes."