At HomeWork Solutions, we find that good ideas can come from any of our stakeholders. An employee offering an improved business process, a client requesting default payroll reporting, a caregiver asking for material to educate their employers about Healthcare Reimbursement Accounts… Ideas from all have helped make HomeWork Solutions the company it is today. In fact, our foundation was built on listening to employees.

Read More

Topics:

nanny,

agency,

senior,

CPA

If you are working as a household employee, it is important to understand what taxes you will need to pay. It is easy to feel confused about what you need to pay and when. This is especially true if your employer does not withhold income taxes from your paychecks.* Here are some important tips.

Read More

Topics:

senior care,

nanny,

agency,

senior,

CPA

Updated 27 December 2022

Every year HomeWork Solutions prepares a summary of new or updated household employment tax laws and benefit information.

HOUSEHOLD EMPLOYEE 2023 WAGE BASE:

The IRS annually reviews, and adjusts as necessary, the wage payment threshold that obligates a family to pay Social Security and Medicare taxes. These tax withholdings are reported annually on a W-2. This threshold will increase to $2,600 for 2023.

Read More

Topics:

nanny,

agency,

senior,

CPA

Hiring a household employee to work in your home is a big decision. It requires carefully selecting someone not only that you trust, but that fits your family’s needs. Once you’ve found the right person, it’s common to have questions about your responsibilities as a household employer.

Read More

Topics:

nanny,

agency,

senior,

CPA

The end of 2022 is right around the corner. This is a popular time for household employers to recognize their employees with a holiday bonus. A bonus is a great way to show your appreciation for a job well done and shows your employees that you are grateful for their dedication.

Read More

Topics:

senior care,

nanny,

agency,

senior,

CPA

Kelley R. is a licensed social worker and a new mom. She and her husband hired a nanny so she could go back to work. After reviewing their budget, Kelley and her husband found a great nanny through a friend’s recommendation. Kelley saw no problem with agreeing to her request for a weekly wage of $800 take home after taxes, about $41,600 per year. Kelley found that getting all the reporting and tax calculations right – particularly when working from a net take home pay – proved to be a headache.

Read More

Topics:

senior care,

nanny,

nanny hourly wage,

nanny wage,

agency,

senior,

CPA

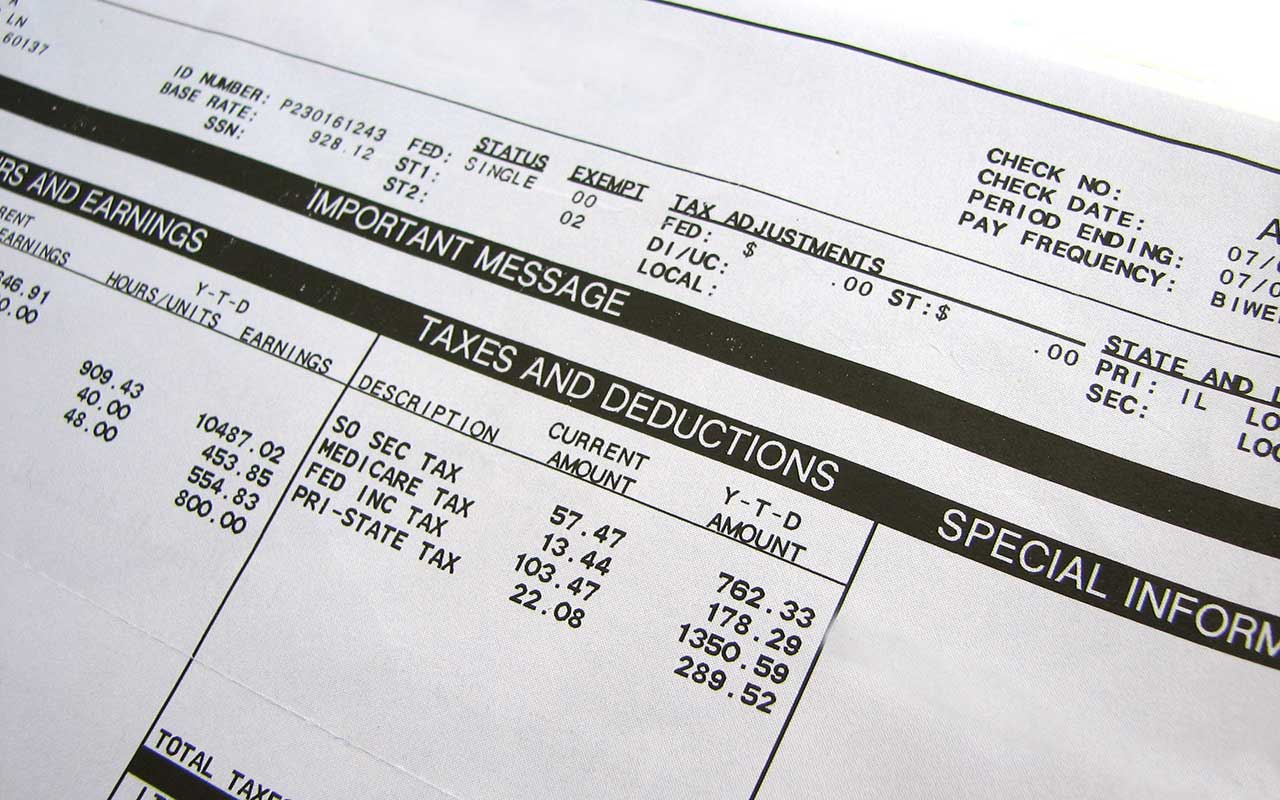

When you hire someone to work in your home, it is important to make sure you classify their employment correctly, and pay them legally. Most household workers are classified as employees, and with that employment relationship comes payroll and tax reporting requirements. Providing a paystub is one of these requirement in most states. The only states without paystub laws are Alabama, Florida, Arkansas, Georgia, Louisiana, Mississippi, Ohio, South Dakota, and Tennessee.

Read More

Topics:

worker misclassification,

payroll,

senior care,

nanny,

wage theft prevention,

agency,

senior,

CPA

One of our HomeWork Solutions Representatives shares the story of a recent client who paid his nanny cash under table. Later, he found himself on the wrong side of his state’s unemployment agency.

Read More

Topics:

nanny,

agency,

CPA

One of our HomeWork Solutions Representatives shares the story of a client who issued her nanny a 1099 form, and later found herself on the wrong side of the IRS.

Read More

Topics:

nanny,

agency,

CPA