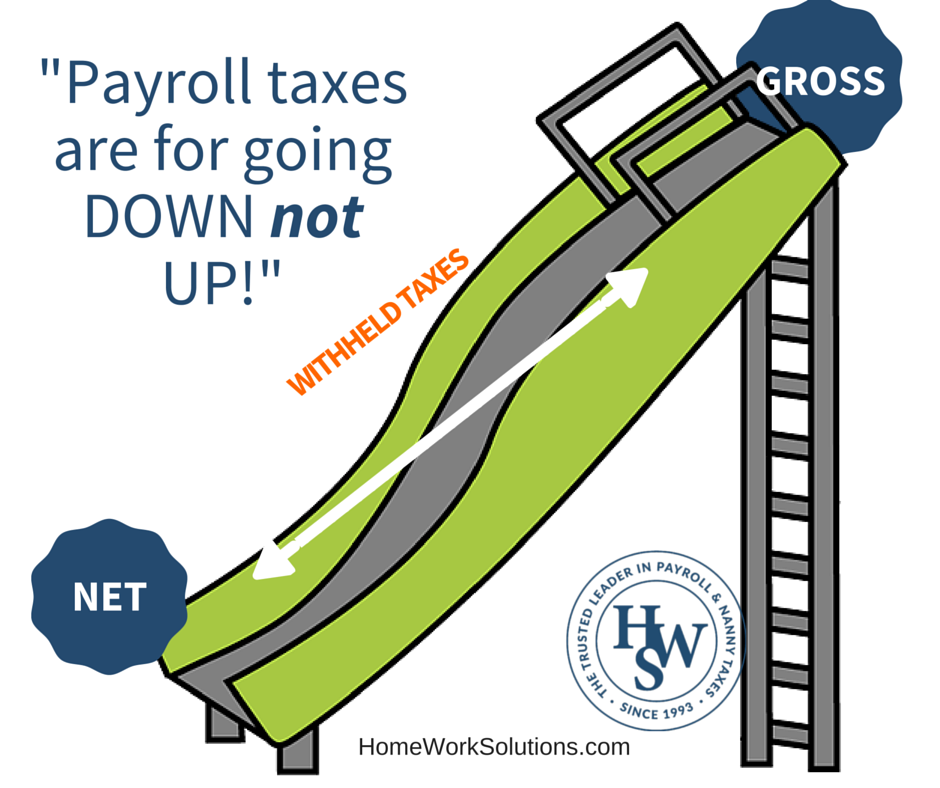

A client calls and say "I want to pay my nanny $16.00 an hour take home, can you help me?" When I hear this question it is like nails on a chalk board; however it’s also a great opportunity for me to explain the nanny taxes, how payroll works and why paying a net per hour is the worst idea. This is often referred to as 'Grossing Up' a paycheck and it can lead to major headaches.

Read More

Topics:

nanny,

nanny payroll,

nanny payroll tax,

nanny hourly wage,

nannies

Nanny jobs are not forever, and the reasons for letting your child's caregiver do vary. Often, the children grow up and your

beloved family nanny is no longer needed. Perhaps the nanny has horrible work habits - always late or a frequent 'no show.' Your family and the nanny simply may not 'click.' The nanny who was a wonderful nurturer of your infant does not have the energy to deal with your demanding toddler. Whatever the reason, figuring out how to terminate an employee gracefully can be an uncomfortable experience for both family and nanny.

Read More

Topics:

household employee,

nanny severance,

nanny,

nanny employee,

nanny separation

The Internal Revenue Service issued new 2014 income tax withholding schedules and they are fully integrated with our online tax calculator now. We are fielding a lot of inquiries about new paycheck amounts and will try to address the common questions here:

Read More

Topics:

nanny,

nanny tax,

nanny taxes,

household payroll tax

Inclement weather, train derailments, flight delays- these are all potential situations that could keep a person from their child or elderly relative. But other emergency situations exist- your charge could develop a high fever, knock a pot of boiling water from the stove, develop an allergic reaction that prevents them from breathing - that requires a nanny or senior caregiver to react quickly and make the right choice in getting medical attention.

Read More

Topics:

senior caregivers,

eldercare,

nanny,

nannies,

emergency plans

In 2014, the Household Employee Wage threshold increased to $1900. This means that any household employee- such as a nanny, housekeeper or elder care worker- earning $1900 or more per year requires their employer to pay what is commonly referred to as the "nanny tax."

Read More

Topics:

household employee,

household employer,

household payroll

One of the first decisions you must make when considering a nanny for your family is whether you want a nanny who lives in or one that comes in daily. Let's take a look at the pros and cons of hiring a live-in nanny.

Read More

Topics:

live-in nanny

Many families pay their household workers directly and subscribe to a service such as HomeWork Solutions' Essential Payroll to prepare necessary quarterly and end of year tax documents. We are often asked about whether pay stubs are necessary.

Read More

Topics:

nanny payroll,

calculate nanny payroll tax,

domestic employer legal responsibilities,

nanny tax calculator,

household paycheck calculator

HomeWorks Solutions is a proud member and supporter of the International Nanny Association - the industry umbrella professional association promoting excellence in in-home care. We have attended every annual conference since 1993, and this year's educational line up for nannies and business members is the best we have ever seen.

Read More

Topics:

International Nanny Association,

INA conference,

nanny agency,

nanny agencies,

Dr. Harvey Karp,

Dr. Jenn Berman

Don’t be stuck in fear ! We are here to help you!

I have told many of our clients that they are not the first person that we have helped when they were behind on their nanny taxes. I tell them that because it’s true!

Read More

Topics:

household employee taxes,

W-2,

nanny payroll tax,

nanny tax,

nanny taxes

.jpg)