Did you know that when you employ a nanny, housekeeper or other household employee who does not reside in your household, you must comply with FLSA overtime regulations?

Did you know that when you employ a nanny, housekeeper or other household employee who does not reside in your household, you must comply with FLSA overtime regulations?

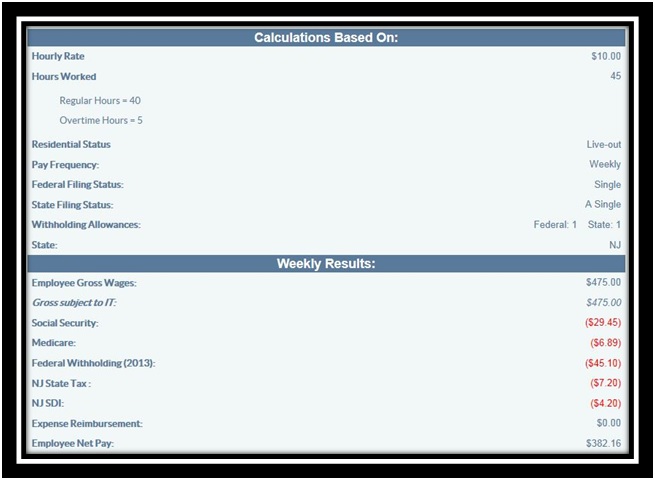

By law you need to pay overtime as stated, “the Fair Labor Standards Act (FLSA) requires overtime pay at a rate of not less than one and one-half times an employee's regular rate of pay after 40 hours of work in a workweek”*

So, why does this matter to a household employer like you?

In some cases, when overtime is not correctly paid, employees will file a complaint with the Wage and Hour division of the Department of Labor. This is most common when the employment arrangement ends unexpectedly or on bad terms. Employers can be required to pay back wages and they can even become personally liable for violating FLSA! This can lead to pricey penalties and legal fees.

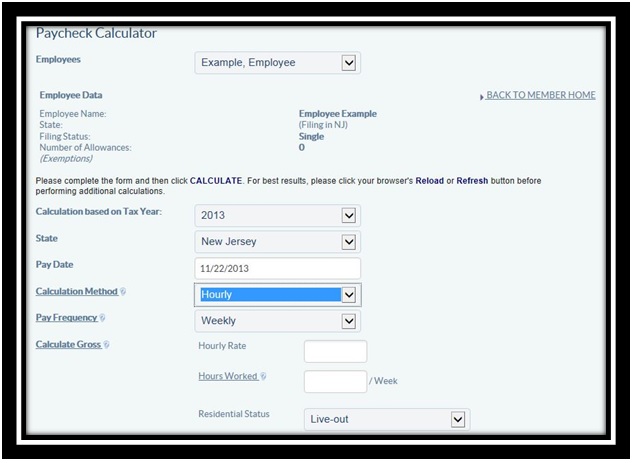

An easy way to make sure you are paying the right rate is to use our Hourly Paycheck Calculator:

Once you choose “Hourly” and fill in your employee’s hours worked and hourly rate, the calculator does the hard work for you:

Now, there’s no need to worry about complying with FLSA and you can easily write your employee’s paycheck with confidence that you are in compliance!

For more expert information, check out this link:

http://www.dol.gov/compliance/laws/comp-flsa.htm

*Some states like California have more specific rules, so contact us if you have any questions about being in compliance in your state.