Payroll changes often happen at the beginning of the calendar year, and nanny tax related changes are no different. The HomeWork Solutions household payroll experts have assembled a short overview of changes a nanny employer, employer of a senior caregiver, or any household employer needs to know.

Read More

Topics:

nanny health insurance,

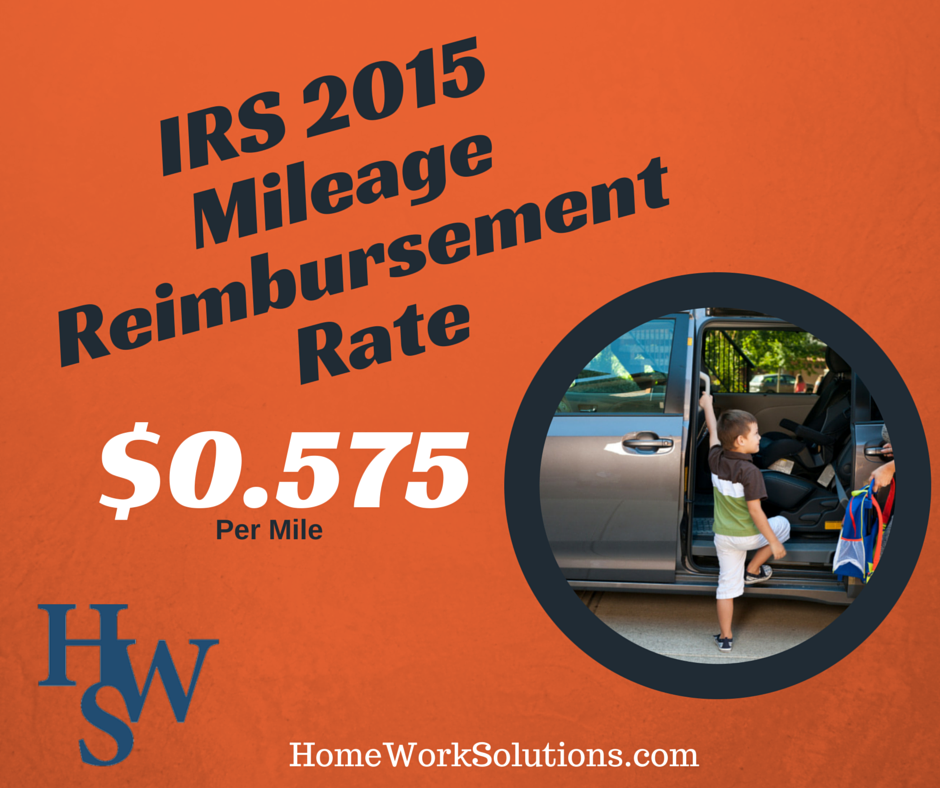

nanny mileage reimbursement,

New York household payroll,

Affordable Care Act,

california household employment,

DC household payroll

New parents often envision that hiring a nanny will be the magic bullet that solves their childcare challenges. Hiring the nanny itself, however, is an activity fraught with worry, stress, and the fear of actually hiring the wrong nanny. Here we offer parents a short list of common mistakes families make when hiring a nanny, and tips to avoid them. Let HWS help you make your experience hiring a nanny simpler and worry free.

Read More

Topics:

hiring a nanny,

interview a nanny

Household employers in the District of Columbia will have new, important obligations to their household employees in 2015.

Read More

Topics:

nanny pay rate notice,

caregiver pay rate notice

At Thanksgiving last year, The Crawford Family got together as so many families do on this day to share a traditional meal, spend time together and talk about where they are and where they want to go.

Read More

Topics:

housekeeper,

household payroll tax

The keys to a nanny's success in the workplace all revolve around attitude. The "secret sauce" all successful professional nannies bring to their workplace includes the following attitudes:

Read More

Topics:

nanny job satisfaction,

nanny

The growing national movement towards aging in place is challenging many families. As noted recently in the New York Times, "Aging in community is important for preserving the quality of life for older adults and providing stability to neighborhoods."

Read More

Topics:

elder care,

senior home care

"Excellence is not a skill, it is an attitude." ~ Ralph Marston

Read More

Topics:

nanny bonus,

nanny background screening

April 2015 Update

The survey referenced below is now closed and published. HWS encourages you to review the results.

The INA reports the following:

Key findings include:

- Average hourly rate USD$18.66, $1/hour increase from 2012

- 49% have had a salary increase in prior 12 months, up from 38% in 2012

- Education and experience correlate with higher hourly wage

- 60% received an annual bonus in 2013, up from 53% in 2011

- INA Credentialed nannies average $19.96 per hour

- 64% are paid legally

Read More

Topics:

nanny salary,

nanny benefits

I recently attended Nannypalooza in Philadelphia where I was asked by a nanny in attendance if I could coach her on how to speak to her employer about being paid on the books. Immediately several other nannies joined the conversation, sharing that this is one of the most difficult conversations to initiate with their employers.

Read More

Topics:

nanny off the books,

nanny job satisfaction,

nanny taxes

Department of Labor Discusses Joint Employment, Changes in the Senior Caregiver Companionship Exemption and Announces Increased Enforcement

The Private Care Association, the voice of private duty home care, met in earlier this month in Orlando, FL and invited the US Department of Labor to discuss Joint Employment and Changes in the Companionship Exemption with its members. A guest appearance was made by Michael Hancock, Assistant Administrator for Policy, Wage and Hour Division of the U.S. Department of Labor and Melissa Murphy, Senior Attorney, Office of the Solicitor U.S. Department of Labor. Mr. Hancock and Ms. Murphy addressed an anxious crowd of almost 200 independent homecare staffing agencies to discus joint employment, the expiration of the Companionship Exemption for home health agencies and stepped up enforcement by the DOL in 2015 related to the enforcement of the Fair Labor and Standards Act (FLSA).

Read More

Topics:

elder care,

aging in place,

senior care,

nanny background screening

.png)