Many of HomeWork Solutions’ professional staff hold American Payroll Association (APA) professional accreditation. Regular professional education is a requirement to maintain credentials, and we receive many notices regarding webinars that help fulfill CPE credit requirements.

Read More

Topics:

elder care,

household independent contractor

Many families who expect a nanny or house manager to purchase items for the family provide a family credit card for the expenses – making tracking of the purchases easy and avoiding the need for expense reimbursement.

Read More

Topics:

nanny expense reimbursement,

nanny mileage reimbursement

We field increasing questions from families and their staff about holiday and vacation pay as families prepare for their summer vacations.

Read More

Topics:

nanny paid time off,

nanny benefits

California is striving to shine a light on its underground economy. At the end of 2011, the LA Times reported that employers who pay their workers under the table - to avoid payroll taxes, workers’ compensation insurance and other government mandates - cost the state about $7 billion annually in lost tax revenues. Last week, California’s Labor Enforcement Task Force set up a public hotline for workers and employers to call in complaints and provide enforcement tips. Employers who are playing by the rules want to create a level playing field by "ratting out" their competitors who cheat. One state official notes, “The hotline will be a valuable tool to gather information and bring into compliance those employers who treat workplace safety and wage and hour laws as a nuisance”.

Read More

Topics:

nanny tax audit,

domestic employer legal responsibilities,

payroll tax enforcement,

california household employment

Efforts by workers’ rights groups to spread the word about New York’s Domestic Workers Bill of Rights have resulted in a big uptick in grievances filed against household employers. Advocacy groups are actively canvassing New York City neighborhoods – in playgrounds and grocery stores and other places where nannies and other household employees are likely to go - to educate these workers about their rights.

Read More

Topics:

new york household employment,

New York household payroll

Worker misclassification - the practice by an employer of treating an employee as an independent contractor for purposes of avoiding employment taxes - is a constant issue in the field of household employment. Many household employers - and employees - simply feel this is easier, that the tax forms are too complicated, or the tax expense too high.

Worker misclassification - the practice by an employer of treating an employee as an independent contractor for purposes of avoiding employment taxes - is a constant issue in the field of household employment. Many household employers - and employees - simply feel this is easier, that the tax forms are too complicated, or the tax expense too high.

Read More

Topics:

worker misclassification independent contractor,

domestic employer legal responsibilities,

payroll tax enforcement

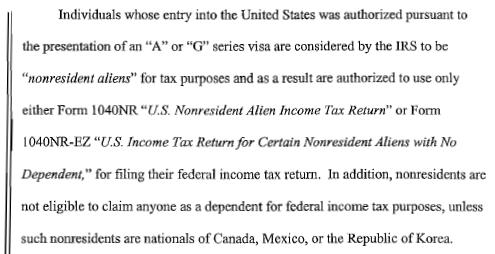

The US Treasury's Internal Revenue Service (IRS) advises that G and A visa holders temporarily present in the United States as a foreign government related individual are non-residents for income tax purposes, no matter how long they have resided in the United States. The situation for a G-5 domestic servant, who is NOT a foreign government related individual is a bit different, and their Federal income tax filing status is determined based on their time in the country.

Read More

Topics:

G5 domestic,

GV domestic,

G-5 non-resident alien

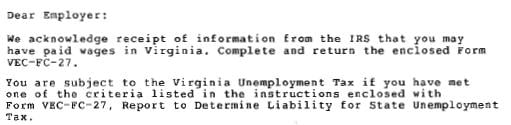

The Internal Revenue Service (IRS) and 11 states, as we reported in October 2011, have entered into information sharing agreements for purposes of employment tax enforcement. Virginia, apparently, is making a concerted effort to collect state unemployment taxes from employers known to the IRS, but not to the state.

Read More

Topics:

nanny tax audit,

nanny tax statute of limitations,

worker misclassification independent contractor,

payroll tax enforcement,

nanny tax compliance

We are receiving an unusual number of phone calls this year related to nanny e-Filing issues. Here are the most common issues. In all cases filing a paper tax return this year is the corrective action needed.

Read More

Topics:

nanny taxes

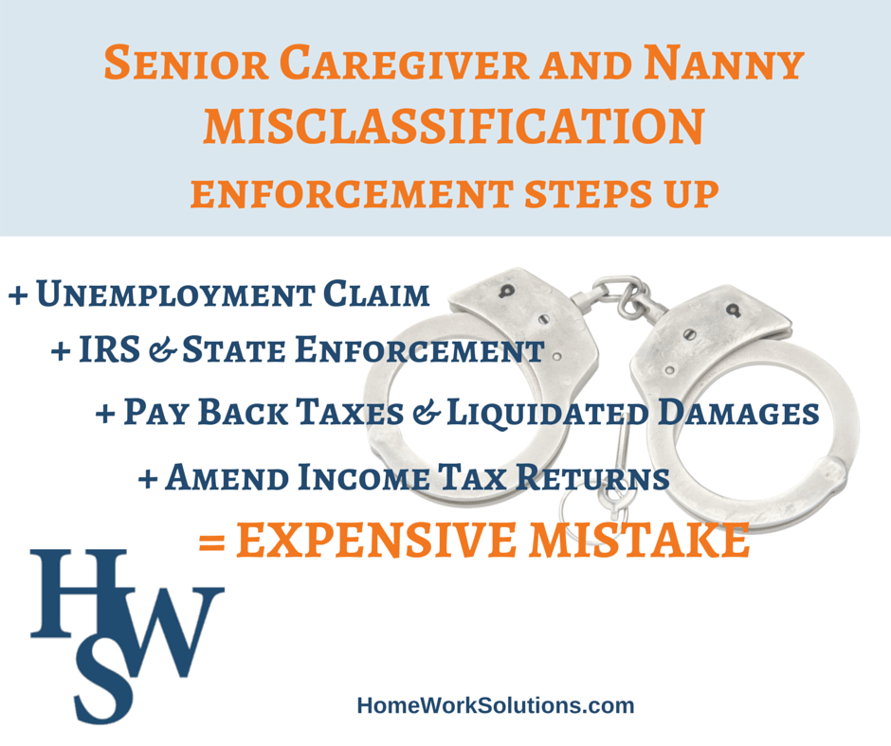

IRS data places "nanny tax" compliance (declaration by families of their household payroll) at about 20%. Household employment experts believe even this number is optimistic. Looking at these statistics, a new household employer has to think that just ignoring this complicated and expensive issue is relatively risk free. What these numbers don't illustrate is the steadily increasing political pressure on the IRS to collect revenue, and the relatively low hanging fruit the "nanny taxes" present. Add to this the very real possibility that the elder care giver or nanny may file for unemployment benefits when the job ends, and the risk evaluation changes dramatically.

Read More

Topics:

nanny payroll tax,

nanny tax,

nanny tax compliance

Worker misclassification - the practice by an employer of treating an employee as an independent contractor for purposes of avoiding employment taxes - is a constant issue in the field of household employment. Many household employers - and employees - simply feel this is easier, that the tax forms are too complicated, or the tax expense too high.

Worker misclassification - the practice by an employer of treating an employee as an independent contractor for purposes of avoiding employment taxes - is a constant issue in the field of household employment. Many household employers - and employees - simply feel this is easier, that the tax forms are too complicated, or the tax expense too high.