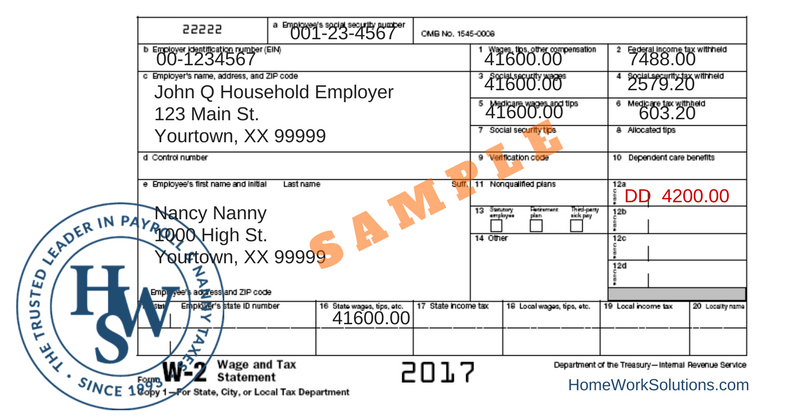

Earlier HWS reported on changes to tax-free employer assistance with nanny health insurance in 2017. As we approach the end of the year it is important to note that the reimbursement by an employer for nanny health care expenses - or any household employee's health care reimbursement - requires reporting of the benefit on the nanny's W-2 form.

Read More

Topics:

nanny,

agency,

senior,

CPA

You may have heard people you know talk about hiring a nanny or au pair, but you may not be sure what the differences are between the two. Many people use the terms interchangably, not knowing that a nanny and au pair are two very different things. If you’re thinking about hiring an in home childcare provider, it’s a great idea to research which one would be the best fit for your family, au pair vs. nanny.

Read More

Topics:

nanny,

agency

New York's comprehensive Paid Family Leave Act becomes effective January 1, 2018.

Read More

Topics:

senior care,

nanny,

agency,

CPA

Nevada has recently passed a new law that gives domestic workers a “bill of rights.” Here, we will go over the basic parts of the Nevada Domestic Worker Bill of Rights (NV DWBR) and how it could affect household employers in Nevada.

Read More

Topics:

nanny,

domestic workers bill of rights,

agency

The Affordable Care Act allows small employers to make health coverage available to their employees through the Small Business Health Options Program (SHOP). The 21st Century Cures Act enacted another option as well, the Qualified Small Employer Health Reimbursement Agreement (QSEHRA).

Read More

Topics:

nanny,

agency,

senior,

CPA

Finding the right nanny for your family takes a lot of preparation and planning. It’s best to head into interviews armed with a list of questions for the prospective nanny. This way, you’ll be able to leave with notes about the candidates for comparison.

Read More

Topics:

nanny,

nanny interview,

agency,

interview questions

What was the APNA Conference Raffle?

Simply put we wanted to help some of our amazing agency partners get the benefits of attending the APNA Conference. We came up with the raffle idea to add some fun and chance to figuring out who got to register on our dime.

Read More

Topics:

nanny,

agency

US Citizens and foreign nationals coming to the US for a temporary stay may legally bring their nanny or other domestic help with them by securing a B1 visa. These employers are typically senior executives for large corporations and certain US government employees routinely posted abroad. The US State Department, which oversees the issuance of the B1 visas, imposes certain requirements on the employer to ensure that the foreign domestic worker is treated in accordance with US labor laws and is not exploited.

Read More

Topics:

nanny,

agency,

senior,

CPA,

B1 Visa,

B-1 Visa

Military families live a unique lifestyle. Oftentimes, a military family won’t live in the same place for more than a few years, and they learn to embrace the adventure of living in new places. No matter how exciting moving from place to place is, it can be difficult at times on each member of the family, especially the children. Add to this the stress that having a parent deployed for long periods of time, and it is understandable that the children (and the spouse at home) need extra emotional support. Having a strong family unit in place is important, but adding a nanny into the mix can be an incredibly beneficial thing, too. Here are some of the pros and cons of working as a nanny for a military family.

Read More

Topics:

nanny job satisfaction,

nanny,

nanny job description,

agency