A client calls and say "I want to pay my nanny $16.00 an hour take home, can you help me?" When I hear this question it is like nails on a chalk board; however it’s also a great opportunity for me to explain the nanny taxes, how payroll works and why paying a net per hour is the worst idea. This is often referred to as 'Grossing Up' a paycheck and it can lead to major headaches.

Why do I think it's the worst idea ever? The answer is simple. When an employer pays net, they lose sight of the Gross amount and what it really means. I have taken many calls from clients who didn’t understand the taxes would be so high in a gross up situation. I am also asked about the employee's income tax refund - they want to know how they get the money back. Getting the money back is out of the question, it's the nanny's paycheck. The money between the Gross and Net are theoretically 'withheld' from the employee's check and the employer sends in the funds to the taxing authorities. It’s her money and part of her check.

Lets take a look at the Fitz Family as an example. They live in Maryland and want to pay their nanny $16.00 NET per hour. She works 40 hours a week and is Single with 1 withholding allowance (also known as an exemption). That is really means is……

|

Social Security/Medicare Only |

Social Security/Medicare and Federal Income Tax |

Social Security/Medicare and Federal & State Income Taxes |

|

|

Gross |

$693.02 |

$793.02 |

$879.71 |

|

Social Security |

$42.97 |

$49.17 |

$54.54 |

|

Medicare |

$10.05 |

$11.50 |

$12.76 |

|

Federal Income Tax |

$0.00 |

$92.35 |

$110.43 |

|

State Income Tax |

$0.00 |

$0.00 |

$61.98 |

|

Net Check |

$640.00/$16 hour |

$640.00/$16 hour |

$640.00/$16 hour |

As you can see from the above chart, depending on what you agree to 'withhold' or cover in the gross up, you are really paying a little over $17 an hour to just under $22 an hour.

You can find yourself in a position of needing to renegotiate with your employee because you didn’t realize that it really meant. Which is exactly what Mr. Fitz had to do after he called in thinking there was an error made in the calculations. First, Mrs. Fitz called in and started to cry that there were not expecting to have so much in taxes to pay. Then Mr. Fitz called to get a better understanding of why the nanny taxes ‘were so high’.

After Mr. and Mrs. Fitz had a better understanding of what it really meant, they talked to their nanny and mutually agreed to adjust the paycheck going forward to an amount that made everyone happy and was manageable.

I also speak to very unhappy nannies whose employer grossed up just to cover the Social Security and Medicare taxes, yet they failed to grasp that the nanny would still owe income taxes. The term 'tax' can be used very loosely in the conversations and what Family A meant was not what the nanny heard. A nanny who gets their W2 form and finds they owe $1200, $1500 or more in income taxes - 2 or 3 weeks of their take home pay - is never happy!

My advice to any employer when this topic comes up, it to use that 'I want my take home to be ____' as a starting point. Do the math. Let HomeWork Solutions help you with this. See what you can afford and still get the employee close to what they are looking for. And write your contract based on the gross hourly wage and not the net. Each year the tax tables change, so locking in to a net amount could cost you more next year when the taxes go up.

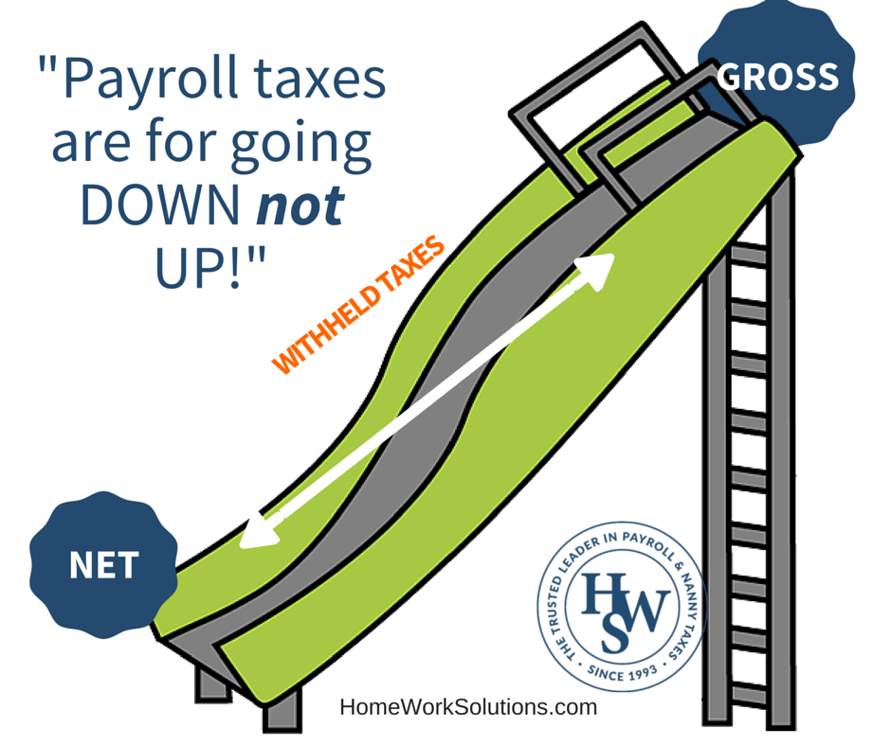

If you have little ones, you may appreciate this analogy. Think of payroll and nanny taxes like a sliding board. The gross is at the top of the slide, the taxes are in the middle and the net at the bottom. How many times have to you told your kids, “slides are for going down not up”. So I’m saying it, Payroll taxes are for going down not up!”

Feel free to try our Nanny Payroll Tax Calculator, which will allow you to calculate your nanny's wages and taxes before distributing payroll.

About the Author: Mary Crowe, FPC is HWS' Client Sales and Quality Assurance Team Lead. Mary joined our team in 2011. Mary's focus is client support and internal Information Technology support, her core competencies. She brings 15 years of successful client services experience, along with strong team building and problem solving skills, to our team.