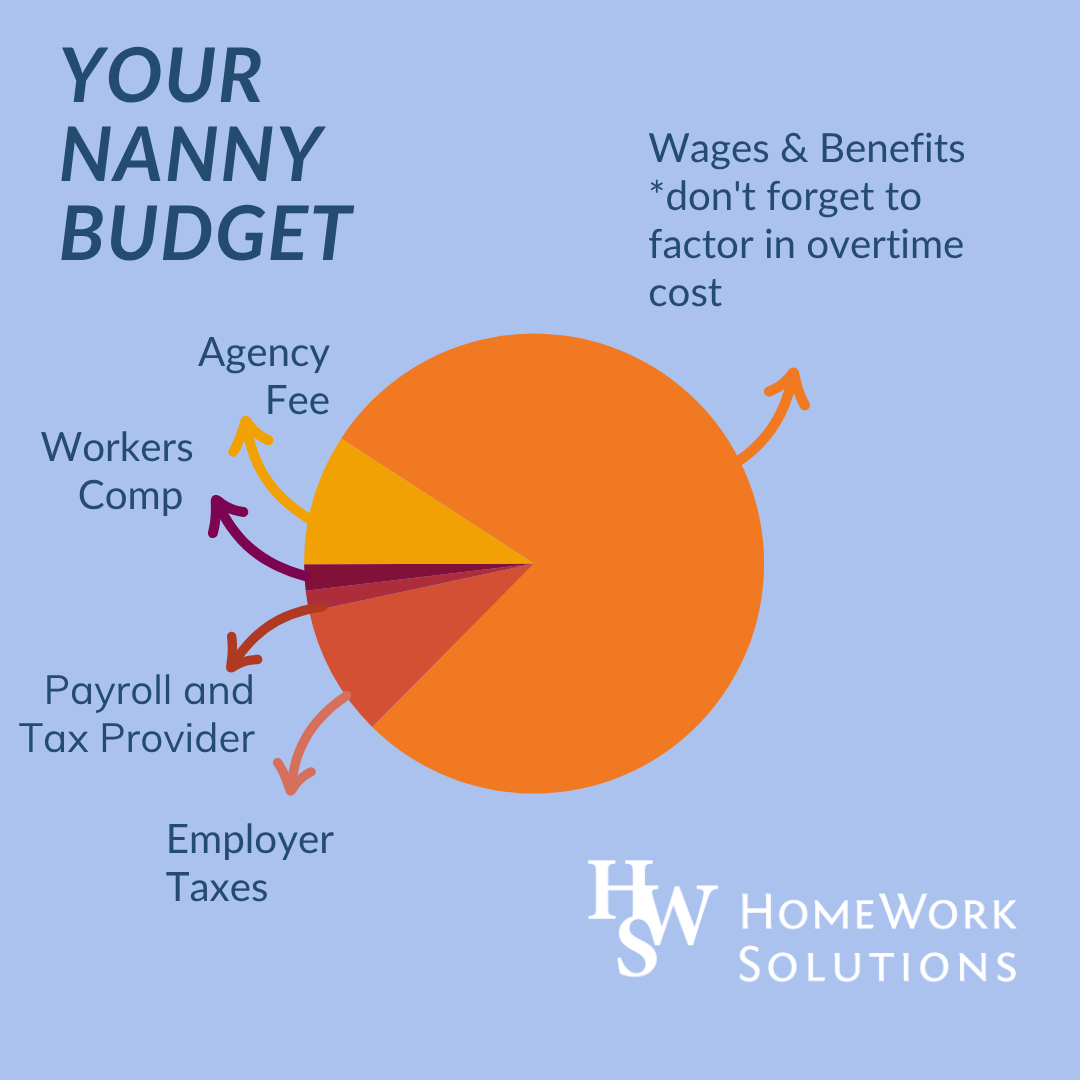

Hiring a nanny is more than offering a wage—it's about building a compliant, respectful working relationship. When families ask, “Can I afford a nanny?”, our answer is: Start with your annual budget and work backwards to determine what you can comfortably and legally offer.

Read More

Topics:

nanny salary,

hiring a nanny,

nanny,

nanny hourly wage,

agency,

nanny pay,

paying a nanny,

household employer taxes,

nanny employment costs,

nanny compensation plan,

nanny budget calculator,

nanny payroll costs,

nanny employer budget

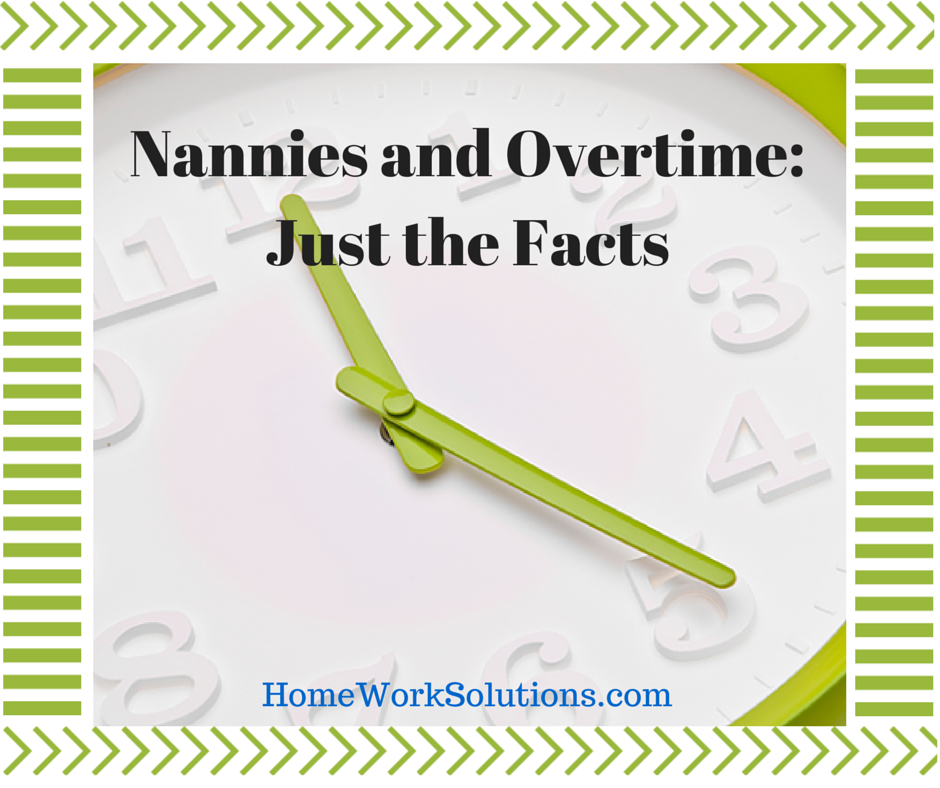

Good communication that establishes a mutual understanding is necessary when hiring a nanny, senior caregiver, or other household employee to work in your home. When it comes to defining benefits such as paid holidays, the details matter to ensure there is no misunderstanding about how these holidays will be compensated. If the employee often works more than 40 hours per week, defining this benefit and clarifying expectations becomes even more critical. Let’s examine how labor laws determine when overtime is due and how guaranteed pay alters the picture.

Read More

Topics:

overtime rules,

household employee,

household employer,

hiring a nanny,

time tracking,

nanny hourly wage,

domestic employer legal responsibilities,

nanny overtime,

Hiring Elder care,

Senior Caregiver Payroll

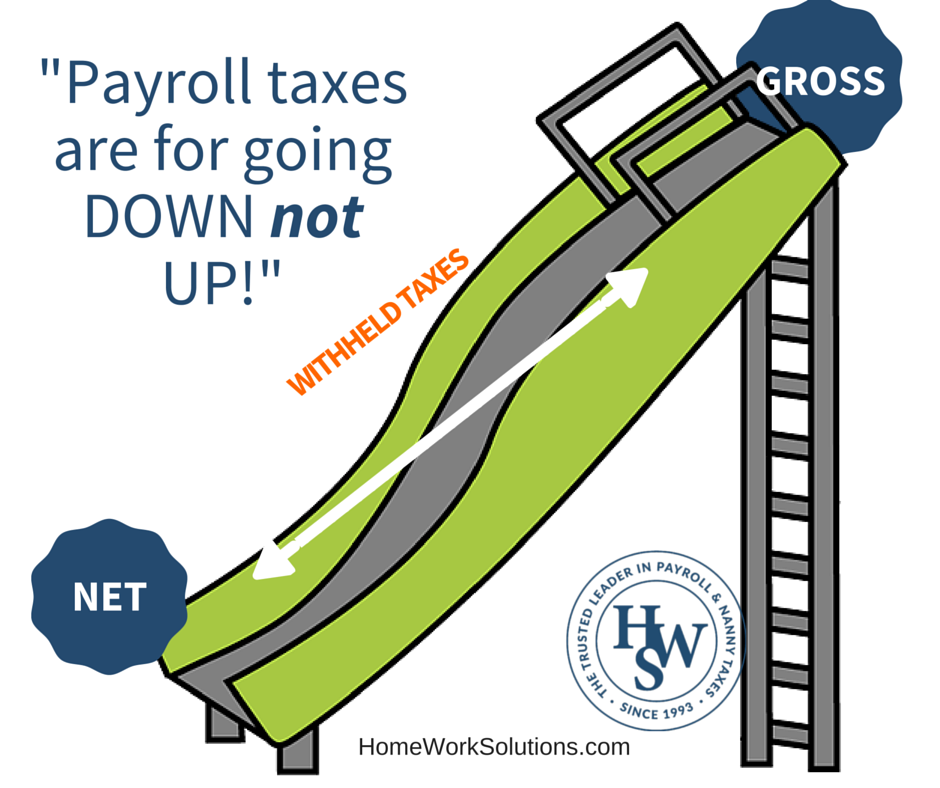

Kelley R. is a licensed social worker and a new mom. She and her husband hired a nanny so she could go back to work. After reviewing their budget, Kelley and her husband found a great nanny through a friend’s recommendation. Kelley saw no problem with agreeing to her request for a weekly wage of $800 take home after taxes, about $41,600 per year. Kelley found that getting all the reporting and tax calculations right – particularly when working from a net take home pay – proved to be a headache.

Read More

Topics:

senior care,

nanny,

nanny hourly wage,

nanny wage,

agency,

senior,

CPA

Whether you hired a nanny, a housekeeper, a personal assistant, or a private educator this year, there are some important things to know when it comes to filing taxes. When you hire someone to work in your home, you become an employer. Tax and labor laws generally apply, even if there are some small exemptions unique to household employers. Many families don’t know this and make the mistake of paying the employee “off the books.” This could be a very costly error. Here are some specific ways to avoid domestic employee tax problems.

Read More

Topics:

housekeeper,

household employee taxes,

nanny payroll tax,

nanny hourly wage,

nanny independent contractor,

nanny tax compliance,

household payroll,

caregiver

A HWS referral partner who operates a nanny referral agency recently contacted our office with the following question:

Read More

Topics:

nanny payroll,

nanny hourly wage,

nanny overtime

There’s all kinds of advice floating around out there about how to handle a nanny’s wages. Here, we’ve included only the facts on nannies and overtime:

Read More

Topics:

nanny hourly wage,

nanny non-exempt employee,

nanny overtime,

nanny work agreement,

nanny contract

A client calls and say "I want to pay my nanny $16.00 an hour take home, can you help me?" When I hear this question it is like nails on a chalk board; however it’s also a great opportunity for me to explain the nanny taxes, how payroll works and why paying a net per hour is the worst idea. This is often referred to as 'Grossing Up' a paycheck and it can lead to major headaches.

Read More

Topics:

nanny,

nanny payroll,

nanny payroll tax,

nanny hourly wage,

nannies

Did you know that when you employ a nanny, housekeeper or other household employee who does not reside in your household, you must comply with FLSA overtime regulations?

Read More

Topics:

FLSA,

overtime rules,

nanny hourly wage,

domestic employer legal responsibilities,

nanny overtime

Nannies, housekeepers, elder caregivers, and most house managers are considered Hourly, Non-Exempt employees under the Fair Labor Standards Act. This means that most are covered under both minimum wage and overtime laws. Accurate and contemporaneous time tracking and records maintenance is a legal obligation!

Read More

Topics:

time tracking,

nanny hourly wage,

domestic employer legal responsibilities

The beautiful baby has arrived and mom is preparing to return to work. The new parents begin interviewing nannies, a stressful endeavor for all concerned! Will she keep my baby safe? Will she love my child? Can I depend on her to be on time and not call out at the last minute? Does she have the experience I am looking for? Can I afford her? The absolutely last thing on the new parent's mind in these interviews is tax and labor law, and this is where nanny and family can find themselves out of sync.

Read More

Topics:

nanny hourly wage,

nanny work agreement,

nanny wage

.png)