School is out, and families nationwide are turning to summer nannies to provide safe, individualized caregiving for their young children over the summer holidays.

School is out, and families nationwide are turning to summer nannies to provide safe, individualized caregiving for their young children over the summer holidays.

Topics: nanny payroll, summer nanny, nanny taxes

The new 2014 Employee Benefit Research Institute survey found that 57 percent of workers have less than $25,000 in total household savings and investments. Two-thirds (68 percent) of those with annual household income of less than $35,000 report less than $1,000 in household savings.

Topics: nanny retirement, nanny savings

New York City's paid sick leave act went into effect April 1, 2014. This does apply in a limited manner to domestic service workers, such as a nanny, housekeeper or senior caregiver.

Topics: new york household employment

Topics: elder care, employment authorization, workers compensation household employees, Hiring Elder care

Navigating the roadmap of senior home care can be challenging, and the everchanging laws make it even more overwhelming. We are receiving an increasing number of emails regarding the so-called "Nanny Tax," and other concerns surrounding private household employment of senior home caregivers. In response to these questions, we decided to address the top three Elder Care FAQ’s

Topics: elder care, eldercare, household employee, nanny tax, Hiring Elder care, senior home care

Usually around this time of year we start getting worried phone calls from families confused by the household employee taxes or the "nanny taxes." We pulled together some more of the frequently asked questions our tax experts are getting in time for April 15th.

Topics: elder care, eldercare, household employee taxes, senior care, 1099 v w-2, senior home-care workers

Let’s face it: sitting your aging parents down to talk about their finances is about as comfortable as talking to them about sex (eons ago, they probably felt the same way you do right now!) But just as it was back then, the conversation- though difficult- is imperative to your future decision making.

Topics: elder care, aging in place, eldercare, senior care, hiring care for seniors, senior home care

Recently, Dr. Judith L. London published a book of 54 stories detailing the challenging and sometimes heroic lives of caregivers of Alzheimer's sufferers. And it's no wonder Dr. London found it compelling to collect a these stories in one place: in a study conducted by Stanford University and the Alzheimer's Association, more than 15 million people provide unpaid care for family members, or even friends, who suffer from the disease.

Topics: elder care, Alzheimer's, senior care

Topics: live-in nanny

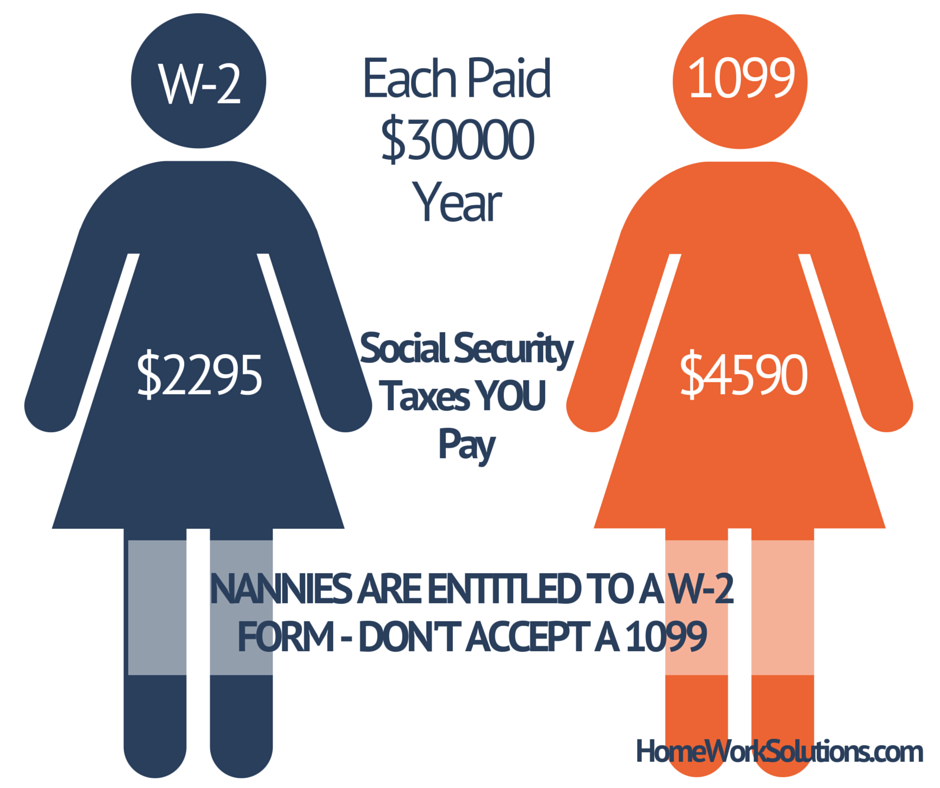

.png?width=290&name=W-2_(1).png) Tax season is in full swing, and Americans are preparing to file their annual income tax returns. If you are a household employer - you employ a nanny, housekeeper or senior caregiver - you will find conflicting advice on how to handle the "nanny taxes."

Tax season is in full swing, and Americans are preparing to file their annual income tax returns. If you are a household employer - you employ a nanny, housekeeper or senior caregiver - you will find conflicting advice on how to handle the "nanny taxes."

Topics: household employee, worker misclassification, independent contractor, nanny tax, nanny taxes, 1099 v w-2