Retirement planning is a vital part of financial health. Many people use a Traditional IRA to help ensure a comfortable retirement (you can help your household employee too). Building an IRA during your working life is only half the consideration; you should plan for distributions as well.

Read More

Topics:

nanny,

agency,

senior,

CPA

If you have hired a caregiver to help your aging parent with day to day care, you likely know that some days can be more challenging than others. Being a senior caregiver comes with rewards, but it can also be a difficult and stressful job. Supporting your caregiver goes a long way. Here are some tips on how you can support your parent’s caregiver for the long haul.

Read More

Topics:

agency,

senior

Planning a vacation requires putting together a variety of different details: hotels, rental cars, airline tickets, and more. But if you have a loved one that requires caregiving assistance and you will be gone for an extended time and will not be able to check in in-person from day to day, you will also need to plan on getting coverage in your absence. This might mean that the caregiver will be required to step in and be available for 24 hours shifts. Not sure how to calculate for overtime when your caregiver is working those long shifts? We can help.

Read More

Topics:

agency,

senior,

CPA

For household employers all the way up to midsize businesses, regulatory changes and administrative tasks can be an uphill battle. If you don’t have the staff to devote to these matters then it makes sense to outsource. The trick then is to do it right. This article touches on a few things to watch out for in the process of selecting a vendor/partner.

Read More

Topics:

nanny,

agency,

senior,

CPA

The changes to US Federal tax laws in 2018 created a lot of confusion, and many taxpayers did not realize that they were withholding too much tax or not enough tax until they prepared their 2018 tax returns this spring. Figuring out how much to have deducted from your paycheck has gotten more and more complicated over the years - in fact the Form W-4 will be modified in 2020 and it asks more questions than ever.

Read More

Topics:

nanny,

agency,

senior,

CPA

Our client, Michelle W. called us when she learned there was a problem caused by only reporting part of her nanny's payroll to New York for tax purposes.

Read More

Topics:

nanny,

agency,

senior,

CPA

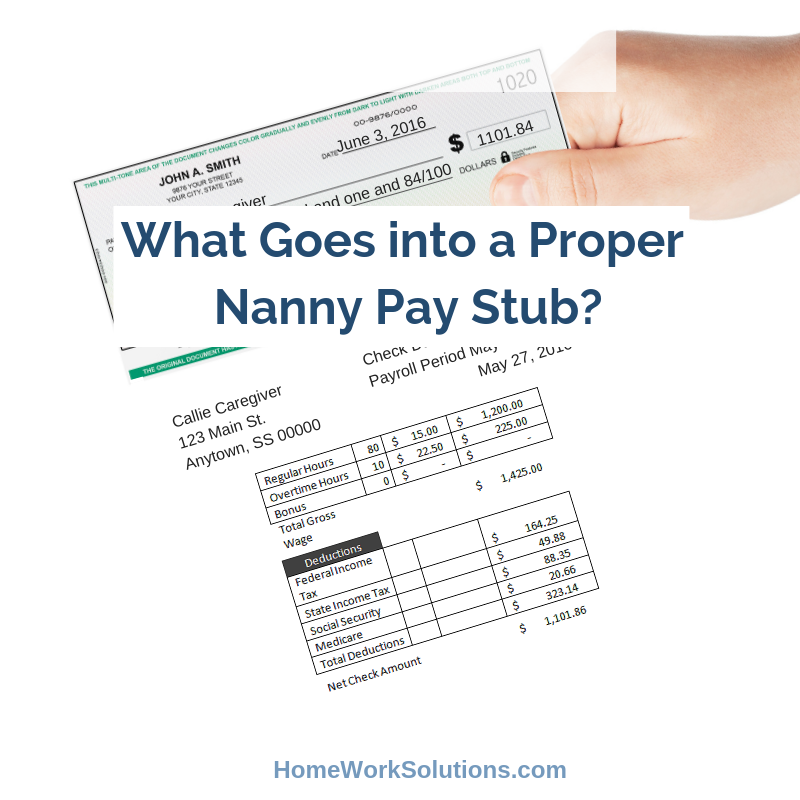

You’ve found a nanny, negotiated wages, and she has started work in your home. Now comes the tricky part of figuring out her payroll tax deductions and issuing the pay stub. If you have never done this before, it can be challenging. Here are some of the main details that need to be remembered when it comes time to pay your nanny.

Read More

Topics:

nanny,

agency,

senior,

CPA

The U.S. Congress has once again brought up the idea of a national domestic workers’ bill of rights. The concept was briefly discussed in the fall of 2018 but has been renewed with additional enthusiasm. Basically, a national domestic workers’ bill of rights would lay out federal law concerning the treatment and rights of domestic workers (nannies, caregivers, housekeepers, etc.). A similar idea to the Fair Labor Standards Act, this law would focus specifically on domestic workers.

Read More

Topics:

nanny,

agency,

senior,

CPA

Sometimes managing money and paying taxes can get confusing. That’s why bringing in a professional to help answer questions and take care of the details is important. We recently had a nanny call and ask us what the difference was between a CPA (Certified Public Accountant) and a Household Payroll Specialist. Here, we will go over some of the primary differences.

Read More

Topics:

nanny,

agency,

senior

Hiring the right caregiver for your loved one is a personal, delicate process and even when you think you’ve found the right person, there are a lot of different reasons why it might not work out in the long run. Whether it’s simply not the right match, rules have been violated, or schedules are not aligning properly to make the job work, making the decision to take action and fire a caregiver usually isn’t an easy one. Here are some tips on letting your caregiver go.

Read More

Topics:

nanny,

agency,

senior,

CPA