Generally, in life, it pays to do things right the first time. Your nanny payroll taxes are no exception to the rule: while it may be tempting to evade these pesky taxes, in the long run, you will be thankful that you managed your household employment taxes well. It will cost much more of your money, time, and patience to deal with the consequences of tax fraud than to file your payroll taxes correctly the first time around!

Read More

Topics:

nanny tax audit,

nanny tax statute of limitations,

nanny tax,

nanny taxes,

caregiver,

nanny tax case study

Part Time Nannies, Summer Nannies

MYTH “My nanny only works during the summer months when our kids are out of school. I don’t need to worry about nanny taxes since she is only a temporary employee.”

Read More

Topics:

nanny tax,

nanny taxes

.png)

HWS has been providing Nanny Tax compliance services since 1993. Did you know, in a recent client survey, the biggest motivation for employers in outsourcing nanny tax compliance is the time saved?

How much time an individual would spend on their nanny taxes will of course vary between individuals. The IRS estimates that record-keeping, keeping familiar with the law, and tax return completion can run 60 hours per year. Record-keeping accounts for the lions share of the time, an activity that needs to be done every payroll period.

I was chatting with a client today. This gentleman has used our services for many years, and his household circumstances are changing. In the course of the conversation, I asked him what factors caused him to continue using our services year after year. He answered without hesitation "The time savings!" He went on to state that he actually spends only about one hour a year on his nanny taxes - primarily in collecting his information and responding to our quarterly requests for wage reports. (This client is a NaniTax Plus subscriber.) He was certain that he had never filed a tax return on time before hiring HomeWork Solutions, and that the savings in late fees alone was more than our fee. I suspect some exaggeration, but not much!

Read More

Topics:

nanny payroll,

nanny tax,

household payroll tax

Navigating the roadmap of senior home care can be challenging, and the everchanging laws make it even more overwhelming. We are receiving an increasing number of emails regarding the so-called "Nanny Tax," and other concerns surrounding private household employment of senior home caregivers. In response to these questions, we decided to address the top three Elder Care FAQ’s

Read More

Topics:

elder care,

eldercare,

household employee,

nanny tax,

Hiring Elder care,

senior home care

Families know that a comprehensive, legitimate pre-employment background check, thorough reference checking and organized behavioral interviewing questions are the gold standard in nanny recruiting. The careful background screening is a must, but you should not be lulled into thinking that just because a nanny that passed these 3 steps with flying colors you don't need to pay attention and observe the nanny on the job.

Read More

Topics:

nanny,

nannies,

nanny tax,

nanny tax compliance,

nanny background screening

With compliance rates hovering around 10-20%, many household employers are only now beginning to seriously consider the costs and risks related to paying nannies and other household workers "on the books." While filing and paying taxes on household employees brings with it additional costs and paperwork, more families are recognizing the merits of filing as employers, and helping household workers with income tax withholding.

Read More

Topics:

household employee taxes,

nanny payroll,

nanny tax,

nanny taxes

The Internal Revenue Service issued new 2014 income tax withholding schedules and they are fully integrated with our online tax calculator now. We are fielding a lot of inquiries about new paycheck amounts and will try to address the common questions here:

Read More

Topics:

nanny,

nanny tax,

nanny taxes,

household payroll tax

Don’t be stuck in fear ! We are here to help you!

I have told many of our clients that they are not the first person that we have helped when they were behind on their nanny taxes. I tell them that because it’s true!

Read More

Topics:

household employee taxes,

W-2,

nanny payroll tax,

nanny tax,

nanny taxes

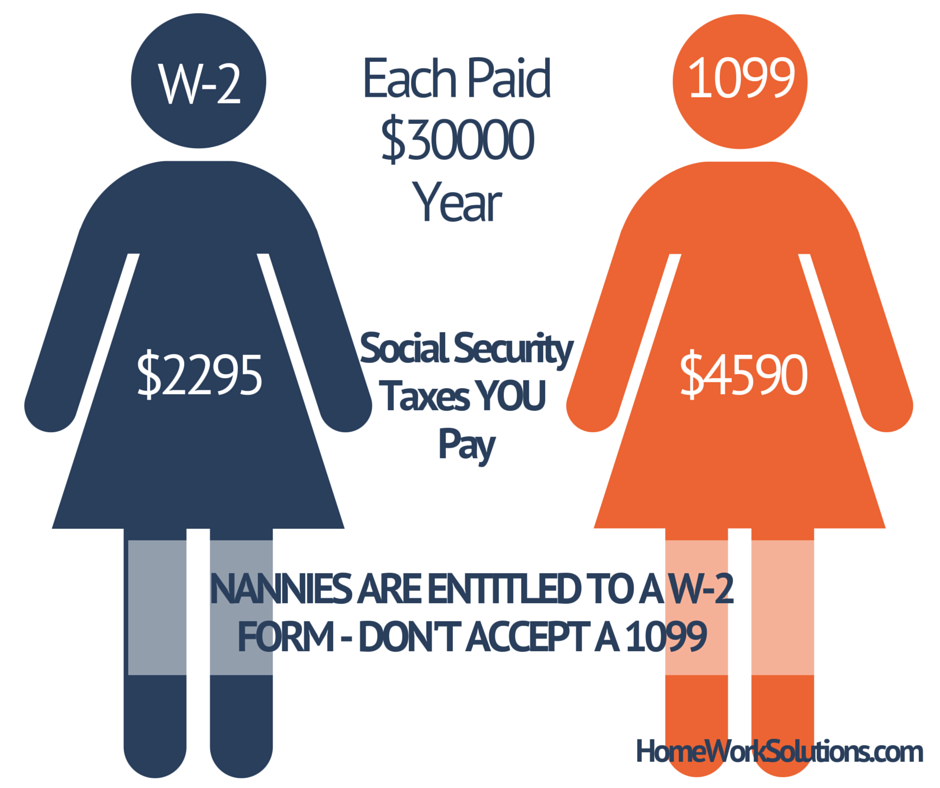

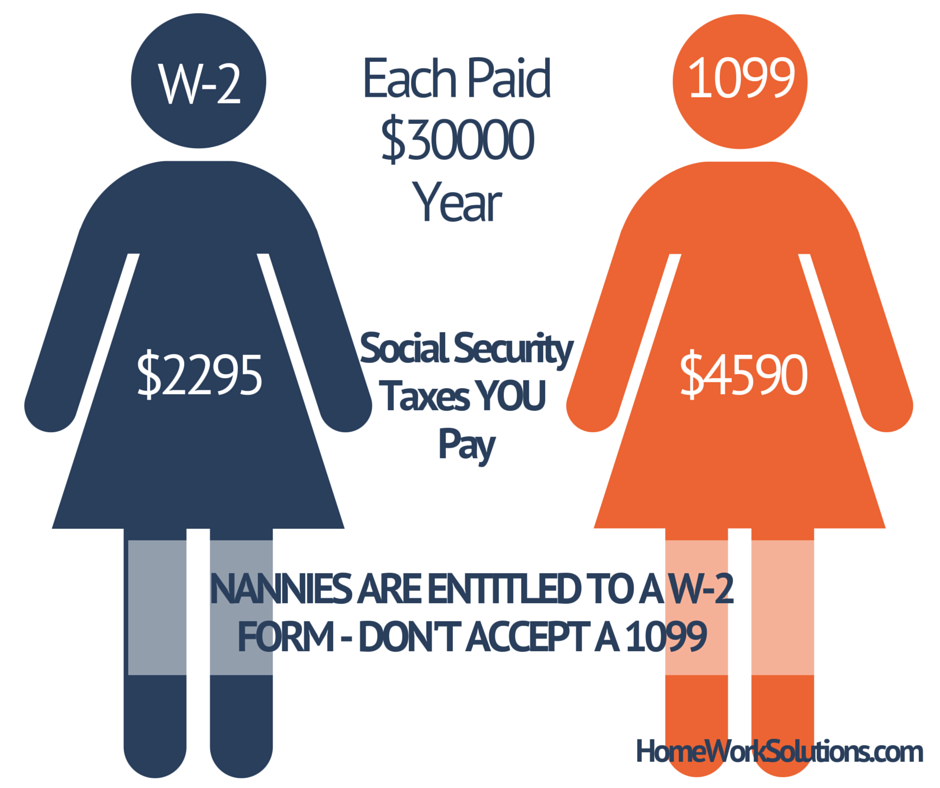

.png?width=290&name=W-2_(1).png) Tax season is in full swing, and Americans are preparing to file their annual income tax returns. If you are a household employer - you employ a nanny, housekeeper or senior caregiver - you will find conflicting advice on how to handle the "nanny taxes."

Tax season is in full swing, and Americans are preparing to file their annual income tax returns. If you are a household employer - you employ a nanny, housekeeper or senior caregiver - you will find conflicting advice on how to handle the "nanny taxes."

Read More

Topics:

household employee,

worker misclassification,

independent contractor,

nanny tax,

nanny taxes,

1099 v w-2

While mileage reimbursement and commuter transit benefits are scheduled to decrease January 1, 2014, other nanny tax numbers will increase.

Read More

Topics:

nanny tax,

domestic workers bill of rights,

nanny mileage reimbursement

.png)

.png)

.png?width=290&name=W-2_(1).png) Tax season is in full swing, and Americans are preparing to file their annual income tax returns. If you are a household employer - you employ a nanny, housekeeper or senior caregiver - you will find conflicting advice on how to handle the "nanny taxes."

Tax season is in full swing, and Americans are preparing to file their annual income tax returns. If you are a household employer - you employ a nanny, housekeeper or senior caregiver - you will find conflicting advice on how to handle the "nanny taxes.".jpg)