You’ve found a nanny to care for your children and now comes the conversation of payment and taxes. If your nanny doesn’t want you to report her wages or pay taxes, how should you respond? It may be convenient to pay your nanny under the table, but not only is this illegal, it could be very costly if you end up getting caught. Failure to pay nanny taxes could result in hefty penalties and fines, often in the thousands of dollars range.

Read More

Topics:

nanny tax,

household payroll tax

We’ve seen it shatter the dreams of potential officeholders, time and time again — no, it’s not adultery, bribery, or breaking into the Democratic National Headquarters — we’re talking about the nanny tax.

Read More

Topics:

nanny tax,

nanny taxes

Having a child is a big commitment – it takes time, patience, and money, but the rewards of being a parent are unlike anything else in life. For many parents, the change in lifestyle that comes with parenting means that you need some extra hands.

Read More

Topics:

nanny tax,

domestic employer legal responsibilities

For many working parents, finding a hired caregiver/nanny that they trust to be with their children during the workday is extremely important. It may be convenient to pay your nanny under the table, but not only is this illegal, but it can be incredibly costly if you get caught. If you do not pay nanny taxes, there are heft fines and penalties, sometimes ranging upwards of $25,000.

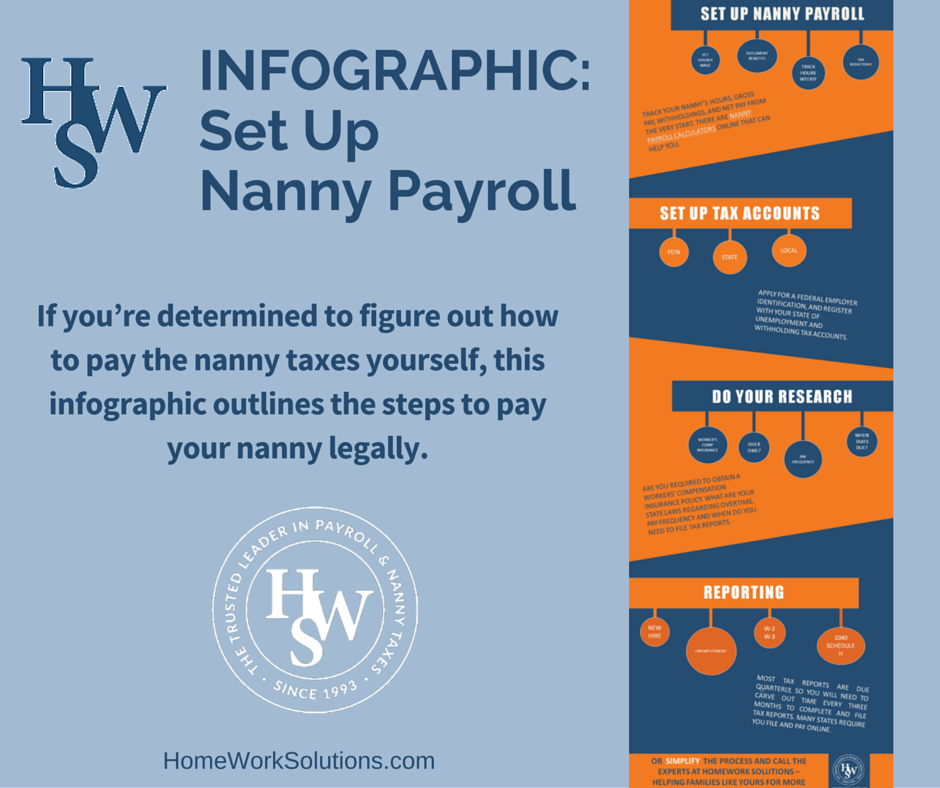

Many families find this both complicated and time consuming. Prefering to dedicate this time to their family, they outsource the nanny payroll to a specialty nanny payroll service like HomeWork Solutions.

If you’re determined to figure out how to pay the nanny taxes yourself, here are the steps on how to pay your nanny legally.

Read More

Topics:

nanny tax

What is a summer nanny? Are you responsible for the nanny taxes with a summer-only nanny?

Read More

Topics:

summer nanny,

nanny tax,

nanny taxes

A Nanny Tax Case Study

Its true! Ignoring the nanny taxes opens up a whole host of complications and not a single one gets better if you ignore it!

Read More

Topics:

nanny payroll,

nanny tax

Share This Infographic On Your Site

Millennials, as a whole, are starting to have children, and since raising a child can be expensive, many Millennials choose to work and use childcare services for help. If you’re a Millennial and you’re interested in learning more about childcare services, then check out some of our thoughts below.

Read More

Topics:

nanny tax,

nanny taxes,

childcare,

millennial

Do you have a nanny and pay him or her over $2,000 in wages? Congratulations! Now you’re considered a household employer and must file Social Security and Medicare payroll taxes. You will have to report your nanny’s income and taxes paid for the year as well as file report and pay employment taxes on your federal income tax return. There are several forms you need to understand if you employ a nanny in the home. Read on to learn more about these tax forms.

Read More

Topics:

nanny tax,

nanny taxes

If you hire people to work in your home -- such as nannies, private nurses, or housecleaners -- then you’re a household employer. You’re responsible for filing the proper taxes and getting the right paperwork to your employees if you pay them over $2,000 for the year (as of 2016).

Now that it’s tax season, be sure you’re providing your domestic workers with the proper paperwork. Start with the following information to ensure a stress-free tax season.

Read More

Topics:

household employer,

nanny tax,

nanny taxes,

domestic worker

Confused about how nanny taxes affect the taxes you pay on your housekeeper’s wages? In honor every mom who appeciates extra help keeping the home in order, we thought we’d clear up some common misconceptions surrounding an employer’s tax obligations on their housekeeper’s wages.

Read More

Topics:

housekeeper,

cleaning lady,

nanny tax,

nanny taxes