Guest blogger Bonnie Low-Kramen is the author the book, Be the Ultimate Assistant, A celebrity assistant’s secrets to working with any high powered employer. Bonnie is the former assistant to celebrity couple Olympia Dukakis and Louis Zorich. Bonnie is now teaching workshops for Personal Assistants in major U.S. cities. Visit www.bonnielowkramen.com for more details.

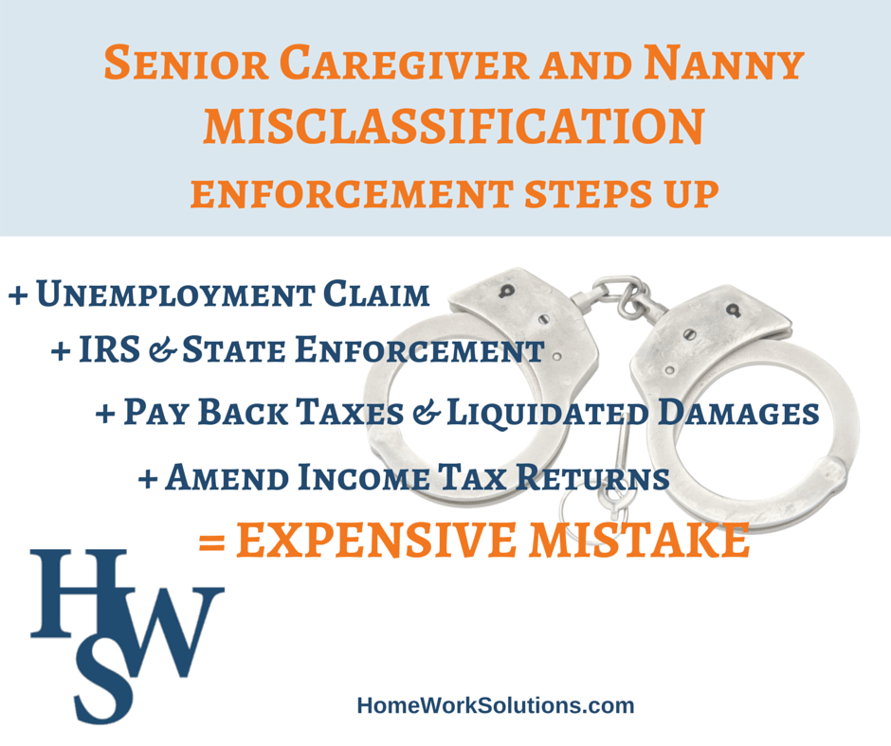

Worker misclassification - the practice by an employer of treating an employee as an independent contractor for purposes of avoiding employment taxes - is a constant issue in the field of household employment. Many household employers - and employees - simply feel this is easier, that the tax forms are too complicated, or the tax expense too high.

Worker misclassification - the practice by an employer of treating an employee as an independent contractor for purposes of avoiding employment taxes - is a constant issue in the field of household employment. Many household employers - and employees - simply feel this is easier, that the tax forms are too complicated, or the tax expense too high.