HWS' Client Care Manager, Mary Crowe, shares the story of a client who issued her nanny a 1099 form, and later found herself on the wrong side of the IRS.

Our client, Linda M. came to us when her relationship with her nanny was in crisis over taxes. Linda lives in New Jersey and she hired her nanny in the fall and was paying her in cash every week. She has an accountant to handle her income taxes, and when she hired the nanny her accountant told her that everyone treats their nanny as an independent contractor.

Read More

Topics:

nanny w-2 form,

worker misclassification,

1099 v w-2

At Thanksgiving last year, The Crawford Family got together as so many families do on this day to share a traditional meal, spend time together and talk about where they are and where they want to go.

Read More

Topics:

housekeeper,

household payroll tax

Monday, September 1 is Labor Day in the U.S. - a Federal holiday that many nannies and caregivers receive as a paid holiday. Families often struggle with how to calculate the employee's paycheck, especially overtime pay, when a paid holiday is in the pay period.

Read More

Topics:

senior caregivers,

caregiver payroll,

nanny payroll,

holiday,

senior home-care workers

We took a difficult call recently from an adult daughter of an elderly couple who employed two senior caregivers. The Smiths live in New York

Read More

Topics:

eldercare,

aging parents,

senior care,

payroll tax enforcement,

nanny background screening

I am the youngest of six and learned many lessons of ‘what not to do’ from watching my siblings. I observed to the owners of HWS the other day, after taking a client call, that we fix the same problems over and over for different clients. Knowledge is power even when the knowledge comes from seeing the mistakes of others.

I want to share with you my top 5 mistakes your ‘employer’ siblings have done before you so that you can learn ‘what not to do’.

Read More

Topics:

nanny payroll,

household payroll

Last Friday, HWS' Client Care Manager Mary Crowe took a phone call that went along these lines:

Read More

Topics:

household employee taxes,

nanny payroll tax

According to Merriam-Webster, "The Sandwich Generation" is defined as a generation of people who are caring for their aging parents while supporting their own children. I define The Sandwich Generation as 90% of my friends. The Sandwich Generation has very full plates between being successful professionals by day and stressed out parent and adult daughter/son by night. Trying to keep all the balls in the air is challenging and can be draining.

Read More

Topics:

aging parents,

senior care,

hiring care for seniors

Moving your family can be one of life's most exciting times, yet also one of the most stressful times. Finding a new place, selling an old place, leaving a job, starting a new one or transferring within a company, packing, unpacking, leaving an old nanny, hiring a new one, (or sometimes the nanny moves or commutes to the new location if it’s a local move) the list can seem like its endless.

Read More

Topics:

nanny payroll,

nanny payroll tax,

nannies,

calculate nanny payroll tax

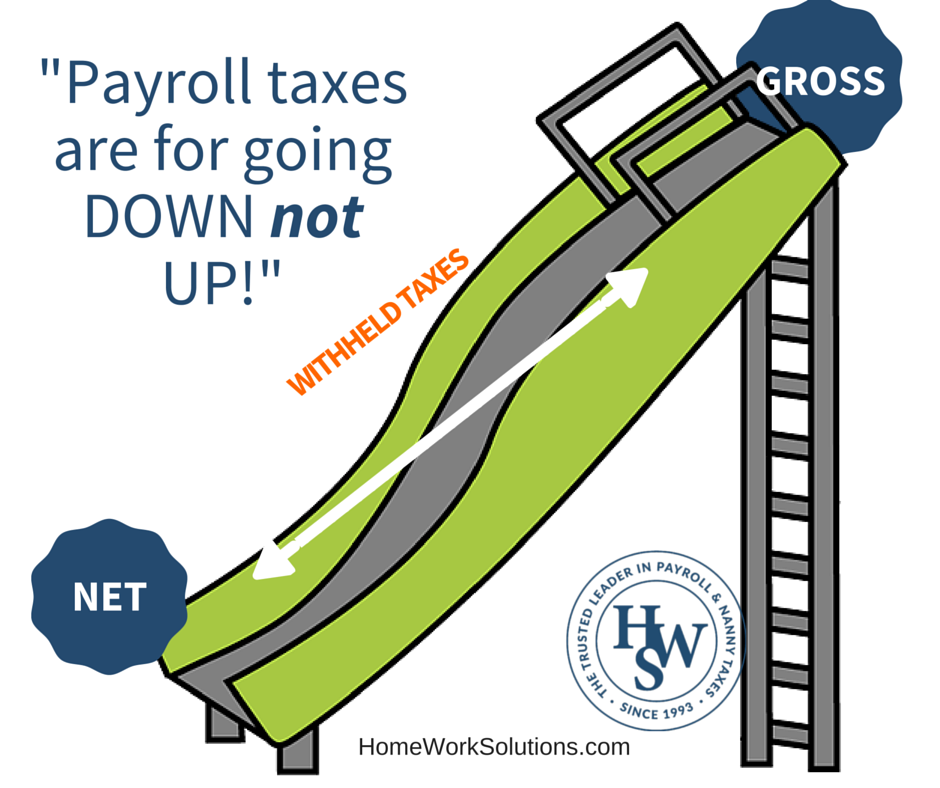

A client calls and say "I want to pay my nanny $16.00 an hour take home, can you help me?" When I hear this question it is like nails on a chalk board; however it’s also a great opportunity for me to explain the nanny taxes, how payroll works and why paying a net per hour is the worst idea. This is often referred to as 'Grossing Up' a paycheck and it can lead to major headaches.

Read More

Topics:

nanny,

nanny payroll,

nanny payroll tax,

nanny hourly wage,

nannies

The Internal Revenue Service issued new 2014 income tax withholding schedules and they are fully integrated with our online tax calculator now. We are fielding a lot of inquiries about new paycheck amounts and will try to address the common questions here:

Read More

Topics:

nanny,

nanny tax,

nanny taxes,

household payroll tax

.png)

.png)