Congress is debating Immigration Reform, legislation that would establish a path to citizenship for the about eleven million undocumented workers living and working in the shadows today, bypassing tax law obligations. A good portion of these are employed as household workers such as nannies, housekeepers and senior caregivers.

Read More

Topics:

domestic employer legal responsibilities,

household payroll tax,

nanny tax compliance

HomeWork Solutions is a leading national nanny/household employee payroll and tax company. We work with thousands of families, and hear and respond to the same questions/concerns over and over again. We want to take the opportunity to share this information with you through this easy to follow Q. and A.

Read More

Topics:

babysitter nanny tax,

worker misclassification independent contractor,

domestic employer legal responsibilities,

nanny non-exempt employee,

nanny independent contractor,

nanny tax compliance,

nanny job description

20 years ago HomeWork Solutions was founded dreaming of creating a service business to help busy families deal with household payroll tax compliance. The failed Zoë Baird cabinet nomination provided the inspiration and belief that many smart, successful families not only wanted, but needed help in this labyrinthine area of tax and employment law.

Read More

Topics:

nanny payroll,

nanny tax,

nanny tax compliance

IRS and states recently affected by Hurricane Sandy will extend tax deadlines and waive some penalties to tax payers affected by this natural disaster.

Read More

Topics:

nanny income tax,

nanny payroll tax,

nanny tax,

household payroll tax,

nanny tax compliance

Rhode Island kicks off tax amnesty program. If you are a Rhode Island tax payer and are delinquent on any states taxes, you will soon have an opportunity to come current on your taxes without having to pay any penalties. The Rhode Island Department of Taxation announced the amnesty program in its most recent newsletter, joining a handful of states offering amnesty to individuals and/ or businesses.

Read More

Topics:

nanny payroll tax,

nanny taxes,

household payroll tax,

nanny tax compliance

Social Security and Medicare, collectively known as FICA taxes, are a mystery to many domestic employers. Who is liable for them, how are they paid, and where are they reported are just some of the questions that plague domestic employers. While both taxes are calculated as a percentage of the gross wages, the employee’s portion of Social Security is 4.2% (for 2011 and 2012 only) while the employer’s portion is 6.2%, and both the employer and employee’s portion for Medicare is 1.45% of the gross wages.

Read More

Topics:

nanny tax,

calculate nanny payroll tax,

household payroll tax,

nanny tax compliance

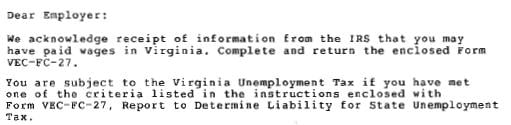

The Internal Revenue Service (IRS) and 11 states, as we reported in October 2011, have entered into information sharing agreements for purposes of employment tax enforcement. Virginia, apparently, is making a concerted effort to collect state unemployment taxes from employers known to the IRS, but not to the state.

Read More

Topics:

nanny tax audit,

nanny tax statute of limitations,

worker misclassification independent contractor,

payroll tax enforcement,

nanny tax compliance

IRS data places "nanny tax" compliance (declaration by families of their household payroll) at about 20%. Household employment experts believe even this number is optimistic. Looking at these statistics, a new household employer has to think that just ignoring this complicated and expensive issue is relatively risk free. What these numbers don't illustrate is the steadily increasing political pressure on the IRS to collect revenue, and the relatively low hanging fruit the "nanny taxes" present. Add to this the very real possibility that the elder care giver or nanny may file for unemployment benefits when the job ends, and the risk evaluation changes dramatically.

Read More

Topics:

nanny payroll tax,

nanny tax,

nanny tax compliance

If you employ a nanny, chances are strong at some point you will need to let the nanny go. There are myriad reasons a family fires a nanny. The children grow up and your beloved family nanny is no longer needed. Perhaps the nanny has horrible work habits - always late or a frequent 'no show.' Your family and the nanny simply may not 'click.' The nanny who was a wonderful nurturer of your infant does not have the energy to deal with your demanding toddler. Whatever the reason, firing a nanny can be an uncomfortable experience for both family and nanny.

Below are some tips and best practices when letting the nanny go.

Read More

Topics:

nanny employment practices,

nanny tax compliance,

nanny employment termination

Employing a nanny is expensive. After the family's mortgage payment, the nanny's salary is often the biggest expense in the household. Add the cost of taxes on top of this and many families wonder "Why?" They reason that not paying the taxes lets the nanny keep more money and saves them 10% on taxes. The nanny makes little enough anyway - why should she have to pay tax?

Reporting nanny wages and paying Social Security taxes is the law. It is also the right thing to do for your nanny. Think about it. When you and your nanny agree to pay 'off the books' you are mutually agreeing to break the law. Is that the way you want your employment relationship with your nanny to start out? What message does that send her?

Risks of Nanny Tax Avoidance...

Read More

Topics:

nanny payroll tax,

nanny tax,

nanny taxes,

nanny tax compliance