Life is busy, and sometimes hiring household employees to help around the house is a necessity. If you are considering hiring a nanny, house cleaners, senior caregiver, personal chef, or some other type of experienced domestic employee, there are a few things to keep in mind.

Read More

Topics:

housekeeper,

nanny agency,

hiring a nanny,

nanny payroll,

caregiver background screening,

caregiver,

senior home caregiver,

domestic worker,

agency,

what to expect

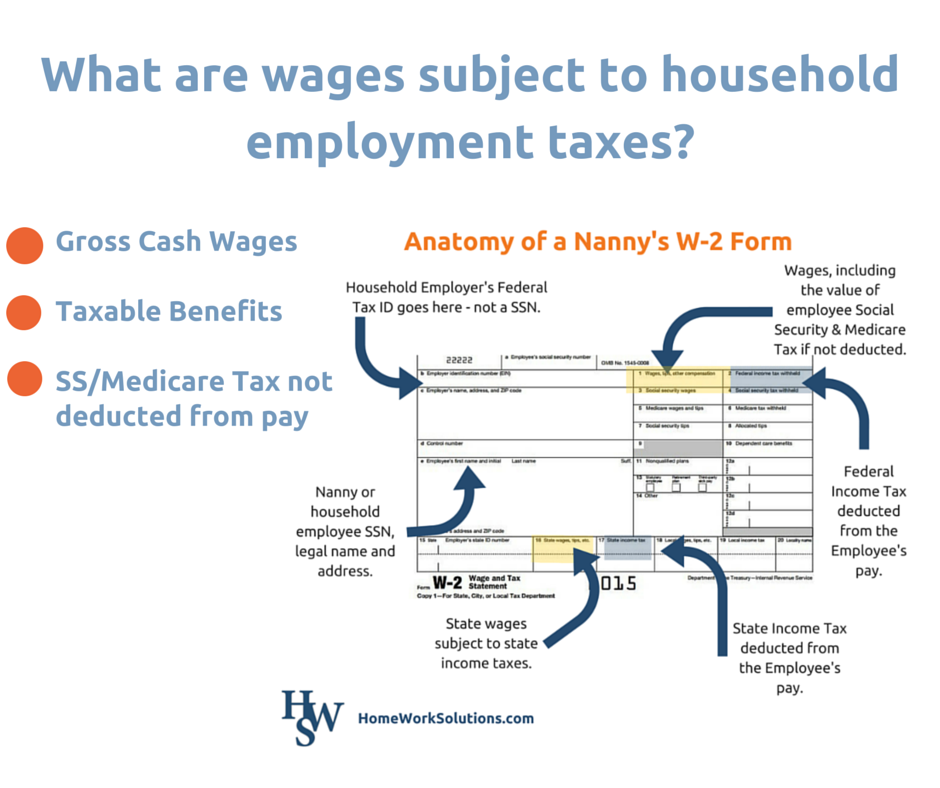

Whether you hired a nanny, a housekeeper, a personal assistant, or a private educator this year, there are some important things to know when it comes to filing taxes. When you hire someone to work in your home, you become an employer. Tax and labor laws generally apply, even if there are some small exemptions unique to household employers. Many families don’t know this and make the mistake of paying the employee “off the books.” This could be a very costly error. Here are some specific ways to avoid domestic employee tax problems.

Read More

Topics:

housekeeper,

household employee taxes,

nanny payroll tax,

nanny hourly wage,

nanny independent contractor,

nanny tax compliance,

household payroll,

caregiver

Have you searched long and hard for the perfect nanny or other household employee? When you find the right person that fits right in with your family, it’s time to determine salary and what will constitute household payroll wages.

Read More

Topics:

housekeeper,

nanny wage,

household payroll

Confused about how nanny taxes affect the taxes you pay on your housekeeper’s wages? In honor every mom who appeciates extra help keeping the home in order, we thought we’d clear up some common misconceptions surrounding an employer’s tax obligations on their housekeeper’s wages.

Read More

Topics:

housekeeper,

cleaning lady,

nanny tax,

nanny taxes

At Thanksgiving last year, The Crawford Family got together as so many families do on this day to share a traditional meal, spend time together and talk about where they are and where they want to go.

Read More

Topics:

housekeeper,

household payroll tax

Summer has come to an end. Great memories. Lots of fun, friends, playdates, swimming pool, beach vacation, etc …

Read More

Topics:

housekeeper,

cleaning lady,

household payroll tax

Did you know that household employers are not legally obligated to pay for ANY holidays or time off to their employees*? It is entirely up to the employer to decide if such a benefit will be offered or not. Clearly this is something that should be discussed when interviewing, and memorialized in a written work agreement. We know from experience this is a big concern for household employees. In some situations, applicants will even choose one job over another based on the holiday and paid time off in the job offer.

Read More

Topics:

housekeeper,

maid,

nanny paid time off,

nanny benefits,

nanny work agreement

Personal finance expert Jane Bryant Quinn recently discussed the "nanny taxes" on the popular TV show The Street - stressing that these are not just for nannies! We have posted often about the obligations of families who hire cleaning ladies, maids, and senior caregivers to report and pay the employment taxes. The IRS recently announced an IRS Nanny Tax amnesty program, promising stepped up enforcement going forward.

Read More

Topics:

elder care,

senior caregivers,

babysitter nanny tax,

housekeeper,

cleaning lady,

maid,

nanny,

companionship services

The American Taxpayer Relief Act of 2012, passed by Congress this January 1, included some substantial good news for employees whose employers supplement their public transportation expense.

Read More

Topics:

housekeeper,

maid,

nanny benefits

.png)