Planning a vacation requires putting together a variety of different details: hotels, rental cars, airline tickets, and more. But if you have a loved one that requires caregiving assistance and you will be gone for an extended time and will not be able to check in in-person from day to day, you will also need to plan on getting coverage in your absence. This might mean that the caregiver will be required to step in and be available for 24 hours shifts. Not sure how to calculate for overtime when your caregiver is working those long shifts? We can help.

Read More

Topics:

agency,

senior,

CPA

For household employers all the way up to midsize businesses, regulatory changes and administrative tasks can be an uphill battle. If you don’t have the staff to devote to these matters then it makes sense to outsource. The trick then is to do it right. This article touches on a few things to watch out for in the process of selecting a vendor/partner.

Read More

Topics:

nanny,

agency,

senior,

CPA

The changes to US Federal tax laws in 2018 created a lot of confusion, and many taxpayers did not realize that they were withholding too much tax or not enough tax until they prepared their 2018 tax returns this spring. Figuring out how much to have deducted from your paycheck has gotten more and more complicated over the years - in fact the Form W-4 will be modified in 2020 and it asks more questions than ever.

Read More

Topics:

nanny,

agency,

senior,

CPA

Working from home could save you more than just commuting costs! You could be eligible to deduct your home office expenses. It is a complicated deduction to claim so take a look at this post and see if you qualify.

Read More

Topics:

agency,

CPA

Our client, Michelle W. called us when she learned there was a problem caused by only reporting part of her nanny's payroll to New York for tax purposes.

Read More

Topics:

nanny,

agency,

senior,

CPA

Managing compensation can be complicated. Employers want to make sure their employees are happy but also want to keep their payroll costs in check. Factors like employee performance, peer wages, and market value all come into play. This article gives you some tips on how to deal with this challenge.

Read More

Topics:

agency,

CPA

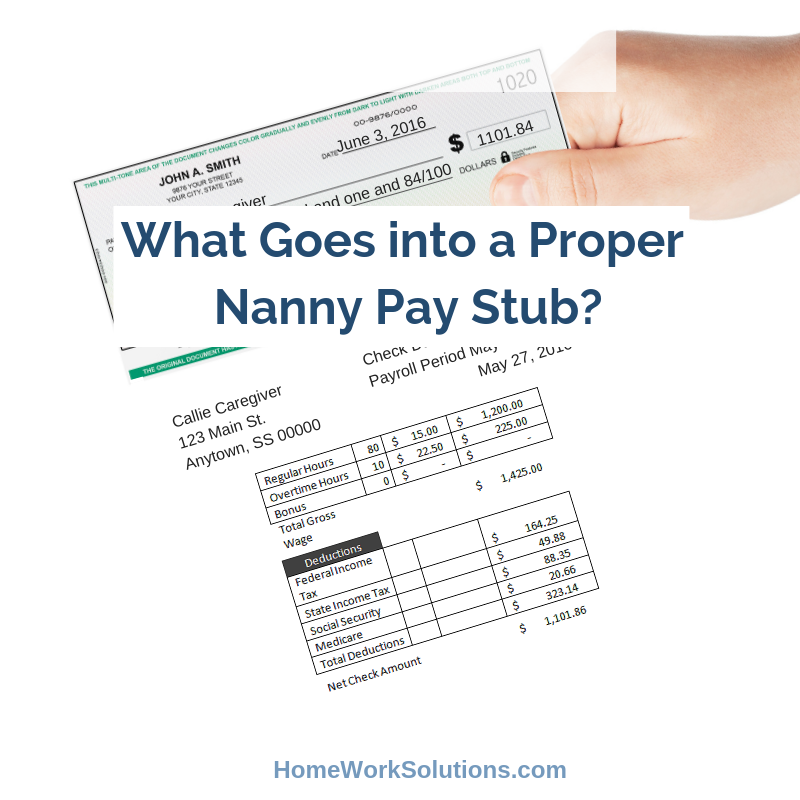

You’ve found a nanny, negotiated wages, and she has started work in your home. Now comes the tricky part of figuring out her payroll tax deductions and issuing the pay stub. If you have never done this before, it can be challenging. Here are some of the main details that need to be remembered when it comes time to pay your nanny.

Read More

Topics:

nanny,

agency,

senior,

CPA

Most companies have gotten comfortable having Millennials in their ranks, which is good because it’s time to start getting acquainted with Generation Z! This group is generally thought of to be born at the end of the 90’s forward, making the eldest of which in their early twenties.

Read More

Topics:

agency,

CPA

The U.S. Congress has once again brought up the idea of a national domestic workers’ bill of rights. The concept was briefly discussed in the fall of 2018 but has been renewed with additional enthusiasm. Basically, a national domestic workers’ bill of rights would lay out federal law concerning the treatment and rights of domestic workers (nannies, caregivers, housekeepers, etc.). A similar idea to the Fair Labor Standards Act, this law would focus specifically on domestic workers.

Read More

Topics:

nanny,

agency,

senior,

CPA

With unemployment at an historic low, employers are finding more difficulty filling open positions. One way to attract top talent is to offer a signing bonus. This strategy can help employers stand out when competing for the top talent, or luring them away from another company. Many companies are finding that signing bonuses are a worthwhile investment.

Read More

Topics:

agency,

CPA