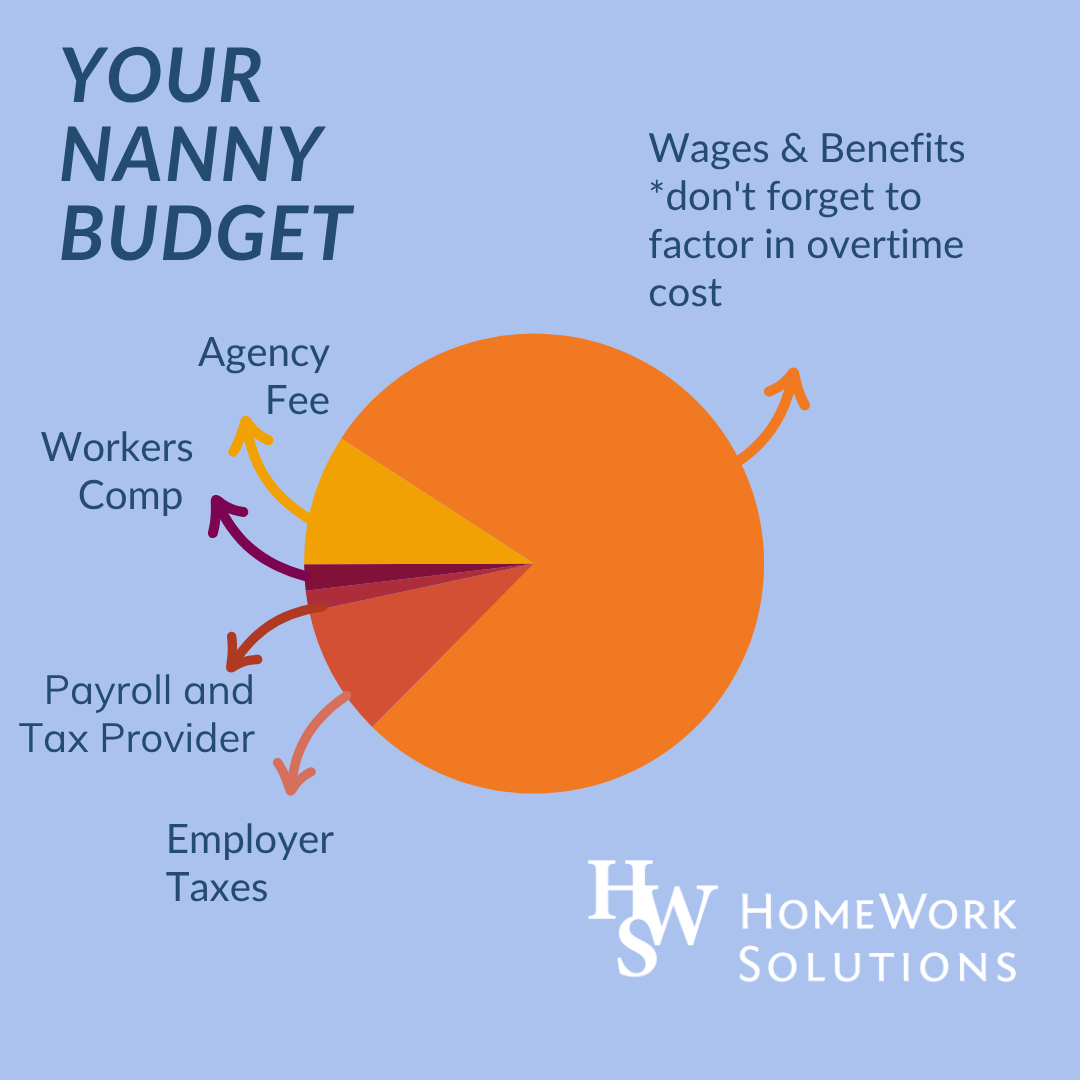

Hiring a nanny is more than offering a wage—it's about building a compliant, respectful working relationship. When families ask, “Can I afford a nanny?”, our answer is: Start with your annual budget and work backwards to determine what you can comfortably and legally offer.

Read More

Topics:

nanny salary,

hiring a nanny,

nanny,

nanny hourly wage,

agency,

nanny pay,

paying a nanny,

household employer taxes,

nanny employment costs,

nanny compensation plan,

nanny budget calculator,

nanny payroll costs,

nanny employer budget

When you hire someone to help care for your loved ones or manage your home, clear expectations and mutual trust are key. Whether you're employing a nanny, senior caregiver, or housekeeper, having a household employment work agreement is one of the most effective ways to ensure a strong, respectful working relationship.

Read More

Topics:

senior care,

nanny,

agency,

household employment work agreement,

nanny contract template,

caregiver employment agreement,

household employee contract,

W-2 household employee,

housekeeper work agreement,

California household employer,

domestic worker rights,

New York household employer,

California nanny,

new york nanny,

work agreement

If you're a household employer in California, there’s a new requirement on the horizon you’ll want to be aware of: the CalSavers Retirement Savings Program. While no immediate action is needed, this is something you’ll want on your radar—especially as the deadline approaches.

Read More

Topics:

senior care,

nanny,

agency,

CPA,

CalSavers for household employers,

CalSavers deadline 2025,

CalSavers,

California domestic worker retirement,

California nanny employer retirement plan,

nanny employer CalSavers,

senior caregiver CalSavers,

HomeWork Solutions CalSavers help,

household employer payroll compliance CA

Hiring someone to work in your home—whether it’s a nanny, a senior caregiver, or a personal assistant—is an act of trust. It’s also the start of a legal relationship that comes with tax and payroll responsibilities many families don’t expect.

Read More

Topics:

caregiver payroll,

nanny agency,

nanny,

nanny taxes,

agency,

household employment,

Pay nanny legally,

household employment taxes,

nanny tax guide

As summer approaches, families are busy planning vacations, summer camps, and activities to keep the kids engaged while school’s out. But what about the weeks that aren’t filled with structured programs — or when your family prefers a day with more flexibility, individual attention, or a break from the large-group setting? For many families, hiring a summer nanny is the perfect way to ensure consistent, personalized care.

Read More

Topics:

nanny,

nanny payroll,

summer nanny,

nanny work agreement,

temporary nanny,

agency,

hiring a summer nanny,

summer childcare

Driving children is a significant responsibility, and when it’s part of a nanny’s role, it deserves careful planning and clear communication. Whether a nanny is using their own vehicle or the family’s, it’s important to establish safety standards, insurance coverage, and reimbursement policies that reflect mutual respect and professionalism. This guide walks you through how to do just that.

Read More

Topics:

nanny,

nanny mileage reimbursement,

agency,

nanny car insurance,

nanny driving children,

hiring a nanny who drives

When you welcome a nanny into your home, you're inviting someone to play an important role in your family's life. Offering benefits is a wonderful way to show your nanny just how much you value their care, dedication, and professionalism.

Read More

Topics:

nanny,

nanny health insurance,

nanny benefits,

nanny mileage reimbursement,

agency,

household employee benefits,

nanny compensation package,

HomeWork Solutions nanny payroll,

tax-free fringe benefits for nannies,

offering benefits to a nanny

When hiring a nanny or other household employee, it's common to hear about guaranteed hours—and for good reason. This benefit offers financial consistency for your employee while giving your family scheduling flexibility. However, confusion often arises when families try to translate this into a “salary,” which can unintentionally lead to violations of wage and hour laws under the Fair Labor Standards Act (FLSA).

Read More

Topics:

nanny,

agency,

FLSA nanny laws,

guaranteed hours,

overtime for nannies,

blended rate nanny,

legal nanny pay

When families begin considering in-home care—whether for a child or an aging loved one—questions about costs come up quickly. One of the most common: Are these expenses tax deductible? The answer is: sometimes, yes. But it depends on your situation and the type of care provided.

Read More

Topics:

nanny,

agency,

senior,

in-home care tax deduction,

senior caregiver tax deduction,

child and dependent care tax credit,

nanny tax credit