Worker misclassification - the practice by an employer of treating an employee as an independent contractor for purposes of avoiding employment taxes - is a constant issue in the field of household employment. Many household employers - and employees - simply feel this is easier, that the tax forms are too complicated, or the tax expense too high.

Worker misclassification - the practice by an employer of treating an employee as an independent contractor for purposes of avoiding employment taxes - is a constant issue in the field of household employment. Many household employers - and employees - simply feel this is easier, that the tax forms are too complicated, or the tax expense too high.

The Obama Department of Labor (US DOL) began enforcement in the areas of worker missclassification in 2010. In 2011 the US DOL, the Internal Revenue Service, 11 states and one territory entered into a Memorandum of Underderstanding (MOU) for the purpose of information sharing between the federal agencies and their state counterparts to help identify employee misclassification, and pursue administrative and legal action against the employers. In 2012 California signed the MOU as the 12th state.

Maine signed into law April 18, 2012 H.B.960, "Act To Standardize the Definition of "Independent Contractor." In the Maine statue, "An employer that intentionally or knowingly misclassifies an employee as an independent contractor commits a civil violation for which a fine of not less than $2,000 and not more than $10,000 per violation may be adjudged." This is in addition to assessments for back taxes, penalties and interest.

The Maine law closely mirrors Federal language, simply stating that "Services performed by an individual for remuneration are considered to be employment ... unless it is shown to the satisfaction of the bureau that the individual is free from the essential direction and control of the employing unit..." It goes on to state that an independent contractor controls the means and process of the work (how the work is done), is customarily engaged in an independently established business, has opportunity for profit or loss, pays for their own assistants or sub-contractors, and has an investment in the tools of the trade.

Under U.S. common law, a worker who performs services for you is your employee if you can control what will be done and how it will be done. It does not matter whether you give your household employee great latitude or that the employee has occupational or professional training for his/her position, but simply that you have the right to control the work. It does not matter if the work is performed on a full time or part time basis. It does not matter whether the worker lives with you or not. It does not matter if he/she is paid hourly, daily or a salary. It does not matter how the employee refers to herself or how you refer to him/her in an employment contract. The household worker is your employee and you are generally obligated for all payroll tax filings and remittances.

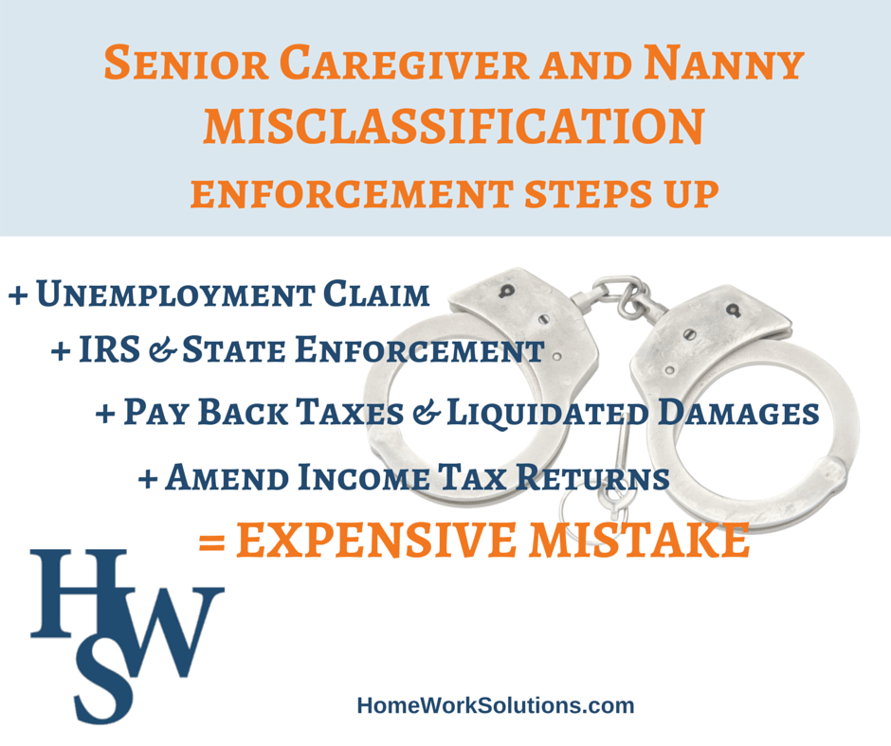

The actions being taken at both the Federal and state levels to correct worker misclassification are the most coordinated and aggressive we have seen in our twenty years in the household payroll arena. Tax collection activities always step up when there are revenue shortfalls, and shortfalls in the unemployment compensation funds at both the state and federal levels are at historic highs. The Commonwealth of Virginia recently mailed out letters with questionaires to thousands of entities (businesses and households alike) that they identified, with the help of IRS data, as possibly misclassifying employees.

HomeWork Solutions provides payroll and payroll tax services specifically to household employers. We are recognized experts in the field with 20 years of experience, helping households nationally. If you would like to discuss your situation, call 800.626.4829 for a free consultation with one of our household employer consultants.

2015 Update:

Nanny and Senior Caregiver Misclassification a US DOL Enforcement Priority