Many nannies work a series of short term assignments throughout the year. These can range from several days to several months, and this may be something that you’re used to doing on a regular basis. But, these types of situations can leave nannies/caregivers confused about how wages should be paid from a payroll and tax perspective. Here, we discuss some of the facts about how your temporary nanny position affects how you pay your taxes.

Temporary Nanny Situation #1:

If you’re a temporary nanny, earning more than $1900, see below:

Fact #1: The employer is responsible to pay all employment taxes. This includes 7.65% of your wage (or 15.3% of your wage if they don't deduct but agree to pay your share) for Social Security and Medicare, as well as state and federal unemployment taxes (about 4% on average).

Fact #2: You as the nanny, however, are responsible for all income taxes on your wages. Your employer may deduct these taxes from your paycheck throughout the year; however, if they do not, you will need to budget for this when filing your personal taxes.

Fact #3: Be sure that you request that an end of year W-2 form is sent to you in January. This is the employer’s responsibility, but it never hurts to remind them.

Temporary Nanny Situation #2:

If you’re a temporary nanny, earning less than $1900, see below:

Fact #1: You are not required to pay social security or Medicare taxes on this income.

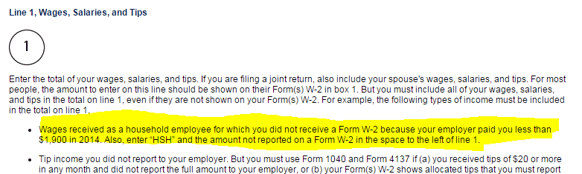

Fact #2: You are responsible for all income taxes on your wages. The IRS instructs temporary nannies to include all wage income – with or without a W-2 – on Line 1, Wages, Salaries and Tips on the annual income tax return. This goes for the 1040 EZ as well as a long form.

Note: Do not report this as Schedule C self-employment income.

Remember: In almost all situations, you will need to provide your social security number to your employer, no matter how short or long your job duration is If you are unsure of how to calculate your income taxes or have additional questions on wages and taxes and how your temporary nanny positions are affected, contact your CPA or personal tax preparer and they can help.

Nannies, if you want a tip sheet that helps the family understand their nanny tax obligations for your temporary work, click below and you will receive a guide to share with them.