Understanding Your Role When Hiring a Household Worker

When you hire someone to work in your home, whether it’s a nanny, housekeeper, or caregiver, someone must legally be the employer. In most cases, that someone is you.

Why Employment Status Matters

Being clear on who the employer is isn’t just a technicality. It affects who is responsible for paying employment taxes, how labor laws apply, and establishes a professional and legal working relationship. It also protects both your family and the person you’ve hired from legal or financial complications.

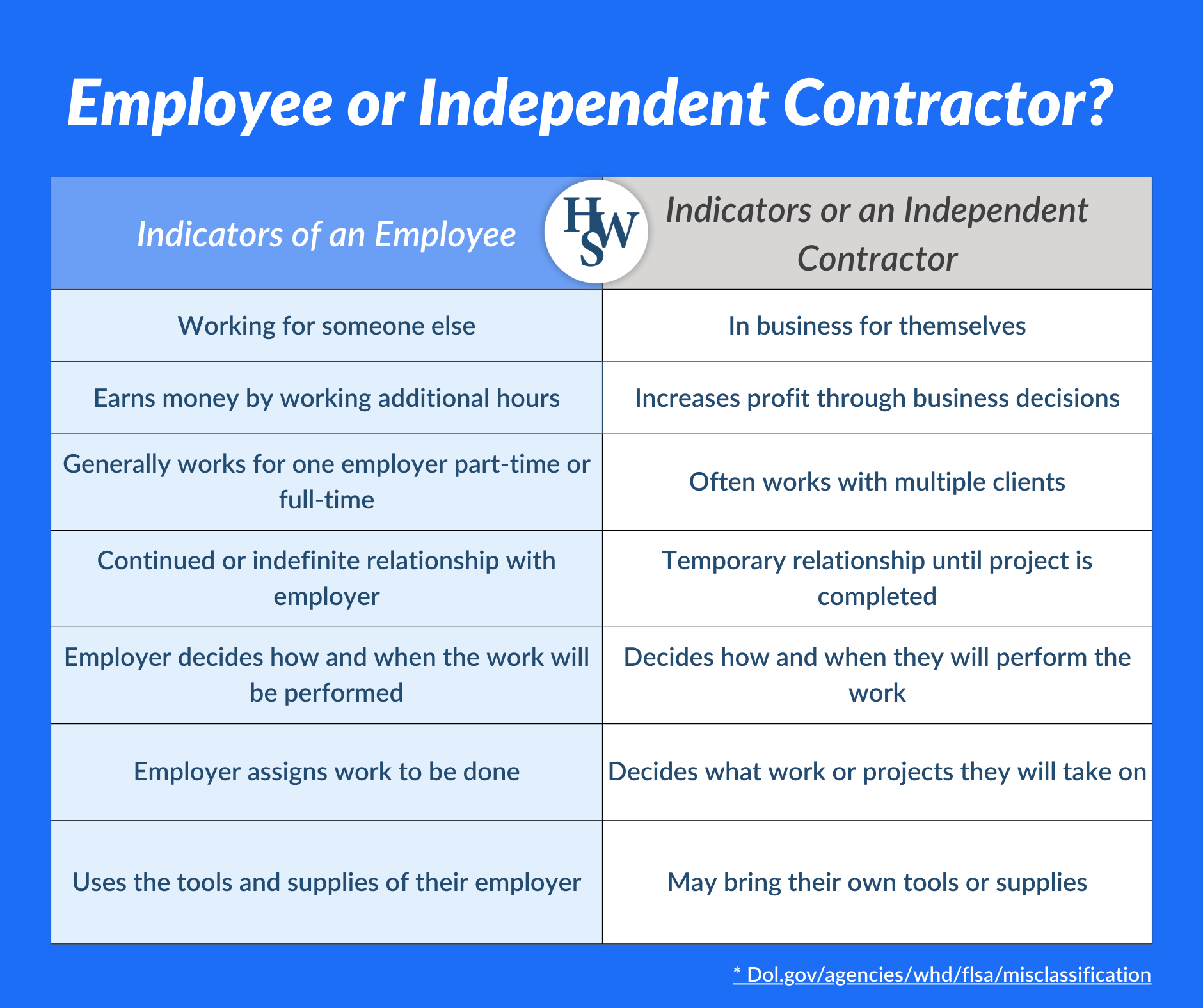

Misclassifying a worker, for example, labeling them an independent contractor when they should be an employee, can lead to audits, back taxes, and penalties. The burden of proof falls on the family, so it’s essential to get it right from the start.

Most Families Are the employers, especially with Nannies

In nearly all traditional nanny arrangements, the family is the legal employer. If the caregiver works in your home, follows your schedule, and takes direction from you, then the IRS and Department of Labor will consider them your household employee. You are responsible for:

- Withholding and paying Social Security and Medicare taxes

- Providing a year-end W-2

- Paying federal and state unemployment taxes

- Following federal and state labor regulations

Even if you found the nanny through an agency or they only work part-time, these factors do not automatically make them an independent contractor. Nannies rarely meet the legal standards for self-employment.

What About Newborn Care Specialists (NCS)?

Newborn Care Specialists (NCS) operate differently from traditional nannies. Many experienced NCSs:

- Advertise their services to the public

- Have multiple short-term clients throughout the year

- Maintain control over how care is provided

- Offer their services through a formal business entity

Because of this, many NCS arrangements are between a family and the NCS's business, which sets the terms of their work. However, not all NCSs do this. Some prefer to work as employees and do not operate as independent business owners.

As a hiring family, it’s important to be clear up front. Is your agreement with the NCS as a business, or are you hiring them as an individual? This distinction matters for tax and labor law compliance.

Make sure your written contract clearly outlines the relationship. If you intend to hire an NCS’s business (not the individual), ask for an invoice and a business tax ID number as part of the initial engagement. If they don’t provide this, you may need to treat them as your employee instead.

Senior Care Can Be More Complex

When hiring a caregiver for an older adult, employment classification depends on the circumstances. Some senior caregivers work for multiple families, hold professional licenses, or are employed through an agency. These factors can change the legal employer-employee dynamic.

For example, a licensed nurse who provides care to several clients through their own business may be self-employed. On the other hand, if a caregiver works only for your family and follows your instructions, then you are likely the employer even if they were referred by an agency.

Again, don’t assume. Review your specific arrangement and use official guidance to determine classification.

How to Determine Who the Employer Is

Before your caregiver’s first day, ask yourself:

- Do I set the schedule, duties, or provide supplies?

- Will this person work regularly and/or only for my family?

- Am I directing how their work is done?

If so, you are most likely the employer. To be certain, compare your situation to the Department of Labor’s guidance on household employment.

Why It’s Worth Getting Right From the Start

Classifying your household worker correctly isn’t just about doing the right thing; it’s about protecting your family legally and financially.

If you misclassify an employee as an independent contractor or fail to withhold and pay employment taxes, you could face serious consequences. These may include:

- Back taxes for Social Security, Medicare, and unemployment

- IRS penalties for failure to file or pay on time

- Interest on unpaid tax amounts

- State-level fines for wage and hour law violations

- Liability for unpaid overtime or minimum wage

Even a well-intentioned mistake can trigger an audit or costly settlement, especially if your former employee files for unemployment or reports issues to a labor board.

Starting off the right way with proper classification and payroll & tax compliance not only helps you avoid these risks but also builds trust with your caregiver. You’re showing that you value their work and are committed to a professional, legal arrangement.

We’re Here to Help

At HomeWork Solutions, we’ve been helping families since 1993 handle household payroll and taxes the right way. Whether you're hiring a full-time nanny, a part-time house manager, or a senior caregiver, we help you understand how to correctly classify workers, manage payroll, and stay compliant without stress. Contact us today for a complimentary consultation. We’re here to help!