When you hire someone to work in your home, it is important to make sure you classify their employment correctly, and pay them legally. Most household workers are classified as employees, and with that employment relationship comes payroll and tax reporting requirements. Providing a paystub is one of these requirement in most states. The only states without paystub laws are Alabama, Florida, Arkansas, Georgia, Louisiana, Mississippi, Ohio, South Dakota, and Tennessee.

Why are pay stubs so important?

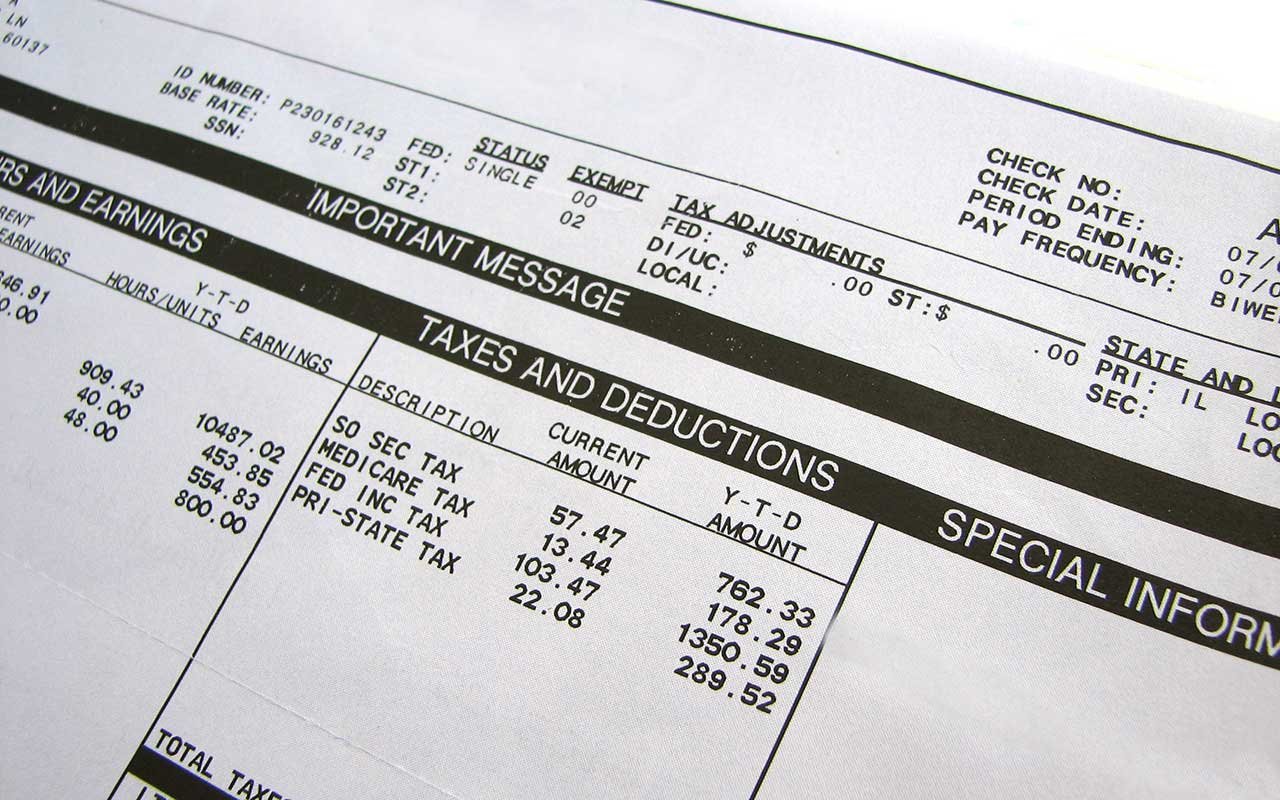

Paystub laws have been enacted to prevent wage theft by employers. They ensure employers are accurately paying their employees for all hours worked (including overtime) and only processing deductions that are allowed by law, such as the employee’s taxes. Many states levy significant fines upon employers who fail to provide employees paystubs including specific pieces of information. An itemized paystub usually includes:

- Employer name and address (some require the employer’s EIN also)

- Employee’s name

- The dates covered by the paycheck

- The date of the paycheck

- The pay rate for regular hours and overtime hours

- The number of regular hours and overtime hours paid

- The gross wage computed (amount before any deductions)

- Itemized list of all deductions

- The net payment (take home, the amount of the check or direct deposit)

- Year-to-date totals for all dollar amounts in addition to pay period amounts

- Leave accrual

Paystubs also protect you as an employer. If there is ever a dispute between you and your employee about pay or hours worked, a mathcing set of employee-signed timesheets and paystubs showing hours paid can be used to show that you have paid for all hours worked. If you don't have accurate records, any potential wage and hour dispute will be much more difficult to fend off.

What needs to be deducted from your employee’s paycheck?

Tax obligations vary by location, so it is important to research requirements in your state. Typical deductions may include Medicare and social security taxes, federal and state income tax, local income tax, and any other state taxes that are required by law such as disability insurance. If you decide to offer health insurance benefits or allow for employee contributions to a retirement savings plan, these will also need to be included as line items.

While the classification of the worker doesn’t change based on the amount of wages, what taxes are required to be paid might. If you pay a household employee more than $2,400 in wages in a calendar year (2022), then you are required to remit social security and Medicare taxes. Federal unemployment tax, state unemployment tax, and disability insurance taxes are generally assessed at a lower threshold, $1,000 in most states .

If you are uncertain about where to begin when it comes to paying your new employee, we can help. Our experts at HomeWork Solutions understand the different tax and labor laws surrounding household employment. We will answer your questions and make sure your employee’s paystub is accurate, so you don’t have to worry. Contact our experienced team today at 1-800-626-4829 or info@homeworksolutions.com.