Paying caregivers "under the table" is illegal and carries significant risks, including tax evasion charges, legal penalties, and potential lawsuits for both the employer and the caregiver.

The Risks of Paying Caregivers "Under the Table"

Paying caregivers "under the table" might seem like a convenient way to avoid paperwork and taxes, but it’s illegal and can result in serious consequences, including tax evasion charges, with interest, civil lawsuits, and loss of tax breaks. Both the employer and the caregiver are required to pay taxes and report income to the IRS, and failing to do so can lead to significant legal and financial consequences. While managing payroll for an in-home caregiver might seem daunting, it’s easier than you might think to handle it legally, ensuring peace of mind and protection for both parties.Legal and Financial Consequences of Paying Caregivers "Under the Table"

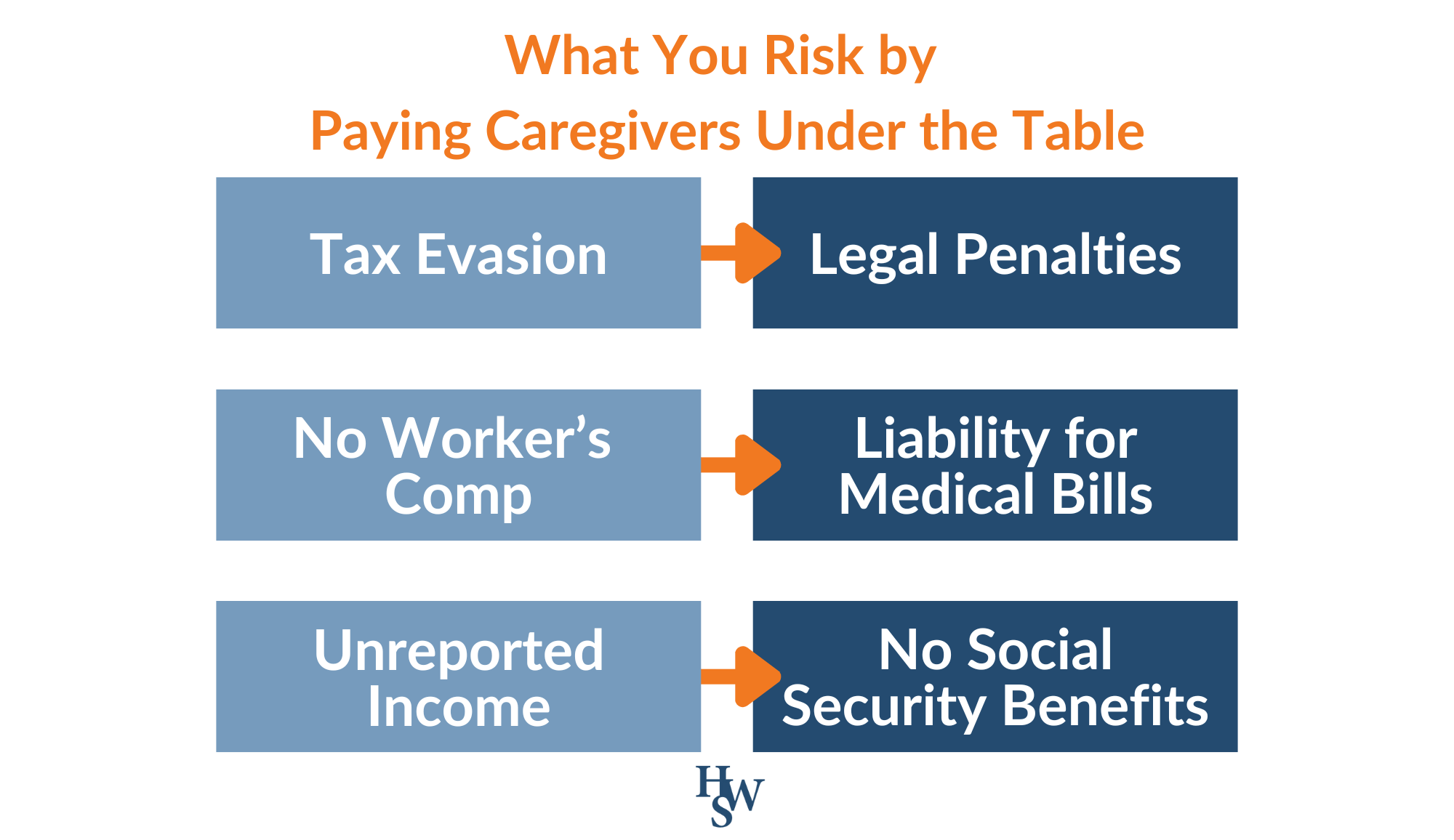

Tax Evasion and Legal Penalties

When you choose to pay a caregiver "under the table," you’re essentially committing tax evasion, which is a serious offense under U.S. law. According to the IRS, failing to report wages and not paying the required payroll taxes can result in hefty fines and even criminal charges. IRS Publication 926: Household Employer’s Tax Guide clearly outlines the responsibilities of household employers, including the obligation to withhold and pay Social Security, Medicare, and federal unemployment taxes on behalf of the caregiver. Additionally, both the employer and the caregiver can face legal consequences if these obligations are not met. For the employer, this can mean lawsuits related to tax evasion, unpaid wages, or failure to comply with the Fair Labor Standards Act (FLSA). For the caregiver, not having reported income means no credits towards Social Security benefits, leaving them without financial security in retirement.Impact on Employment Relationship and Benefits

Paying a caregiver "under the table" not only jeopardizes your legal standing but also complicates the employment relationship. It can prevent the caregiver from receiving unemployment benefits if they lose their job, as there is no history of wages earned or payments into the unemployment insurance system. Furthermore, if a work-related injury occurs, and the caregiver is not properly insured through workers' compensation insurance, the employer could be liable for substantial medical bills and legal damages.

The Process of Legal Payment: It’s Easier Than You Think

Defining a Household Employer and Household Employee

Correctly classifying a worker is essential for legal compliance. A household employee is someone hired to provide personal care services in a home, and in most cases, they are not considered independent contractors. This is because the employer controls key aspects of the working relationship, such as how, when, and where the work is done. Household workers, like senior caregivers, nannies, and housekeepers, are typically classified as household employees, meaning the employer is responsible for withholding and paying employment taxes. Even if the worker is a family member or works part-time, they are still considered a household employee if the employer dictates the terms of their work. Misclassification as an independent contractor can lead to legal and financial penalties, so it's crucial to understand the IRS and Department of Labor guidelines for worker classification. For more information on worker classification, visit the IRS resources on Hiring Household Employees and the Department of Labor’s Employment Relationship.Steps to Legal Compliance

Handling payroll for a household employee might seem complicated, but it’s quite straightforward once you understand the process. Here’s a simplified breakdown:Register as a Household Employer & Report Hired Employees

You’ll need to obtain an Employer Identification Number (EIN) and register with your state’s tax agency. HomeWork Solutions will take care of this process for you, ensuring that all your registrations are completed correctly and on time. You are also required to complete new hire reporting to the state for each employee upon hire.Set Up Payroll

Calculate and withhold federal taxes, social security, Medicare, and state taxes from your caregiver’s paycheck. You must also ensure compliance with minimum wage laws and overtime requirements under the Fair Labor Standards Act and in accordance with state law. We offer a comprehensive payroll service that takes care of all these details for you, ensuring that your caregiver is paid accurately and legally, with all necessary deductions handled seamlessly.File Taxes

You’ll need to file IRS Form 1040 Schedule H to report household employment taxes annually, and file a W2 with the Social Security Administration to report your employee’s wages. Additionally, you’ll have to pay federal and state unemployment insurance taxes, ensuring your caregiver is eligible for unemployment benefits if necessary. We handle all tax filings on your behalf, guaranteeing that your payroll tax returns are filed accurately and on time, so you never have to worry about penalties or missed deadlines.Workers’ Compensation Insurance

This is crucial to protect both you and your caregiver in the event of a work-related injury, and it is mandatory in most states. Employers are only able to secure a workers' compensation insurance policy when paying over-the-table. Failure to provide this insurance can result in significant legal and financial consequences.Protect Yourself & Your Caregiver

Let HomeWork Solutions handle payroll and tax compliance so you can enjoy peace of mind.

Schedule my FREE ConsultationCommon Misconceptions About Paying Caregivers Legally

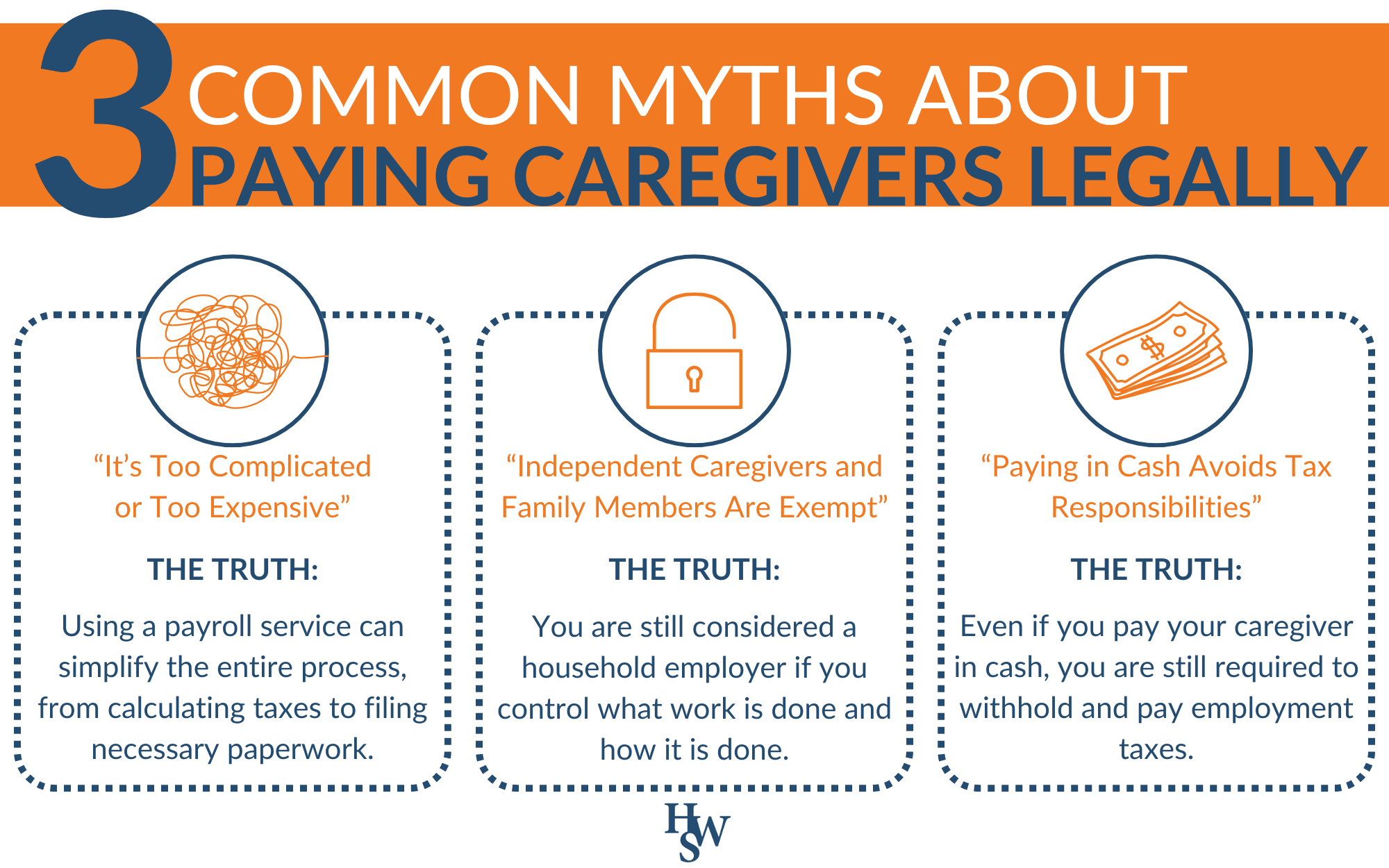

Myth: It’s Too Complicated or Expensive

One of the most common misconceptions about paying caregivers legally is that it’s too complicated or expensive. In reality, using a payroll service can simplify the entire process, from calculating taxes to filing necessary paperwork. The cost of such a service is a small fraction of the total household employment budget, and brings peace of mind that comes from knowing you’re compliant with all legal requirements. Professional advice can be invaluable in ensuring you navigate these responsibilities correctly, without the risk of tax evasion or penalties.Myth: Independent Contractors and Family Members Are Exempt

Another common myth is that if you hire an independent caregiver, private caregiver, or a family caregiver, you’re exempt from legal requirements like paying payroll taxes. This is not true. If the worker truly controls their contributions, runs their own business, and takes financial risk, they may in fact be excluded from a household employment relationship; but household employees are too often misclassified as independent contractors. If you have an in-home care provider, you are still considered a household employer if you control what work is done and how it is done. This means you are required to comply with all employment tax laws, including withholding income tax and paying social security and Medicare taxes.Myth: Paying in Cash Avoids Tax Responsibilities

Some household employers believe that paying a caregiver in cash allows them to bypass tax responsibilities and other legal obligations. This is a dangerous misconception. Even if you pay your caregiver in cash, you are still required to withhold and pay employment taxes, file the appropriate paperwork, and provide a W-2 form at the end of the calendar year. Cash payments to household employees are often revealed when a former employee files for unemployment benefits, later resulting in significant significant back tax assessments and tax penalties to the employer for failure to file. Utilizing a professional payroll service can help ensure that all payments, whether made in cash or otherwise, are properly documented and compliant with federal and state laws.