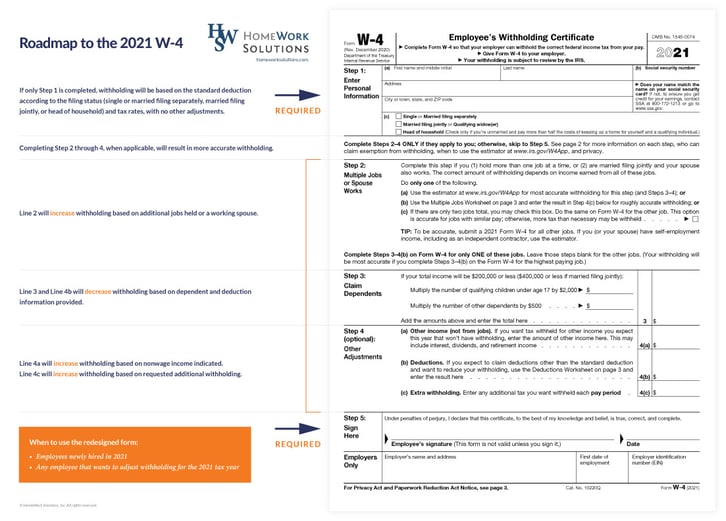

New W4 for 2021: What You Need to Know to Get it Done Right

In the effort to simplify its withholding calculations, the IRS released a re-designed W4 in 2020, with no major updates in 2021. The new form must be used if you are starting a new job or modifying your withholdings (how much your employer takes out of your paychecks for federal income taxes). You do not need to fill out a new form every year. However, if you are married you may want to ensure you and your spouse both updated your W4s to ensure accurate withholdings when all household income is taken into account. The same guidance applies if you have multiple sources of income, such as a second job.

Remember, if you withhold too little from your check, it will result in a bill at tax time to make up the difference. Withholding too much will mean a refund, but that is just less money in your pocket during the year and an interest-free loan to the Federal Government.

Step By Step:

Step 1: Everyone must complete this step.

This is where you enter your personal information. Your name, address, social security number, and your filing status (single/married but filing separately, married filing jointly, or head of household). If no filing status is selected, then the taxes will be withheld at the higher Single rate.

Step 2: Complete if your spouse works or you have more than one job.

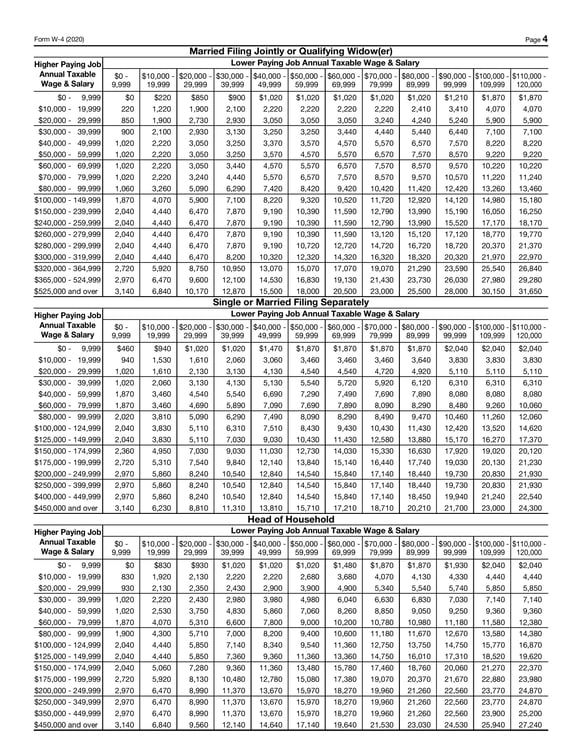

Read the disclaimer right above step 2, as you will only fill out this section (and the subsequent sections) if they apply to you. You can always reference Page 2 if you have questions. Step (a) will give you the most accurate estimate to your withholdings, as it directs you to the IRS withholdings calculator. Step (b) is accurate, but you would do the calculations yourself. Step (c) is the least accurate option, albeit the easiest, as it assumes that the wages you earn from each job are equal.

Step 3: Complete if you are claiming dependents.

This is where you would state how many dependents you have, so that you may lower your withholdings throughout the year. Dependents are no longer claimed as ”allowances.” Instead, you claim a fixed dollar amount per dependent based on their age. For more information about the Child Tax Credit, please visit IRS Publication 972 - Child Tax Credit.

Step 4: Complete if you have other income (not from employment), deductions, or would like to withhold extra funds.

For section (a), this is where you would state if you have additional income such as retirement income or dividends. In section (b), you would enter deductions you plan to claim beyond the standard deduction. For your reference, standard deductions for 2021 are:

- $25,100 for married filing jointly

- $12,550 for single and married filing separately

- $18,800 for those filing as head of household

Section (c) allows you to specify if you would like extra funds withheld from each paycheck. This is particularly important for individuals who are married filing jointly with a working spouse or individuals who have more than one job. This figure can be obtained by working through the instructions noted in step 2 above.

Step 5: Everyone must sign the form

The form is not valid without your signature, and you must provide a signed copy to your employer.

Worksheets

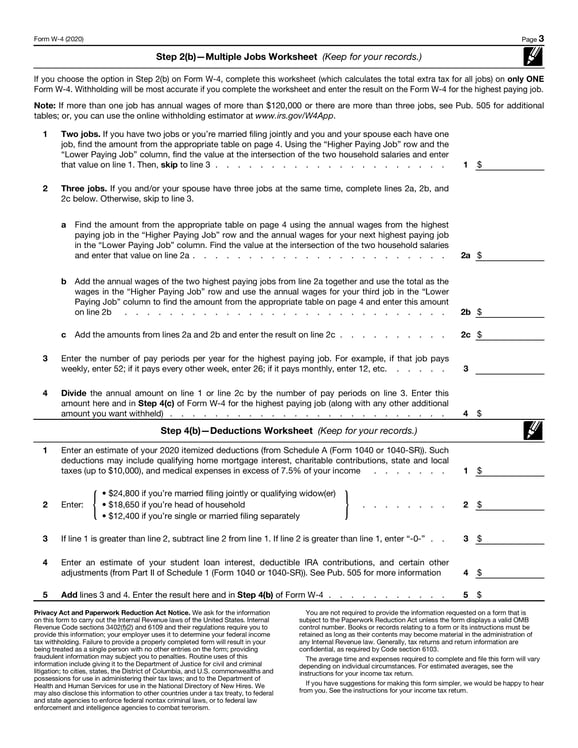

As was stated above, the W-4 Form has two worksheets attached:

The first allows you to calculate withholdings when there are multiple sources of income.The lines will allow you to match the total compensation with the amount to enter in the withholdings line of the actual form W-4 (Step (4c)).

The second, allows you to calculate deductions if you plan to itemize, rather than take the standard deduction. Anyone filling out the deductions worksheet should have their prior-year tax returns available to help, so that the accurate number may be entered for deductions on the actual form W-4 (Step 4(b)).

For further questions, visit the new IRS W4 FAQ Page, which is a handy resource on how to fill out the new 2021 W-4, and whether you should adjust your W4 for 2021 even if you are not required to do so. You should also consult the Tax Withholding Estimator, which the IRS published to help guide you with the amount you need to withhold (Step 2).

At least in this regard, they made one thing easy!

If you have questions about your state tax withholdings, give our payroll specialists a call at 800-626-4829. They will be more than happy to answer any questions you may have.