We believe the majority of families want to ensure that the nanny or senior caregiver who took care of their family is taken care of in this crisis. Now that families understand what their legal obligations are under the Families First Coronavirus Response Act (FFCRA), let’s take a few moments to understand how the money works out.

A common scenario:

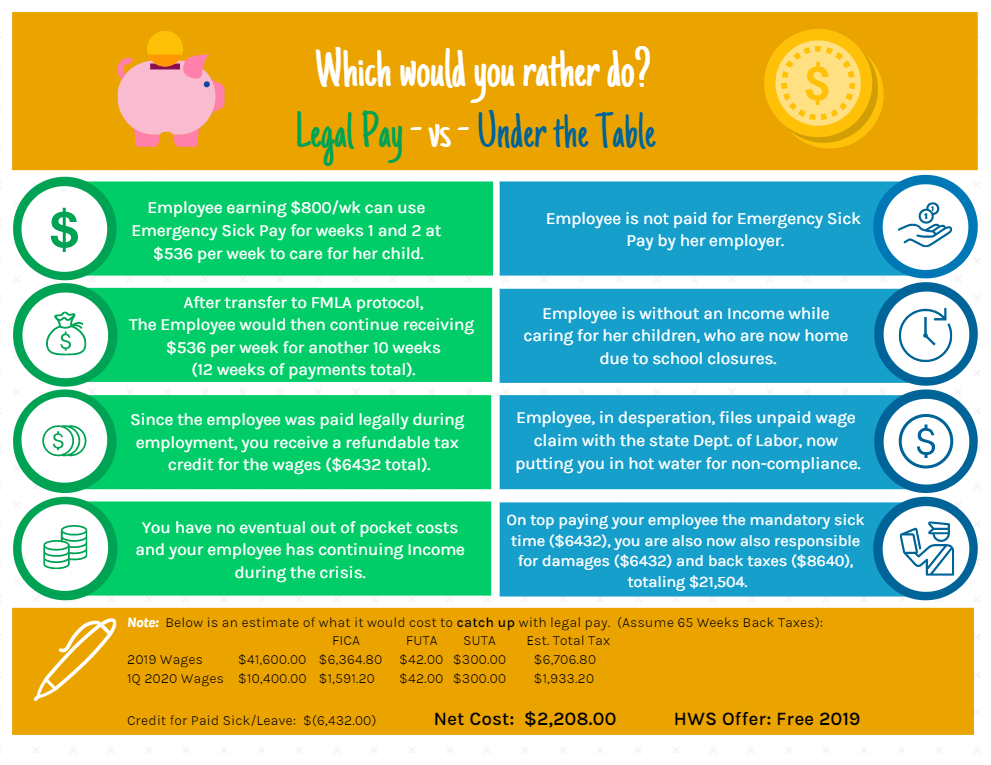

Let’s work with a caregiver who was paid $800 per week and started work on January 1, 2019. The nanny was paid cash-in-hand without proper payroll and tax compliance.

The family and caregiver decide to catch up in payroll taxes for the prior year to protect her access to benefits, and maintain the tax advantages to the family of the benefit payment. The payroll taxes for this caregiver in 2019 are about $6,700. For the first quarter of 2020 add another $1900, for a grand total of $8600.

Presuming that your family’s nanny or caregiver must miss 12 weeks work because she has to take care of her own family, the FFCRA requires that the family pay the caregiver $536 per week (2/3 of $800) for the full 12 weeks, or $6,436. Although the family is initially paying this out, it is a refundable expense on their payroll tax return for 2020. So the net cost to the family to insure that the nanny receives this temporary replacement income is $2,200.

By continuing the partial wage payments, at the end of the crisis your employee will be available to promptly return to work. Should you decide that you will be permanently unable or unwilling to continue to employ a nanny or senior caregiver, this individual will qualify for extended unemployment benefits as she seeks a new position, also funded by the employment taxes you paid. And of course it is the right thing to do both ethically and legally.

So what happens if the family does not catch up on those employment taxes?

Failing to provide mandated benefits to your caregiver places the family at considerable financial risk.

The nanny or caregiver entitled to emergency Paid Sick Leave and FMLA extended leave can file for compensation with the state’s Department of Labor. This is done through the Wage and Hour Division, and is treated as an unpaid wage claim. The nature of these claims are such that when the DOL rules for the employee, she is entitled to all of the back wages, as well as liquidated damages in the amount of unpaid wages. This expense is then $12, 864 in unpaid wages to the caregiver, as well as $6,400 in unpaid taxes, totaling $21, 500 plus penalties and interest on the unpaid back taxes.

HWS Can Help

HomeWork Solutions is committed to do our part to get employees access to the benefits they deserve. We'll waive or discount service fees for prior year payroll tax returns to ensure employees have unemployment insurance income and employers are eligible for a refund of paid sick and family leave. Contact us at (866) 959-7812 and mention "Free 2019."