Household employers are faced with a variety of tasks and deadlines and staying on top of changing dates and policies is an important part of successfully managing your household payroll. It’s imperative that household employers meet all local, state, and federal guidelines and deadlines.

One of the most recent changes comes from The Social Security Administration. They have updated deadlines for W2 and W3 forms for 2016, with the new date being January 31, 2017. This date includes both electronic and paper submissions. Previously household employers had until February 28 to file these information returns. Prior to 2016, employers could receive an automatic time extension to get the forms filed on time. Now, employers can request one 30-day extension to file W2 forms or fill out an application to extend their time to file that includes detailed explanation as to why they need the extension. If it’s discovered to be false, businesses/employers could face perjury charges.

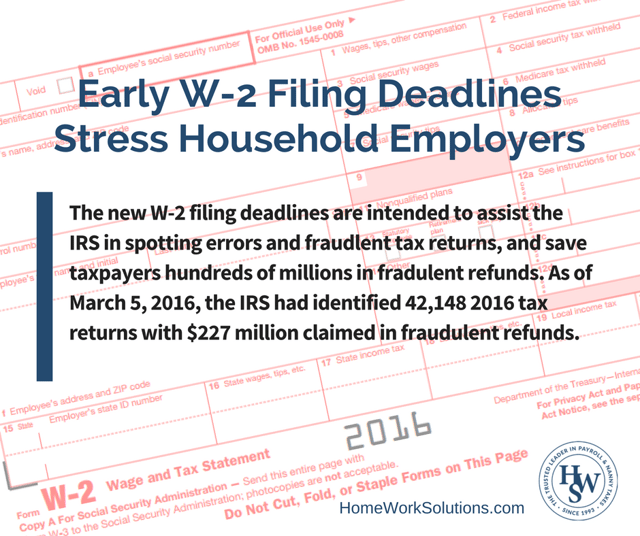

The new W-2 filing deadlines are intended to assist the IRS in spotting errors and fraudlent tax returns, and save taxpayers hundreds of millions in fradulent refunds. As of March 5, 2016, the IRS had identified 42,148 2016 tax returns with $227 million claimed in fraudulent refunds.

How to be proactive with the new deadline:

Review all Employee Name, Address and SSN Details: The new deadline requires household employer to be ready to act, as this change puts even more pressure or time constraints on those that choose to file the paperwork themselves. Another other important to-do is to confirm you have your employee's legal name and current address before the end of the year, as there is no time for corrections. Communicate with your employees well in advance will allow you to get forms ahead of time and make sure that everyone is on the same page.

Consider Hiring Experts on Your Side: Don't give up! If you’re not sure where to start when it comes to managing or keeping track of all of the updates that happen with payroll taxes every year, let us do the work for you! We are experts and we’re on your side. We know that you have a lot on your plate, so that’s why we pay attention to changing deadlines and other important details so you don’t have to worry about it. Contact our professional and experienced team today to talk about how we can help.