.png?width=290&name=W-2_(1).png) Tax season is in full swing, and Americans are preparing to file their annual income tax returns. If you are a household employer - you employ a nanny, housekeeper or senior caregiver - you will find conflicting advice on how to handle the "nanny taxes."

Tax season is in full swing, and Americans are preparing to file their annual income tax returns. If you are a household employer - you employ a nanny, housekeeper or senior caregiver - you will find conflicting advice on how to handle the "nanny taxes."

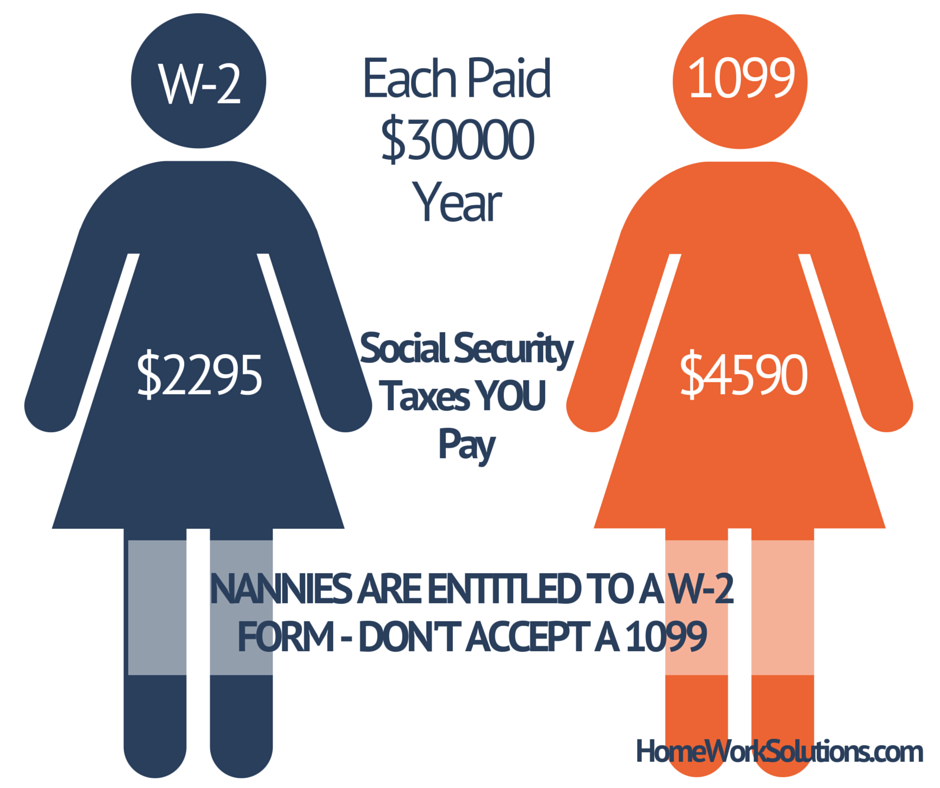

Friends, colleagues, and even some paid tax preparers will suggest that you treat your nanny or household worker as an independent contractor so you can claim dependent care tax credits and not pay the so-called "nanny taxes." This is bad advice! Why?

Nanny Tax Facts:

- A nanny, senior caregiver, or housekeeper is your employee if you provide the place of employment, set the schedule and rate of pay, and have the right to direct in the performance of their duties.

- IRS Publication 926 details the differences between a household employee and an independent contractor.

- Household employees are to be provided a Form W-2 at year end if the wages paid to the worker were $1800 or more (2013 threshold) or if you withheld federal taxes from the worker's pay.

- The household employer is 100% responsible for the payment of Social Security, Medicare and unemployment taxes, even if the household employer did not deduct employee contributions from payroll.

- Misclassification of your nanny or other household employee as a 1099 contractor leaves the family open to government enforcement action, including penalties, interest, back taxes and more. In 2014 the US Department of Labor is providing states more than $10 million in block grants to focus on misclassification and enforcement.

HomeWork Solutions has created this helpful video to help you and your employee understand the difference between a Household Employee and Independent Contractor: