There are a lot of questions that surround taxes that families are required to pay for their nanny or senior caregiver and for most people, the process can be confusing and at times, overwhelming. Here, we answer some of the most commonly asked questions.

Q: Is there a dollar threshold at which W-2 Forms are not required?

A: Household employers are required to issue a W-2 when cash wages in the year reach $1,900 (2015), or if the household employer has withheld income or payroll taxes. When wages do not meet the threshold and taxes were not deducted, a W-2 is not required.

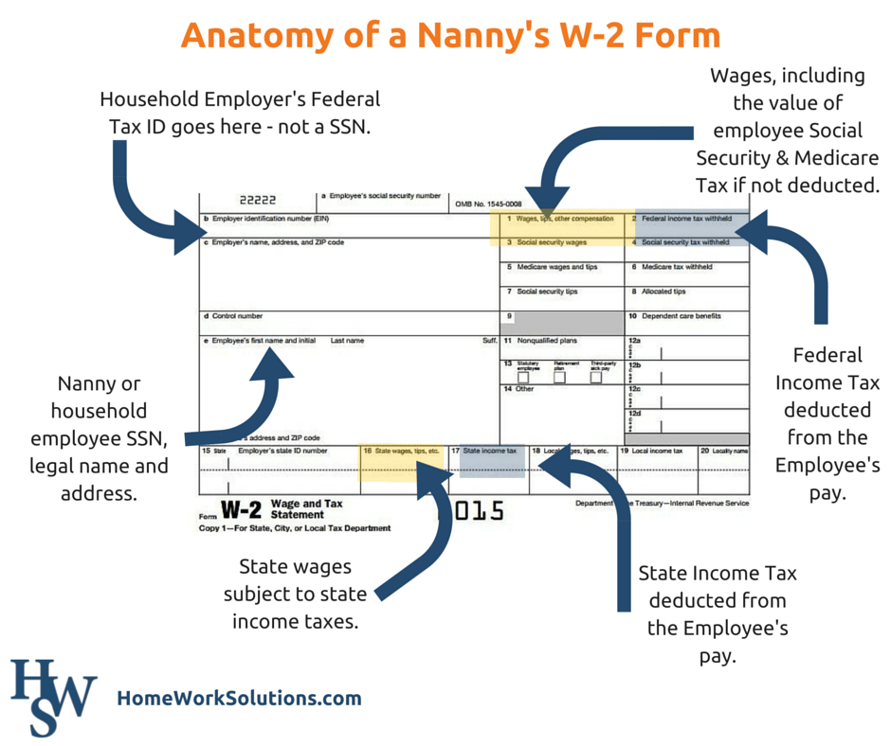

Q: Why would the wages in Box 1 be different than the wages shown in Boxes 3 and 5?

A: There are two situations when these boxes do not agree.

MOST COMMON: Taxes paid by your employer on behalf of an employee (generally, these are Social Security and Medicare taxes) are included in the wage amounts in Box 1 but not in the amounts in Boxes 3 and 5. This typically occurs when an employer pays a net amount or cash wage to the worker and agrees to pay the worker's portion of Social Security and Medicare taxes.

Alternately, if you earned less than $1900 in 2015 from your employer, these wages are NOT subject to Social Security taxes. You will have wages noted in Box 1 for wages subject to federal income tax, may have values in Box 2 Federal Income Tax Withheld IF your employer deducted your Social Security taxes and is now unable to send them to the government. You will file a tax return and if you have an overpayment you will receive a refund.

Q: What should my employer do if I do not yet have a social security number at the time they are required to issue or file a W-2?

A: According to the instructions from the IRS for Forms W-2 and W-3, one should write “applied for” in the social security number section if the number is not available, when you are filing by hand on paper. However, if you file electronically, the Social Security Administration (SSA) instructs employers to enter zeroes (for example: 000-00-0000)

Once you receive your social security number, they must submit a W-2c form to indicate the updated social security number. Then, make sure they provide an updated form to you in addition to filing it with the SSA.

Note: The SSA considers Individual Taxpayer Identification Numbers (ITIN) as invalid SSNs and will not accept these on e-filed documents.

Q: The name or social security number is wrong on my W-2, what should I do?

A: Your name and social security number must match the information on your social security card. A form W-2c must be filed to update the Social Security Administration and the IRS. To fix this, send a copy of your social security card, the incorrect W-2, and a note requesting a W-2 correction form by faxing to: 801-587-9855.

Q: My address on the W-2 is incorrect, what should I do?

A: We have all moved and forgotten to update with our employers. However, a corrected W-2 is not required for a change in address.

Q: The check for the last two weeks of 2015 is not included on my W-2. Is this correct?

A: Your W-2 is issued on a cash basis. Any compensation paid to you during 2015 is considered 2015 income. The final half of December was paid on January 7, 2016 and is therefore not considered income for 2015 and will show on your 2016 W-2.

There can be big fines or other monetary penalties that come with providing inaccurate information or incomplete info, so be sure that you work closely with a household payroll specialist to help you stay organized and fill out the proper paperwork from the beginning. Our team is well-versed in nanny tax preparation and will be able to answer questions that you may be confused about. This can help you avoid expensive errors in addition to helping you better understand how the payroll process works as an employer.

Related Posts

The Affordable Care Act (Obamacare) and Household Employment

Taxes for the Temporary Nanny (free download)