The US Department of Labor on September 17, 2013 issued revised rules within the Fair Labor Standards Act (FLSA) that impact employers of senior caregivers that go into effect January 1, 2015. A key revision is the definition of what constitutes companionship care.

Why is defining 'companionship care' important?

Today, all senior caregivers who provide companionship care in the private home of an individual with disabilities or the elderly are exempt from the minimum wage and overtime protections of the FLSA, and are defined as providing “companion care services.” The tasks and duties that constitute companionship care today are rather broad, and the rules that go into effect January 2015 significantly narrow the tasks and duties definitions. While some privately employed companions will continue to fit the designation of companion caregivers, the new rules will not permit agency-employed caregivers to be classified as companions, period.

Today, all senior caregivers who provide companionship care in the private home of an individual with disabilities or the elderly are exempt from the minimum wage and overtime protections of the FLSA, and are defined as providing “companion care services.” The tasks and duties that constitute companionship care today are rather broad, and the rules that go into effect January 2015 significantly narrow the tasks and duties definitions. While some privately employed companions will continue to fit the designation of companion caregivers, the new rules will not permit agency-employed caregivers to be classified as companions, period.

Agency-employed caregivers will all be covered by minimum wage and overtime FLSA protections. Agency-employed caregivers may not be classified as companions for wage and hour compliance. Only privately employed senior caregivers providing bona fide companionship care services may qualify for this exemption.

So exactly how does the current definition of companionship services differ from the new rules?

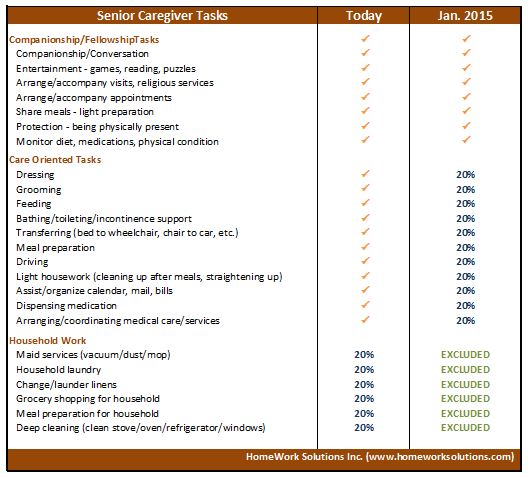

The chart below illustrates the common tasks of a privately employed senior caregiver. This chart classifies the task as either companionship care (√), incidental tasks permitted that cannot exceed 20% of the caregivers time (20%), and those that are excluded (EXCLUDED) and when required the caregiver cannot be classified as a companion.

Conclusion:

Conclusion:

Currently, privately employed senior caregivers may provide some general housekeeping services to their employers so long as the time spent on household work does not meet or exceed 20% of their total time on duty AND remain exempt from minimum wage and overtime protections. This is called the "companionship exemption."

Effective January 2015, a privately employed senior caregiver who provides ANY general housekeeping services will not qualify for the companionship exemption, no matter how incidental. Additionally, a privately employed senior caregiver who provides personal care services will not qualify for the companionship exemption if the time spent on these services meets or exceeds 20% of their total time on duty. These caregivers will be considered domestic services employees and subject to applicable overtime and minimum wage rules.

The companionship exemption becomes strictly limited to services defined as fellowship and protection, with only incidental personal care services allowed.

Resources:

FACT SHEET 79A