Did you know that every paycheck's net or take home calculation will change in 2013? Calculate your nanny paycheck deductions before you issue any 2013 payroll.

Did you know that every paycheck's net or take home calculation will change in 2013? Calculate your nanny paycheck deductions before you issue any 2013 payroll.

Congress passed legislation late last evening that settled income tax rates for 2013. What does that mean to you and your employee?

1. 2013 Federal Income Tax Withholding rates have not yet been published. IRS instructions are to use 2012 income tax tables until the new rates are available. There will be very little change in income tax withholding for most nannies and other household workers.

2. The temporary "payroll tax holiday" was allowed to expire. This means everyone's Social Security tax to be withheld from a paycheck increased by 2%, reverting to the historical 6.2% that had been in place for more than 20 years. Net paychecks, or take home pay, will go down for everyone.

Visit the HomeWork Solutions' nanny payroll calculator tool before issuing any 2013 payroll. Employers who fail to deduct enough Social Security tax from their household employee's payroll will remain responsible to pay these monies to the IRS.

HomeWork Solutions' Clients Who Issue Nanny or Household Payroll Directly:

We need confirmation from you that you have adjusted your employee paychecks. You let us know by reporting a payroll change online in our Member Service area. This is easy!

Step 1. Log into your personal account at 4nannytaxes.com.

Step 2. Select Calculate Paycheck next to your employee's name.

Step 3. When your employee's name is selected in the drop down, basic wage data will pre-populate. When the form is complete, select Calculate Payroll Taxes.

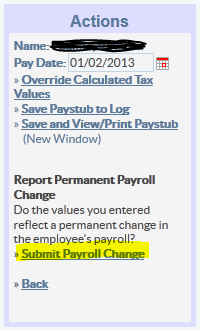

Step 4. From the Results select Actions > Record Permanent Payroll Change to update your employee profile in our records.

Step 4. From the Results select Actions > Record Permanent Payroll Change to update your employee profile in our records.

Step 5. We also advise you to select Save and View/Print Paystub and provide your employee with a copy of their new payroll tax deductions. New York and California employers are required to take this step.

TIP! Many employers use this payroll calculator tool to record payments made every pay period. This makes reporting wages paid at quarter end a snap! You simply log into your account, Select your stored payroll records from the list, submit, and you are done!

Questions? Call us for a free telephone consultation at 800.626.4829. Our representatives are available weekdays to answer your questions and to help you with your account. Not a client but need help with the new calculations? We would love to help, give us a call!

Final Tip:

Final Tip:

The IRS will issue new income tax withholding rates later in January. We will publish as they become available. It is not anticipated that there will be significant changes in most employee calculations, nor will 'retroactive' adjustments be necessary as as been the case in the past.

Our goal is to keep you informed. Subscribe to our blog by entering your email address in the box on the upper right side of this page, or ![]() LIKE us on Facebook to get all blog post notifications.

LIKE us on Facebook to get all blog post notifications.