Did you know that if you pay a senior caregiver or nanny directly that it’s likely that the law considers your caregiver an employee?

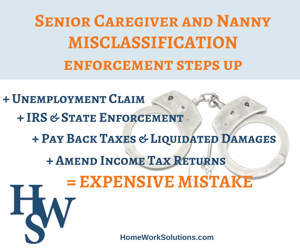

As an employer, you have the responsibility to understand and follow pertinent labor regulations and laws. This includes tracking hours worked each week, paying FICA and overtime, and getting insurance for workers compensation, which will help protect you and the caregiver in case an injury occurs on the job. If you don’t adhere to these laws and instead classify your employee as an independent contractor, you could be liable for misclassification. It could be an incredibly costly mistake that leads to back tax payments and other expensive penalties.

As an employer, you have the responsibility to understand and follow pertinent labor regulations and laws. This includes tracking hours worked each week, paying FICA and overtime, and getting insurance for workers compensation, which will help protect you and the caregiver in case an injury occurs on the job. If you don’t adhere to these laws and instead classify your employee as an independent contractor, you could be liable for misclassification. It could be an incredibly costly mistake that leads to back tax payments and other expensive penalties.

According to the US Department of Labor, two-thirds of misclassification investigations are a result of worker complaints.

As the economy has continued to improve, there has been more awareness made of independent contractor misclassification across the United States. Recently, North Carolina and Virginia announced a misclassification enforcement initiative that will crack down on employers classifying their employees as contractors. Virginia’s new initiative means that employers will be liable both federally as well as on a state level as they are required to enforce payroll requirements and if they do not, they will face penalties including IRS penalties.

If you are a caregiver, be sure you know why the employee and independent contractor difference is important:

- Employees are protected from retaliation or discrimination from employers

- Employees can be sure that employers are held accountable for wage violations, overtime, breaks, and reimbursements

- Employees can receive unemployment compensation when the job ends

- Employees are covered under workmen’s compensation in the event of an on the job injury

A household employee who is improperly treated as an independent contractor will waive her rights to some or all of these above items. When you enter work in the service sector as an in-home caregiver, be sure that your employment agreement states that you will be named as an employee. If you’re an employer, be sure you understand what wage laws are applicable in your state. If you are unsure about how to manage the details of having an in-home employee, be sure to contact HomeWork Solutions to talk to a payroll specialist. You’ll need to know that you’re covered when it comes to insurance, taxes, and other important legal matters. Our team of specialists is dedicated to getting your financial and legal items in order so you can have a successful experience as an employer.