Do you have a nanny and pay him or her over $2,000 in wages? Congratulations! Now you’re considered a household employer and must file Social Security and Medicare payroll taxes. You will have to report your nanny’s income and taxes paid for the year as well as file report and pay employment taxes on your federal income tax return. There are several forms you need to understand if you employ a nanny in the home. Read on to learn more about these tax forms.

Read More

Topics:

nanny tax,

nanny taxes

If you hire people to work in your home -- such as nannies, private nurses, or housecleaners -- then you’re a household employer. You’re responsible for filing the proper taxes and getting the right paperwork to your employees if you pay them over $2,000 for the year (as of 2016).

Now that it’s tax season, be sure you’re providing your domestic workers with the proper paperwork. Start with the following information to ensure a stress-free tax season.

Read More

Topics:

household employer,

nanny tax,

nanny taxes,

domestic worker

A Nanny Payroll Case Study

There’s no doubt about it. Nanny taxes are complicated. There are federal and state taxes, as well as federal and state labor laws that need to be upheld. For some families, while taxes can be a little overwhelming, they think that they can figure it out themselves. This can be done, but before you do it yourself, you need to know it all – the ins and outs of preparing nanny taxes. If not, the do it yourself method can go terribly wrong. Consider this case study of a family that thought they had a good understanding of tax filings, but in fact, ended up making some costly errors.

Read More

Topics:

household payroll literacy,

nanny taxes,

payroll recordkeeping,

nanny tax case study

Confused about how nanny taxes affect the taxes you pay on your housekeeper’s wages? In honor every mom who appeciates extra help keeping the home in order, we thought we’d clear up some common misconceptions surrounding an employer’s tax obligations on their housekeeper’s wages.

Read More

Topics:

housekeeper,

cleaning lady,

nanny tax,

nanny taxes

Generally, in life, it pays to do things right the first time. Your nanny payroll taxes are no exception to the rule: while it may be tempting to evade these pesky taxes, in the long run, you will be thankful that you managed your household employment taxes well. It will cost much more of your money, time, and patience to deal with the consequences of tax fraud than to file your payroll taxes correctly the first time around!

Read More

Topics:

nanny tax audit,

nanny tax statute of limitations,

nanny tax,

nanny taxes,

caregiver,

nanny tax case study

Every American dreads this date. APRIL 15th! We see images of adding machine tape, lines at the post office, and piles of tax receipts. January is the month household employers deliver W-2 forms to their nanny, housekeeper and other household employees. After a month of frantic phone calls from employers and caregivers alike pleading for tax help, I can offer the following reflections:

Read More

Topics:

nanny taxes,

1099 v w-2,

nanny tax compliance,

Senior Caregiver Payroll

Part Time Nannies, Summer Nannies

MYTH “My nanny only works during the summer months when our kids are out of school. I don’t need to worry about nanny taxes since she is only a temporary employee.”

Read More

Topics:

nanny tax,

nanny taxes

When a nanny who has earned her wages under the table is fired and files an unemployment claim, nanny taxes can become a big deal for the former employers (your family!). Read on about how—and why—paying your household employees on the books is the best choice for you and your family.

Read More

Topics:

nanny off the books,

nanny taxes,

nanny tax compliance

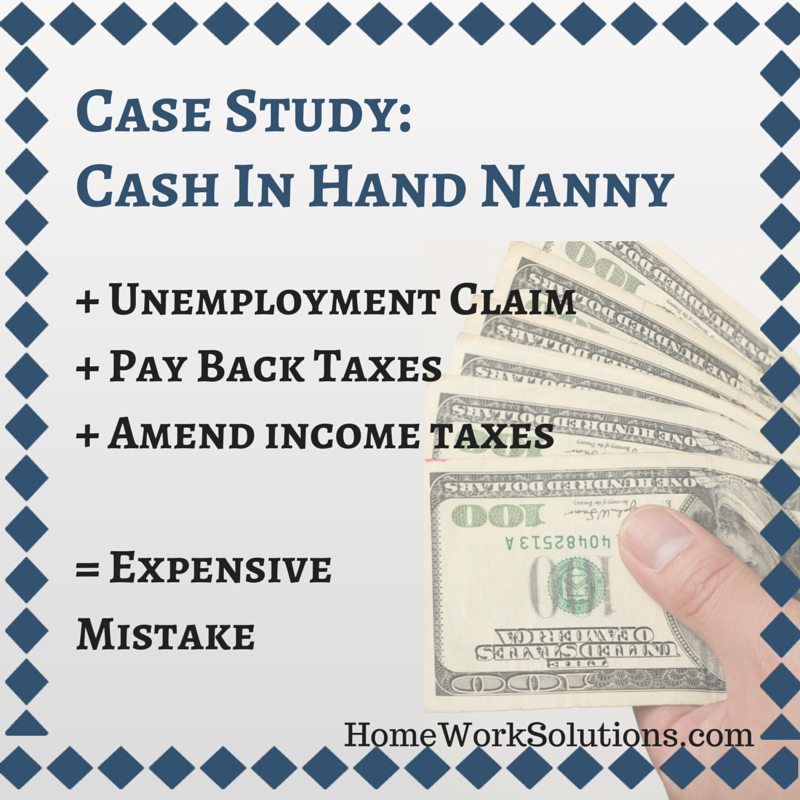

HWS' Client Care Manager, Mary Crowe, shares the story of a client who paid the nanny cash under the table, and later found himself on the wrong side of his state's unemployment agency.

Mike and Joyce R. hired a nanny when their twins were infants. They agreed with the nanny at the time that they were going to pay her $500 a week off the books. The nanny worked out wonderfully and she stayed with Mike and Joyce for almost three years, and was let go when the twins started a full-time pre-school/daycare situation. The family’s needs had changed, and they found another very part-time nanny to cover the afterschool hours.

Read More

Topics:

nanny off the books,

nanny unemployment insurance,

nanny taxes,

nanny tax case study

I recently attended Nannypalooza in Philadelphia where I was asked by a nanny in attendance if I could coach her on how to speak to her employer about being paid on the books. Immediately several other nannies joined the conversation, sharing that this is one of the most difficult conversations to initiate with their employers.

Read More

Topics:

nanny off the books,

nanny job satisfaction,

nanny taxes